5 warning signs the economy is spiraling toward recession — and why there’s ‘major disconnect’ between stocks and the job market

A trader reacts after the closing bell of the New York Stock Exchange on November 5, 2008.

To Jon Wolfenbarger, the stock market’s success and the labor market’s recent deterioration don’t seem to add up.

As of market close on Friday, the S&P 500 sat at 5,626, just below record highs. And yet, the unemployment rate continues to inch up, job openings continue to fall, and payroll data continue to underwhelm.

The short explanation for this discrepancy is investor hype around artificial intelligence and continued hope for an economic soft landing, according to Wolfenbarger, the founder of investing newsletter BullAndBearProfits.com and former investment banker at JPMorgan and Merrill Lynch.

But how long that enthusiasm can continue to outweigh declining labor market indicators remains to be seen. In a pair of notes this month, Wolfenbarger has laid out several pieces of evidence from job market data showing the outlook continuing to worsen, threatening to throw the economy into recession and lampoon the market’s soft-landing hopes.

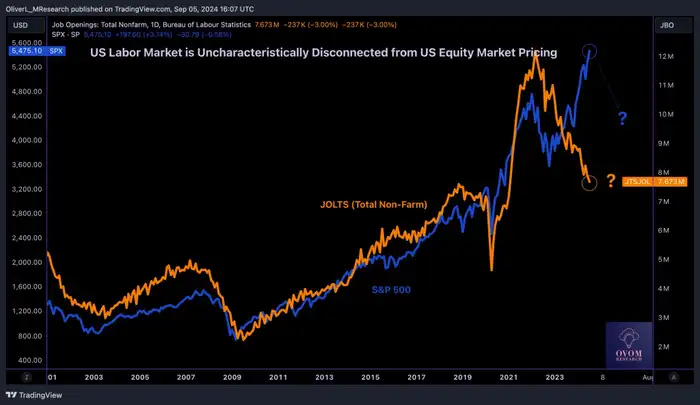

The first is declining job openings, which are down to 7.6 million from 2022 highs above 12 million. Since data started being collected in December 2000, the significant declines in job openings in 2001, 2008, and 2020 were all accompanied by recessions. While openings have fallen a lot, however, they are still above pre-COVID levels and may just be normalizing after pandemic stimulus has dried up.

Still, job openings data has had an impressively close correlation to stock market performance since 2000. This suggests the amount of job openings may have to turn around soon, or the market may be ahead of itself and in for a correction.

“Historically, there’s been a strong relationship between JOLTS openings (orange line) and the S&P 500 (blue line), although there has been a major disconnect during the AI-driven rally of the past two years,” Wolfenbarger wrote in a September 9 note.

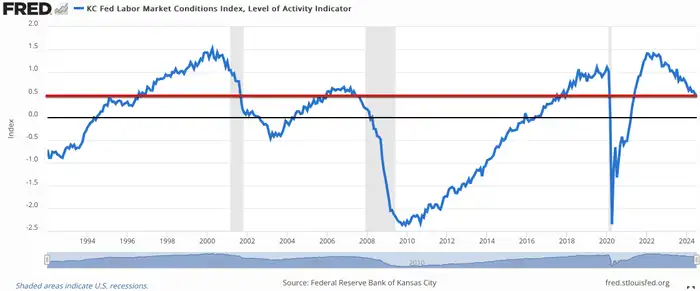

Another sign Wolfenbarger shared showing the labor market is turning sour is the Kansas City Fed’s Labor Market Conditions Index, which is a composite of 24 job market indicators. The last three times is has climbed above 0.5 and then declined again below that level, the economy has gone into recession.

The indicator sits at 0.53 right now, down from 1.4 in May 2022.

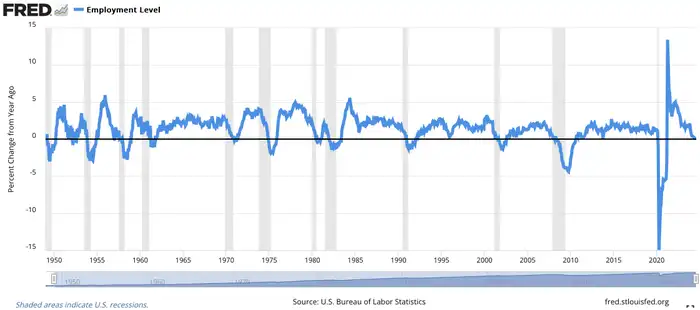

Third, the year-over-year percentage change in the employment level, or number of people employed. It just hit 0%, and negative year-over-year growth has typically coincided with recessions over the last several decades, Wolfenbarger said.

While the employment growth is softening, there has also been a rise in the amount of part-time employees who cite economic reasons for taking part-time roles. Part-time employment levels usually surge during recessions, though current growth levels are not yet as pronounced as in prior downturns.

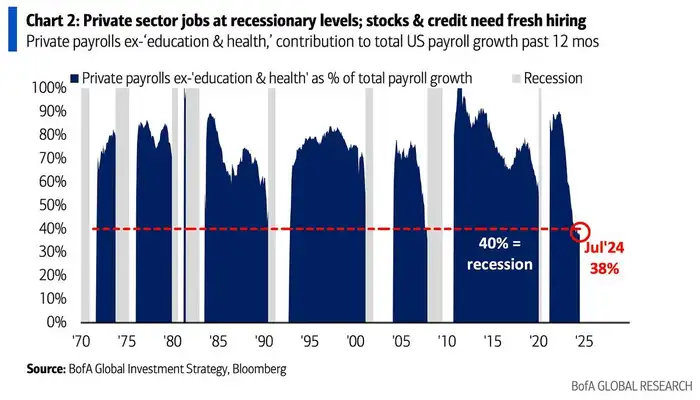

Finally, in a September 2 note, Wolfenbarger shared a chart from Bank of America showing the decline in private job growth as a share of all job growth. The chart excludes the healthcare and education sectors, which are typically immune to economic downturns. Private job growth is an important measure because it takes government payroll growth out of the equation, which is also resistant to business cycles.

Wolfenbarger’s views in context

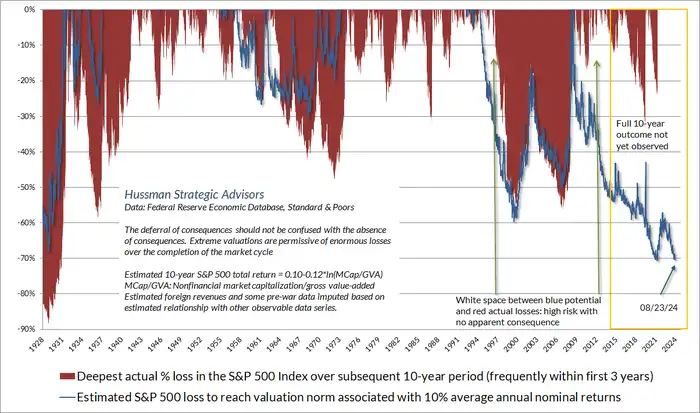

Wolfenbarger sees the potential for severe downside for stocks. In an email to B-17 on Friday, he confirmed that he continues to see a drop of as much as 70% in the S&P 500 as plausible.

He cites John Hussman’s valuation metric of the market-cap of non-financial stocks-to-the gross value-added of those stocks. With the measure currently at all-time-highs, Hussman said in August that the S&P 500 would have to fall around 70% to get to levels where investors could expect 10% annualized returns over the following decade.

It goes without saying that this is an extreme scenario and well outside of consensus on Wall Street. But a market decline of some significance is not out of the question if the economy does continue to soften beyond what investors are comfortable with.

Stocks sold off after the July and August jobs reports came in below expectations. The longer the streak of poor payrolls print extends, the higher the risk of recession will appear to investors, and the sharper potential market declines could be.

The Federal Reserve is expected to start slashing interest rates next week to help the economy land on its feet after an inflation surge, and markets believe the central bank will reduce the benchmark rate by 2.5% by the end of 2025.

But history has shown that the Fed has often moved too late when reducing rates, Wolfenbarger said.

“We do not expect this time to be different,” he wrote in the September 9 note.