Qualcomm has good reasons to bid for Intel — but a takeover probably won’t happen

Intel has received a takeover bid from Qualcomm at a time when the storied chip giant has been struggling.

If Qualcomm sees it through, its takeover bid of Intel would likely be the biggest in Silicon Valley history. While it has good reasons to go after the storied chip giant, a lot is working against it.

The possibility of Intel handing its 56-year history over to a younger rival emerged last week after several reports said that California-based semiconductor firm Qualcomm had made a takeover approach.

Qualcomm is no newbie in Silicon Valley. It was founded 39 years ago, in 1985. Since then, it has grown into a company worth over $188 billion, specializing in everything from wireless networks to smartphone processors and modems.

But recent trouble brewing at Intel, a longtime chip designer and manufacturer, has apparently given Qualcomm reason to consider acquiring a company that has lost more than half its value this year and dropped to a market capitalization of just over $93 billion.

While some of its top competitors, like Nvidia, have soared to new heights as a result of the generative AI boom, Intel has struggled to capitalize on investor interest in the technology. It has also grappled with production and strategy challenges.

The company took a serious tumble in August — a month in which it lost almost $30 billion in market value — after announcing layoffs affecting 15,000 employees and a suspension of its dividend from the fourth quarter of this year.

It’s worth noting that Qualcomm’s talks to takeover this troubled business are very early-stage and exploratory in nature. A person close to Qualcomm told the Financial Times that the company “would only pursue a friendly deal.”

Intel presents Qualcomm with pros and cons

Intel’s Pat Gelsinger has enacted sweeping new measures to boost the company.

For some, the logic to pursue the deal here is apparent.

Speaking on CNBC last week, industry analyst Patrick Moorhead said Intel’s exposure to key areas like data centers, the PC market, and chip manufacturing capabilities — which Qualcomm lacks as it outsources that process to Taiwan’s TSMC — means there are “synergies in this.”

The company has also taken steps that seem to make it a more attractive purchase. Intel’s CEO Pat Gelsinger also announced a set of drastic measures to bring change to the company last week that could set it on a brighter path.

These measures included a “multi-year, multibillion-dollar” deal to work on custom chip designs with tech heavyweight Amazon Web Services, pauses on plans to build plants in Europe, and separating its manufacturing unit, Intel Foundry, into its own entity.

That said, not everyone is convinced that Qualcomm needs Intel — or that a buyout would be a good idea for either company.

Richard Windsor, an equity research analyst and founder of Radio Free Mobile, thinks that while “it is possible to see how Qualcomm and Intel could fit together” — one company designs chips and the other has factories — lots of Intel’s bits won’t fit so well.

“The vultures are hovering around Intel and while Intel will make a tasty and nutritious meal for some, I think Intel would end up sticking in Qualcomm’s crop and give it a bad case of indigestion,” he wrote in a note on Monday.

He points to a few key reasons.

Intel’s x86 processors lag behind Qualcomm’s and rival firm Arm’s offerings. Redesigning chips to be made by Intel “sounds like a risky proposition,” he said, given Qualcomm’s “already established excellent relationships” with manufacturers like TSMC.

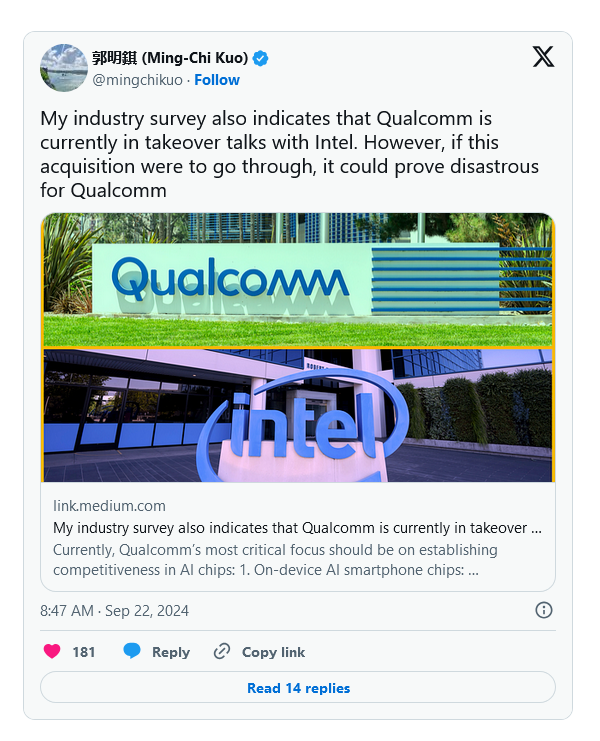

Ming-Chi Kuo, a Taiwan-based market analyst at financial services firm TF International Securities, went a step further, claiming a takeover of Intel could be “disastrous” for Qualcomm in a post over the weekend.

His rationale was that Qualcomm’s “most critical focus should be on establishing competitiveness in AI chips” for segments like smartphones, but he doesn’t see an acquisition of Intel helping.

It could boost its position in the market for AI PCs, but the analyst thinks Qualcomm already has a strong position here, as its processors are being used in Microsoft’s Windows on Arm platform — a version of Windows running on Arm technology that Microsoft is committed to.

“While the acquisition of Intel could rapidly increase Qualcomm’s PC market share, it comes at a significant cost,” he wrote. “Qualcomm can grow in the AI PC market even without the acquisition.”

It’s also unclear how Qualcomm would find the cash to buy Intel. The company’s cash on hand is $13 billion, but even adding in free cash flow, it still falls far short of Intel’s current price.

The impact on competition would likely spark alarm among regulators, too. A Qualcomm bid for Intel could face similar regulatory obstacles to the takeover attempt Nvidia made for Arm in 2020 and later abandoned in 2022.

Intel will, of course, want to consider its options. Bloomberg reported on Sunday that a new option was on the table after investment giant Apollo offered to make a “multi-billion-dollar investment” in the company.

For Intel’s Gelsinger, that could offer the chip firm some vital capital to see through its new plans an help it stand on its own two feet.