ESPN Bet has big ambitions and a tough outlook as it launches in New York and aims to gain share in sports betting

Betting is an increasingly big part of ESPN’s growth strategy, its executives have said.

As Frank Sinatra famously sang of New York: If you can make it there, you can make it anywhere.

Executives at ESPN and Penn Entertainment hope that’s true of ESPN Bet, which will soon debut in the Big Apple as football season heats up. The nascent sportsbook hopes to make a strong first impression with millions of potential customers and reintroduce itself to others.

ESPN sees betting as a major growth area as it hedges against the steady decline of the pay-TV bundle. Its brand is synonymous with sports globally, and it has unrivaled reach with an audience of hundreds of millions of sports fans across pay TV, streaming, its website, and social media.

Penn’s new strategy for ESPN involves creatively capitalizing on that advantage by integrating ESPN Bet-branded betting lines and content across ESPN platforms, and by sending personalized player-prop bets based on fantasy rosters. The company hopes its massive platform and popular talent will attract new users to ESPN Bet.

“It’s very early in the journey for ESPN Bet, and it’s an interesting opportunity for us to be truly a disruptor in this space,” said Mike Morrison, ESPN’s VP of sports betting, at his company’s media day in late August.

However, ESPN Bet faces long odds. Industry analysts expect the service to carve out a niche, though it may be too late to truly challenge leading services like FanDuel and DraftKings.

“When you factor in the structural advantages that so many of their competitors have, it becomes challenging to see how Penn can effectively make up a substantial amount of ground in the rest of the decade — let alone in a single NFL season,” Chris Grove, partner emeritus at research firm Eilers & Krejcik Gaming, told B-17.

ESPN declined to make an executive available for this story. Penn didn’t respond to a request for comment.

Why securing a bronze medal is no sure bet

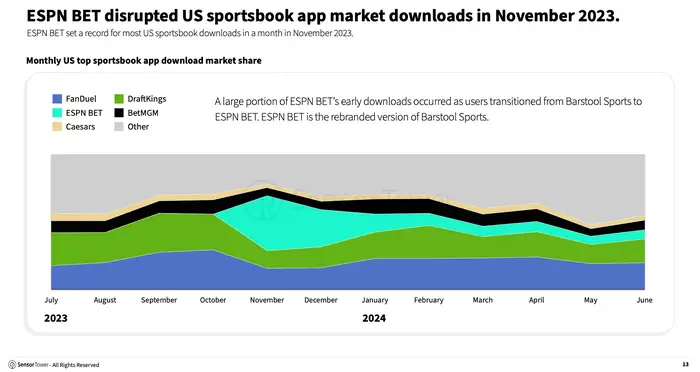

ESPN Bet was unveiled last August as ESPN licensed its heralded brand to casino operator Penn, which previously ran Barstool Sportsbook. The service launched in November and made a major splash by capturing 8.1% of the rapidly growing US online sports betting market in its first month, according to Bank of America.

But as the NFL season wound down, so did ESPN Bet’s momentum. A far lower spend rate than its peers drove the service’s market share below 4% in the first quarter of 2024, BofA estimated.

That’s troubling for Penn, given that its CEO specifically said last summer that “we’re not doing this deal to be 4% or 5% market share players.” It’s early, but analysts noted that ESPN Bet is far from Penn’s projections, which were for the service to take up to 20% market share by 2027.

“By the expectations that Penn set out for ESPN Bet, it’s hard to give it anything higher than a C,” Grove said.

Eilers & Krejcik estimates that ESPN Bet has less than 3% of the online sports betting market, though Grove noted that the newer service should be judged by its share in markets it’s in, not its national share. In those states, ESPN Bet’s share is generally between 3% and 6%.

Morningstar gaming analyst Dan Wasiolek came to a similar conclusion, noting that the service made up 6.2% of Michigan’s sports-betting market and had 4.7% share in Pennsylvania in July.

But while ESPN Bet is just starting out, industry experts say it’s unlikely to beat FanDuel or DraftKings, which have consistently made up a combined 70% to 75% of the market thanks to a yearslong head start.

“It’s FanDuel, DraftKings, and then everyone else,” Wasiolek said in an interview. He said he’s keeping his expectations for ESPN Bet in check.

Grove shared that skepticism about ESPN Bet’s prospects.

“There are both entrenched operators like BetMGM, and Caesars who aren’t going to let Penn pass them by without a fight,” Grove said. “And then there are also emerging and ascendant brands who arguably are as well positioned — if not better positioned — than Penn to claim that third-place prize; Bet365 and Fanatics are two good examples there.”

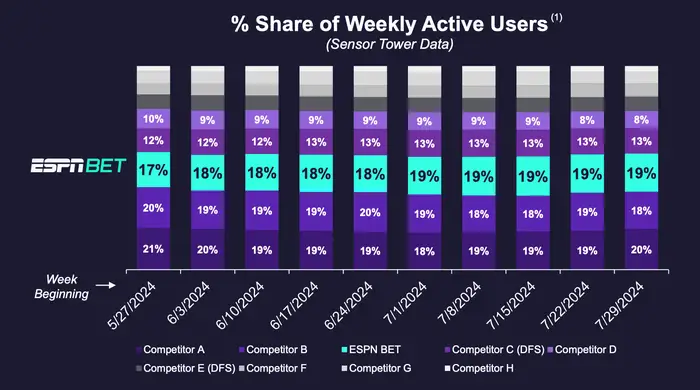

In its second-quarter investor presentation, Penn boasted that it’s neck and neck with its largest competitors when it comes to weekly active users, according to Sensor Tower data. The research firm also found that ESPN Bet is third in app downloads share at 13%.

While that sounds promising, Wasiolek said it doesn’t bear out in market-share data, or the company’s revenue. That suggests ESPN Bet users are committed but make smaller bets, or that the service is collecting less money on bets it fields.

A Worldwide Leader in Sports-betting?

Despite those tough odds, Grove and Wasiolek agreed that ESPN Bet shouldn’t be counted out. Even if the service is never a top-tier player, it can be lucrative for Penn and ESPN.

“They’re going to have a piece of a huge, growing pie that we think is already becoming increasingly profitable,” Wasiolek said.

While avid sports bettors may already be hooked on a betting app, casual bettors who like ESPN’s content could flock to ESPN Bet, especially as it launches in new states.

“They have the brand power of ESPN, and the monthly users on that platform are hundreds of millions,” Wasiolek said. “So it’s about engaging those people.”

That gives ESPN’s namesake betting app a big advantage, but it’s unclear whether that will be enough in the ruthless sports betting market.

“ESPN is a singular brand, and there’s no doubt that it provides Penn with unique opportunities, and there’s no doubt that you’ll see Penn unlock more of those opportunities as the integrations across the ESPN ecosystem become deeper and more meaningful and as the ESPN Bet product improves,” Grove said. “The problem is that Penn’s competitors are not standing still.”