3 theories about the $46 million ‘whale’ moving betting odds in favor of Donald Trump

The “whale” placing huge bets on Donald Trump’s victory in next month’s election has politics and betting market commentators scratching their heads, though they have some theories about what might be going on.

A person or entity believed to be behind four accounts on the crypto-based betting platform Polymarket has staked about $46 million on the former President’s victory, according to Polymarket data on Wednesday.

It’s unclear who owns the four accounts on Polymarket — Fredi9999, Theo4, PrincessCaro, and Michie — though they have exhibited characteristics to suggest they’re linked, a Wall Street Journal report said last week.

The betting activity has raised questions about who the whale is and what their aims might be, beyond simply making money on a potentially lucrative bet. It’s left political betting experts wondering what’s going on, though a few were willing to float their theories about the wagers.

Here’s what some had to say about the whale that’s been throwing its weight around in the betting market.

1.The bets are an influence campaign

According to Paul Krishnamurty, a betting markets expert and a political oddsmaker for BetOnline, the big bets could be an attempt to influence the election by generating publicity for the former president and making it appear that his odds of winning are much higher than polls suggest.

Trump leads Harris on Polymarket, with an estimated 64% chance of winning the election, while the odds of a Harris win are around 36% on the site. That’s much different than the polls, with Trump and Harris virtually tied based on the latest polling average from 538.

Krishnamurty cautioned that it’s impossible to know whether the bets are a genuine opinion about how the race will shake out.

“But it is equally possible to believe the bets were placed with the intention to change the narrative in Trump’s favor,” he added.

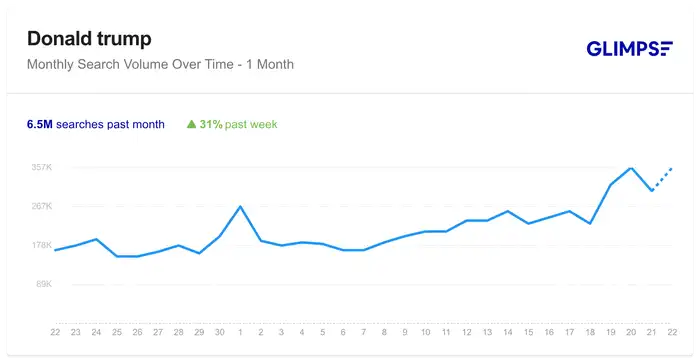

Google search interest for “Donald Trump” has climbed 24% over the past week, according to the search analytics tool Glimpse. Search volume over the last month peaked on October 20th, around the time the Polymarket whale became known to markets.

Google search interest in “Donald Trump” has surged 31% over the past week, according to Glimpse.

Donald Trump also climbed to the number one trending topic on social media as of Wednesday morning, according to the social intelligence firm LunarCrush.

Similar types of bets have also been seen in prior elections, Krishnamurty noted. He pointed to several elections in the UK and the US, when some bettors were wagering large amounts of cash on a clear “underdog” candidate.

“I would just say this sort of thing has happened before,” he added. “Trump is uniquely popular amongst gamblers ever since the 2016 election, really when he was a big underdog. And I think you would find that he has been overbet in every single election.”

If it is an attempt to influence the election, Krishnamurty doubts it will be successful.

“I find it hard to believe that anyone is changing the way they vote based on who’s leading in the betting markets,” he added.

Polymarket founder Shayne Coplan defended the integrity of the market in an interview in The New Yorker this week.

“There is nothing stopping people from going and buying something that they think is underpriced, but they’re not doing it right now because no one has enough conviction that it should be worth more,” Coplan told the magazine, in reference to bets on Harris winning.

2.It’s a genuine bet on the outcome of the election

The Polymarket whale may simply be extra-bullish on Trump winning on November 5, said Joe Vezzani, the CEO of LunarCrush, which monitors social media, cryptocurrency exchanges, and influencers to track crypto sentiment.

Vezzani and other commentators have argued that betting markets may be more accurate than polls, given that people are wagering real money and often respond quicker to developments in the race.

He said the surge of bets in Trump’s favor may also be a function of the election drawing closer.

“I think the way that people make decisions when there’s money on the line is different than the way maybe they would make a decision if there wasn’t,” Vezzani said, though he believed the election would still be a close call. “I think it’s TBD for this election still.”

3.The whale is trying to shift betting odds to make more money

The user believed to be behind the Polymarket accounts could be also trying to deliberately move the betting odds with the goal of making more money, Krishnamurty speculated.

The swell of betting on the former president has increased the value of those positions. Krishnamurty noted that Polymarket allows users to close out their positions ahead of the presidential election.

“Let’s take the hypothetical assumption that it is a genuine plan to manipulate the market, right?” Krishnamurty said. “You cash out if you want. So there’s really no risk.”

If the bet was split across four accounts, that could be a sign that the whale is trying to make money off of short-term moves in the market, Vezzani said. Multiple accounts give the trader an option to quickly sell out of some positions to capture small market moves, he noted.

“One thing is that Polymarket, it’s not a bet for an outcome. You don’t have to wait until election night, so you can add or move the money whenever you want based on the price increase,” he said.

Again, there’s no way to prove the theory without the account holders coming forward and explaining their motivation, Krishnamurty and Vezzani reiterated.

Bets for Trump on Polymarket, though, have surged over the last week. As of Wednesday morning, open positions for Donald Trump’s victory swelled to $756 million, compared to $482 million worth of open positions for Kamala Harris’ victory.

Polymarket did not respond to a request for comment from B-17.