A boomer who couldn’t afford retirement in the US moved to Ecuador and said she’s living an ‘upscale life on a modest budget’

Gretchen Kay moved to Ecuador from the US in 2016.

Gretchen Kay, 69, and her husband Robert, 69, worked successful careers for most their lives. But when it came time for their retirement, they realized they were very unprepared.

After years of not investing enough in their retirement accounts, they discovered that they wouldn’t be able to afford healthcare in the US. This pushed them to consider other living arrangements, and they decided to leave the US entirely, settling in a new complex along the beach in Ecuador for a fraction of the cost they were paying in Utah.

They moved to a town between the Canoa and San Vicente that was popular among expats but had a robust local culture. Gretchen, who asked to use her first and middle name for privacy reasons, said prices for healthcare were in some cases over 10 times cheaper than in the US and that housing was about five times less expensive. She said she went from stressing constantly about retirement to living comfortably, though life is at times lonely.

We want to hear from you. Have you recently moved to a new country or state? Please fill out this quick form.

“You don’t have to just give up and say, I’m going to be a Walmart greeter and live in an RV for the rest of my life on a rented piece of land,” Gretchen said. “You can come down here and live well.”

Moving to Ecuador

Gretchen said she always had an entrepreneurial mindset, as she was raised by a “pretty affluent” family of business owners.

She and her first husband ran a commercial printing company for eight years before they got divorced, and she later built spec houses. During the decade before she moved, she worked at a resort, which she said was physically demanding. Her current husband worked for four decades in Moab in uranium exploration and started a solar-grid company.

With her earnings, she traveled frequently, once on a horseback trip spanning over 1,000 miles through the Pacific Crest Trail. She said even though her adventures were costly, she had no regrets about them.

“Between all those things, the result of that wonderful, exciting life was that I didn’t save for retirement,” Gretchen said. “It never even occurred to me. My dad never talked about it. I knew nothing about retirement, and that’s my own fault.”

Because she ran her own businesses early in her career, she wasn’t directed to put much toward her 401(k). Robert had enough to get by but not enough for long-term savings. They ended up with about $3,000 a month in Social Security.

“We did a lot of math and realized that we just couldn’t afford to retire in the US unless it was some really dire situation we wouldn’t be happy in,” Gretchen said. “We had to be pretty judicious about what we could afford later on.”

Like many boomers facing retirement, Gretchen felt her medical costs were daunting. The copays for her joint replacements were “a devastating amount,” she said.

Gretchen had relatives in South America, including a sister in Peru. In 2013, she read in the magazine International Living that Ecuador was the top country for retirement and had the lowest income requirements to obtain residency compared to other countries she considered. She also read that the local communities were more welcoming to tourists than other Latin American countries.

Her husband went on a real-estate tour along Ecuador’s coast, exploring the many new developments along the water. They settled on an American-constructed building with more robust architecture, though she said the paperwork to move was difficult. They hired an immigration attorney and underwent various screenings and background checks and made the move in 2016.

Living comfortably for cheaper

With $3,000 a month in Social Security and a small brokerage account, Gretchen and her husband live comfortably in Ecuador. They live on less than $1,000 and save the rest to return to the US, where they spend a few months a year in San Diego. Their neighbors are mostly expats, though she said many wealthier Ecuadorians are also moving to the beaches.

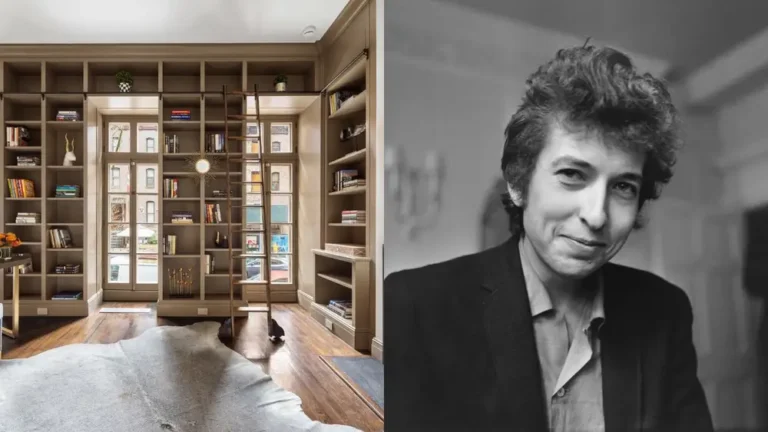

Gretchen Kay and her husband live in a newly built expat condo in Ecuador.

They bought their brand-new condo on the beach for $115,000 in Ecuador and said similar condos rent for $800 a month. She said the prices have stayed rather low because a huge earthquake in 2016 damaged many properties along the coast.

Gretchen said her HOA fee — which includes property insurance — is $160 a month, her electricity is about $100 a month, and her property taxes are $60 a year. In Utah, they paid over $1,000 a year in property insurance and about $1,000 in property taxes.

“There’s hardly any cost of living here,” Gretchen said, adding that the price of groceries is similar to the US because of tariffs on many imported goods. Still, eating out costs about a third less than a similar meal in the US. They decided not to have a car because buses run frequently and taxi rides are inexpensive — a taxi to the grocery store costs about $8, she said.

Her medical expenses are also much lower in Ecuador. After a hip replacement she received in the US failed, she was rushed to the hospital in Ecuador and paid $6,000 for the surgery. When she asked the Mayo Clinic how much that surgery would’ve cost in the US, she was told it would be about $80,000. An MRI in Ecuador costs $190; in the US, it costs about $1,000. She also said she’s taken care of immediately and can easily secure medical appointments, while she often waited months to get a similar appointment in the US.

Gretchen Kay and her husband have taken trips to the Galápagos Islands nearby.

“Even Medicare, with all the supplements that you need and the different parts, was way over our financial ability, and you still have to pay 20%,” Gretchen said. “Here, we could get on the national health plan for $80 a month for both of us.”

It took some time to get adjusted to Ecuador’s emphasis on independence and “personal responsibility.” She said many homes are surrounded by barbed wire, while her complex has four security doors. She added that police often won’t respond to smaller incidents, and the infrastructure is often “chaotic” and hard to navigate.

Life is sometimes lonely and monotonous

They’ve taken some trips to other parts of the country including Quito, Cuenca, and the Galápagos. However, Gretchen said they have little desire to continue exploring as the roads are often difficult to navigate, and they’re content spending time in their small town.

“We had a much more lively social group here a couple of years ago, and they had cars, so we would go the nearest little town for karaoke or trivia nights,” Gretchen said. “Then, those people moved away or died, and my husband and I decided it wasn’t worth it for us to keep taking taxis into town. We don’t really go unless someone else invites us, and that’s kind of a shame.”

At her age, she said she’s lost some of the energy to explore and get acquainted with the locals in her area, though she said she regrets not putting in more effort. She said many locals are welcoming and appreciate that many expats are respectful of their heritage and culture.

“We’re really polite and careful and deferential to the locals; we never act like loud Americans,” Gretchen said.

She said she had plenty of hobbies she wanted to start in Ecuador, though her hip problems and skin cancer put a wrench in her plans. She’s trying to find more sedentary hobbies such as cooking or reading.

“I’m kind of embarrassed to admit we’re in the category of never leaving the complex; we found a gringo complex here, and we pretty much just stay here,” Gretchen said. “Our only interactions are at the grocery store, our taxi drivers, and repair people, and for that, we use Google Translate. We thought we would learn Spanish by osmosis, but we haven’t.”