Trump’s crypto allies boast lavish lifestyles amid trail of debts

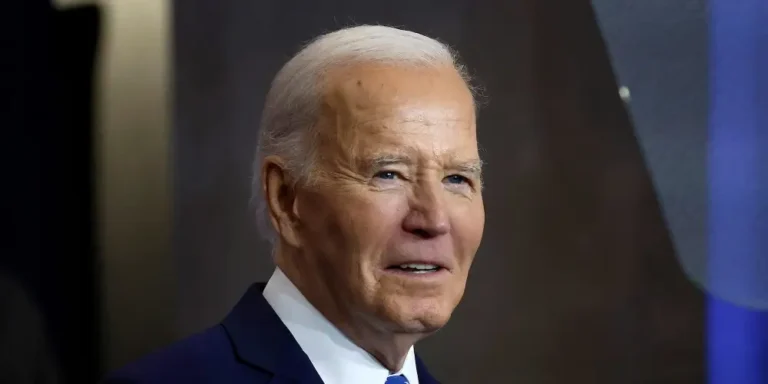

Former U.S. President, pictured here at a Virginia campaign rally, recently became the face of the crypto venture World Liberty Financial. His new business partners have checkered pasts.

Donald Trump is the face of a new cryptocurrency business whose founders have a professional past littered with debts, lawsuits, and some questionable dating advice.

In an X space on Monday, Trump formally unveiled World Liberty Financial, a cryptocurrency business that promises to launch its own crypto token whose value will be pegged to the U.S. dollar, alongside entrepreneurs Zachary Folkman and Chase Herro.

“Crypto is one of those things we have to do,” Trump said during the livestream. “Whether we like it or not, I have to do it.”

Pundits have characterized the move as an attempt to appeal to cryptocurrency enthusiasts, who tend to be young, white men, amid scrutiny of Trump’s past skepticism towards digital currencies. Trump also made other moves to curry favor with crypto fans, including a campaign stop on Wednesday at a bar in Greenwich Village where Trump paid for hamburgers and Diet Cokes with bitcoin.

It’s unclear what Trump’s precise role in the business could be — he’s reportedly identified in some internal documents as a “chief crypto advocate” — but ethics experts say it could present a conflict of interest if Trump wins the presidential election, at which point he would be overseeing cryptocurrency regulations. Three of Trump’s children are employees of World Liberty Financial, including his 18-year-old son Barron, who CoinDesk reported holds the title of “DeFi visionary” at the company.

But the key players behind the company appear to be Folkman and Herro, who spoke for nearly an hour on the X livestream and who hold the titles of head of operations and data and strategies lead, respectively.

Folkman and Herro, both 39, portray themselves as millionaires many times over. On Facebook, their posts show them racing around the Caribbean on a powerboat and relaxing by the beach with their wives. In 2021, Herro bragged about living in the Ritz Carlton resort in Puerto Rico.

Herro describes his life as a rags-to-riches story: As a teen and young adult, he was repeatedly arrested and served jail time on drug charges, but he says he turned his life around and is now a legitimate businessman.

Court records tell a more complicated story. Herro and Folkman have incurred debts and sparked lawsuits in nearly every jurisdiction they’ve lived in, with both appearing in various lawsuits from 2010 to 2020 in places including California, New York, and the US Virgin Islands.

Herro and Folkman could not be reached for comment by B-17. World Liberty Financial’s spokesperson, Jim Redner, told B-17 he has “no information.”

“I’ve been kept in the dark. I’ve been trying to get information, but I have nothing,” Redner continued. “In 25 years, it is the most unusual project I have ever been associated with.”

In 2010, Herro was sued in Los Angeles by a former business partner who alleged he’d invested $170,000 in what he thought was Herro’s medical marijuana dispensary. In fact, Herro had simply taken the money and run, according to the suit. Herro was ordered to pay a $207,366 default judgment.

Around the same time, Herro was sued by JPMorgan Chase and by a collections agency in San Diego. Herro also appears to owe more than $280,000 in unpaid California state taxes, according to lien notices.

Other court records indicate Herro was running an advertising business using fake Facebook accounts. In 2014, Herro sued a man he alleged had sold him 20 dud Facebook accounts that Herro had wanted to run ads on. The accounts stopped working almost immediately, Herro alleged, putting him out the $100,000 he’d paid. The parties settled out of court.

The same year, Herro sued the company behind a “colon cleansing” product Herro had been marketing on Facebook for nearly $570,000 in unpaid invoices, according to court documents previously reported by Bloomberg. The owner of the company was later convicted of an unrelated securities fraud and is currently in prison.

The landlords of the Virgin Islands home Folkman and Herro rented in 2016 sued the pair and their roommates for $36,000 in unpaid rent and $75,000 in property damage, including damage from six dogs the landlords alleged were living in the home without authorization. (The parties settled out of court.)

Herro is also currently being sued by a woman who chartered his speedboat — Herro rents out the boat, christened Clickbait, for $1,250 a day — and suffered a spinal cord injury.

Folkman’s entré into business came in 2011, when he co-founded the company Date Hotter Girls LLC, where he dispensed pick-up artist advice under the name “Zack Bauer.” In a video from a 2011 conference for “alpha males,” Folkman boasted about his system “to take girls home and have sex.”

“That’s what she showed up to the bar for,” he told attendees. “That’s why she’s wearing a miniskirt and high heels and put on all that makeup and took an hour and a half to get ready. That’s why she changed her shirt five times and she went out wearing a thong.”

In 2020, while Folkman was selling a nonrefundable $2,000 ecommerce training course promising to “teach you the exact strategies I’ve used to build multiple 7- and 8-figure businesses with nothing but online advertising and some basic offer creation,” he racked up $77,000 in credit card debt. A bank statement included in a lawsuit seeking to recoup the overdue balance filed by American Express showed nearly all of his expenditures were on Facebook ads. (Folkman never responded to the suit, and a judge dismissed the case after AmEx missed a filing deadline.)

B-17 attempted to locate the three people who had contributed positive testimonials to the course’s website but could not. The photos next to their names were of other people.

Folkman and Herro’s previous venture into crypto ended ignominiously. Both were involved in a project called Dough Finance, whose source code appears remarkably similar to that of World Liberty Financial, Coindesk reported. Hackers stole $2 million from Dough Finance users in July. The project’s website is now inactive, though the company posted on X that it has recovered some of the stolen funds and plans to return money to users.

It’s still unclear when World Liberty Financial will begin allowing investors to purchase its tokens. But even before its official launch, it’s already warning crypto buyers about scams.

“Attention community: Please be aware of scams and fake tokens,” World Liberty Financial posted on Telegram last month. “Do not engage with these tokens!”