Here’s how moguls like Rupert Murdoch control their companies — without owning their companies

Rupert Murdoch is trying to make sure his son Lachlan (left), controls the company after he’s gone. His son James Murdoch (right) is fighting the move in court

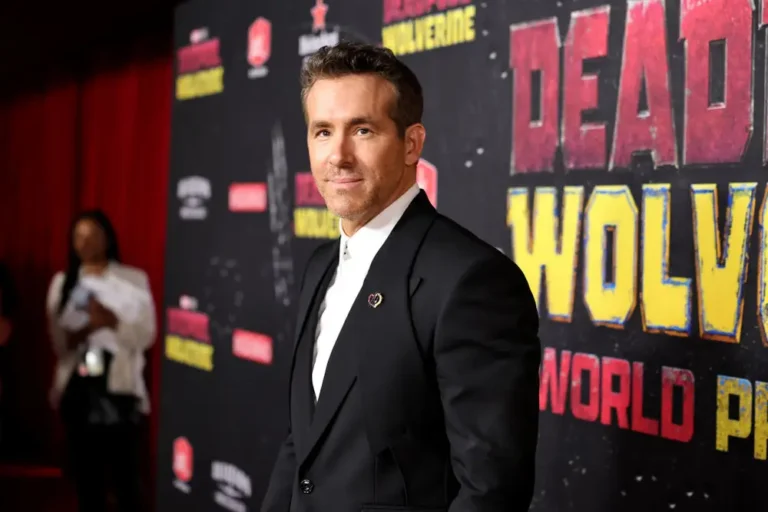

Rupert Murdoch is fighting with his children over control of his media empire, and the “Succession”-style brawl is headed for a Nevada courtroom.

But wait a minute: Both News Corp. and Fox are publicly traded companies. Shouldn’t shareholders be the ones who make the ultimate decisions about what happens there?

That’s a reasonable question! But the answer to that one is: No, not really.

That’s because the Murdoch empire is built on a dual-class stock structure, which gives the family the power to effectively control the company, even if they don’t own the majority of its shares.

And they’re not the only big company you know that’s set up that way: Some of the most powerful media companies have been running that way for decades. And more recently, some of the biggest companies in tech have adopted multiple class structures too.

The results are public companies that are effectively private. Regular shareholders can weigh in — primarily by buying or selling shares, to register their approval or disapproval over the way things are going — but the truly crucial decisions — like selling the company — are usually made by one or two people, or a family.

Companies like Meta, Comcast, and Alphabet have similar structures

In media, you can find examples of this at places like The New York Times (controlled by the Ochs-Sulzberger family), Comcast (largely controlled by the Roberts family), and Paramount (still controlled, for the moment, by Shari Redstone). Tech companies set up like this include Meta (Mark Zuckerberg), Google/Alphabet (Larry Page and Sergey Brin), and Snap (Evan Spiegel).

The structure and details differ by company, but they generally work in the same way: There’s one class of shares that you, a regular investor, can buy or sell. And then there’s another class of “voting” shares that do just what it sounds like: They give the people who own those shares the ability to vote on what happens.

Elon Musk was able to buy Twitter, which he eventually changed to “X,” because of its single-class share structure that didn’t give its founders control.

If you want real-world examples of why any of this matters, see Twitter: That company didn’t have a dual-class structure, which meant that none of its founders had the ability to block Elon Musk from buying the company in 2022. (Musk’s Tesla, by the way, has a single-class structure as well.)

Or, in the present tense, see BuzzFeed, where founder Jonah Peretti controls the company, and doesn’t have to listen to Vivek Ramaswamy, even though the former Republican presidential candidate has been buying up BuzzFeed shares.

Periodically, you’ll hear people complain about these kinds of structures because they think they insulate the founders/owners from the discipline of the market. Redstone, for instance, is now facing a lawsuit from an investor who says her decision to sell the company benefits her but not regular shareholders.

On the other hand: None of these structures are secrets, so anyone buying into these companies knows — or should know — what they’re getting into. And in most cases, as long as the stock goes up, they’re not going to complain. Like a lot of things, this only becomes a problem when the company is having problems.