2 charts show LA neighborhoods hit by wildfires were left exposed by recent insurance rollbacks

Thousands of California homeowners at risk from the Los Angeles County fires find themselves exposed in a volatile home-insurance market.

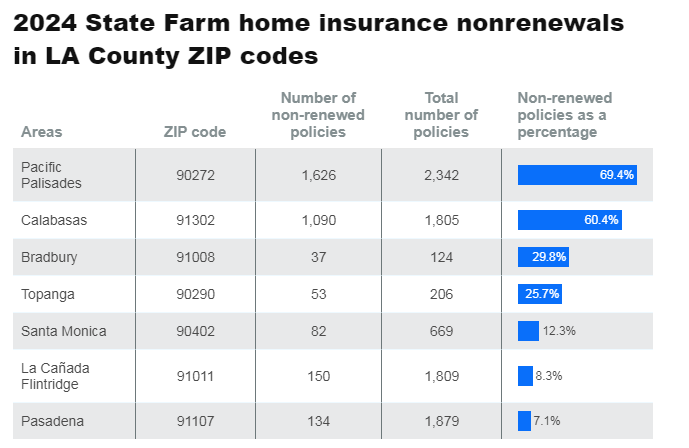

Last year, California’s largest home insurer — State Farm — canceled thousands of policyholders’ plans in areas across LA County, including in Pacific Palisades and parts of Santa Monica and Calabasas, that are under evacuation orders and warnings as the fires rage. Nearly 70% of State Farm policyholders in the affluent Pacific Palisades neighborhood were dropped by the company beginning in July.

The following table shows the ZIP codes that were under evacuation orders or warnings as of Wednesday afternoon and had the highest rate of nonrenewals from State Farm last year.

Several other major insurers have dramatically restricted their coverage across California in recent years, citing surging costs from more frequent and intense disasters coupled with rising home-repair costs and inflation.

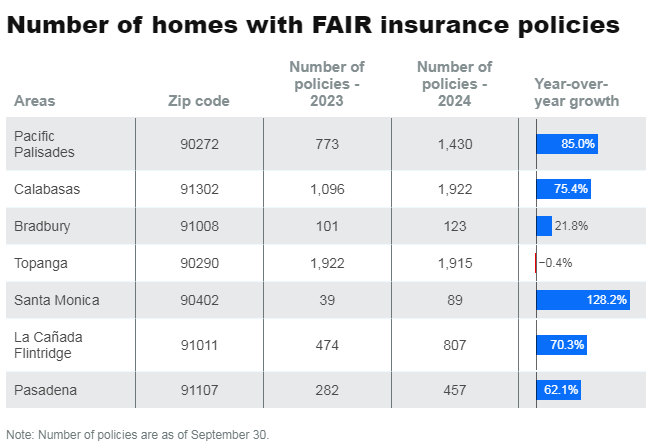

Thousands of LA County homeowners who haven’t been able to obtain private insurance have joined the ranks of those covered by the state’s insurer of last resort — the Fair Access to Insurance Requirements plan. The FAIR plan is regulated by the state government and backed by a slew of private insurance companies. But its premiums tend to be much higher than those of typical private insurers and its coverage is often more restricted.

This table shows how FAIR insurance coverage changed in the above ZIP codes between 2023 and 2024.

As private insurers have stepped back in recent years, the number of residential FAIR plan holders across the state jumped 123% between September 2020 and September 2024. The FAIR plan’s dollar-value residential exposure surged from $271 billion in September 2023 to $431 billion in September last year.

It’s not clear how many homeowners affected by the LA County fires are uninsured. Most mortgage lenders require homeowners to purchase insurance, and some require additional insurance for specific disasters, including fires.

Some major home insurers, including Farmers — the second-largest in California — have recently begun to expand their offerings in California after the state announced regulations requiring insurers to cover a certain percentage of homes vulnerable to fire in exchange for allowing them to use future-risk modeling to calculate premiums.

In 2023, California had the fourth-highest home-insurance nonrenewal rate among states, a recently released Senate Budget Committee report said. Six of the top 10 counties in the country with the highest rates of nonrenewals by large home insurers in 2023 were in California, the report said.

But rising home-insurance costs and rates of dropped policies are nationwide problems. The National Bureau of Economic Research recently reported that the average home-insurance premium spiked by 13%, adjusted for inflation, between 2020 and 2023. The share of home-insurance policies from large insurers that weren’t renewed increased last year in 46 states, the Senate report found. And more than 200 US counties saw their nonrenewal rates spike threefold between 2018 and 2023.

Areas more vulnerable to disasters, including flooding, wildfires, and hurricanes, have seen the biggest spikes in premiums and dropped policies.

“Our No. 1 priority right now is the safety of our customers, agents, and employees impacted by the fires and assisting our customers in the midst of this tragedy,” a representative for State Farm told B-17.

A representative from the California FAIR Plan Association also told B-17 in a statement that the insurer was “prepared” to handle the wildfire impact and “has payment mechanisms in place, including reinsurance, to ensure all covered claims are paid.”

Representatives for Farmers did not respond to a request for comment.