4 stocks set to benefit from China’s stimulus measures while also hedging geopolitical risk: $21 billion firm’s portfolio manager

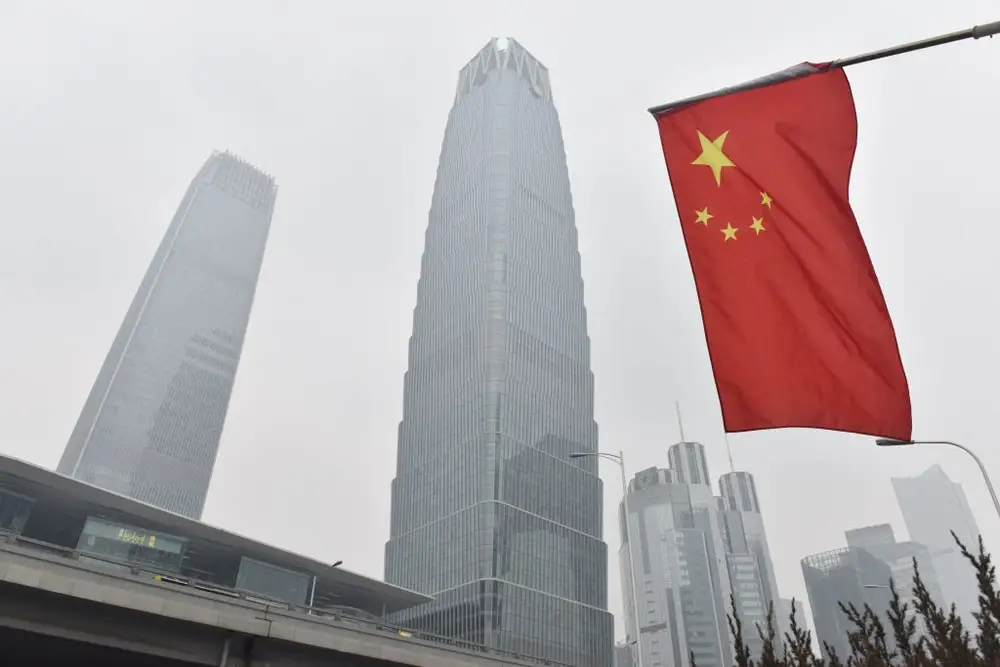

A Chinese flag flies near buildings in the central business district on a polluted day in Beijing on February 27, 2018.

A $113 billion Chinese government stimulus package stoked investor appetite for stocks listed in the country in late September. But its market’s abrupt plunge on Wednesday shows that risk remains high.

China’s benchmark CSI 300 Index and Shanghai Composite Index slid 7.1% and 6.6%, respectively, posting their biggest losses since February 2020. The stock market drop comes after Beijing failed to announce more details about its stimulus package.

The recent volatility in the Chinese market doesn’t come as a surprise to Zehrid Osmani, portfolio manager at $21 billion Martin Currie.

“Historically, the Chinese stock market can be prone to short-term speculative behaviors,” Osmani said.

However, that doesn’t mean Osmani is writing off any investment in China. Below, Osmani shares how he maintains exposure to the world’s second-largest economy while also reducing exposure to risk.

Mixed signals

Wall Street is seeing growth potential in the Chinese market.

Valuations are low coming out of the pandemic, creating an attractive entry point into the market, Osmani said. Investor positioning, or how collectively bullish or bearish investors are based on allocations to the market, is also low in China. This creates the potential for the market to rebound.

Osmani also sees strong growth in the Chinese middle class that will help drive consumption and improve the Chinese economy.

Bank of America also points out that the Chinese market has historically been boosted by US rate cuts, with Chinese stocks having a strong negative correlation with the US 10-year Treasury yield. The bank sees solid and improving fundamentals within Chinese companies and believes government stimulus will be helpful in increasing liquidity within the Chinese market.

Investors should exercise caution when investing in China, though, Osmani said. He points to some structural challenges the Chinese economy faces, such as an aging population and a slump in the property sector.

That’s not to mention the growing geopolitical tensions in the region as Taiwan emerges as a critical semiconductor manufacturer in the AI revolution. Tariffs and other policy initiatives that could disrupt international trade are on the table as the US presidential election draws closer.

The future of the Chinese economy depends on the Chinese government’s next steps, according to Osmani. Investors should keep an eye out for policy developments. In Osmani’s view, the recent stimulus package is a starting point that could avert a hard landing and put the Chinese economy on a 4.5% to 5% GDP growth rate this year.

“What will be more important is to see whether there are additional initiatives again in the next few months, which could then accelerate the economic momentum into 2025,” Osmani said.

Hedging China risk

Osmani has been gradually exiting investment positions directly tied to China in recent years, opting instead to invest in European or US companies that have indirect exposure.

“There are ways to be exposed to the Chinese improvement in the economic cycle that could come from policy initiatives without necessarily being directly exposed to the Chinese stock market,” Osmani said.

Companies in the luxury goods, cosmetics, and automotive industries are especially attractive, according to Osmani. These companies’ business models are sensitive to the Chinese economic cycle, with a large proportion of revenues coming from China, Omani said.

Within the automotive industry, Osmani points out that European car manufacturers typically have more China exposure than US ones, especially luxury car manufacturers.

Below, Osmani shares four stocks with indirect revenue exposure to China. They are all constituents of the Martin Currie Global Portfolio Trust Fund.

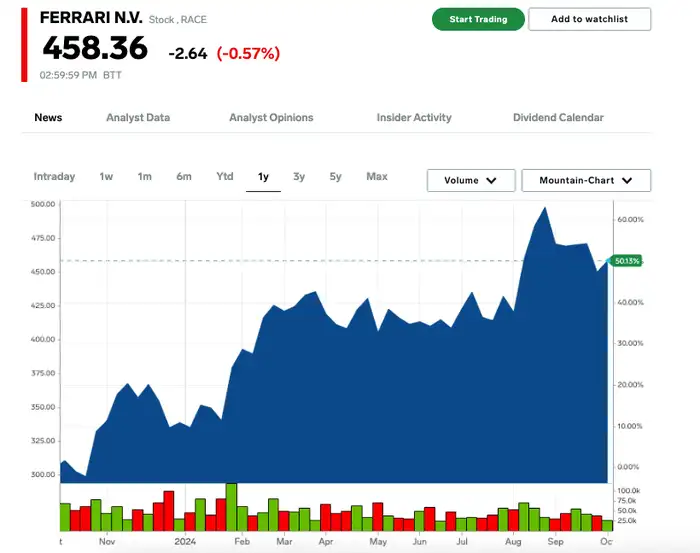

Ferrari

Ticker: RACE

Moncler

Ticker: MONRY

L’Oréal S.A.

Ticker: LRLCY

Estée Lauder

Ticker: EL