EEOC says Globe Life “created, condoned” a work environment that is hostile and abusive to women

The U.S. Equal Employment Opportunity Commission has found that Globe Life tolerated a “pervasive pattern of harassing conduct” against women at one of its top-producing sales agencies.

Many of the sexual harassers were so high up in the company that “they constitute alter egos or proxies” of Globe Life and one of its major divisions, American Income Life, the federal commission wrote.

B-17 has learned that the EEOC issued 14 so-called “letters of determination” on Thursday to six current or former Arias agents, validating their charges of sexual harassment, sexual assault, and gender discrimination, including inferior job training and sales leads. B-17 has exclusively obtained copies of all of the letters, including ones addressed to Globe Life, American Income Life, and the Arias Organization, one of AIL’s top agencies. The EEOC issues such letters when it has found evidence that discrimination has occurred.

In the letters, the commission notes that Globe, AIL, and Arias have denied the allegations.

This morning, Globe filed a disclosure with the Securities and Exchange Commission acknowledging receipt of the letters and saying the company disagrees with the commission’s conclusions. Globe also said “the company has policies in place that prohibit discrimination of any form and takes allegations of such conduct seriously.”

The commission found that Globe, AIL, and the Arias Organization have subjected an entire class of women to a hostile work environment, sexual quid pro quos, and retaliation.

The repeated references in the letters to “a class of female employees” could signal that the agency is laying the groundwork for a class-action lawsuit, according to Mark P. Carey, an employment attorney based in Southport, Connecticut.

“It seems like the EEOC is forming its own case against this employer,” said Carey, whom B-17 briefed on the letters. “This case is far from over.”

The commission said it found violations nationwide, going back as far as January 1, 2011, and extending to the present.

American Income Life is one of five wholly owned subsidiaries of Globe Life that sell life, accident, and supplemental health insurance. The abuses documented in the letters took place at the Wexford, Pennsylvania, headquarters of the Arias Organization and at Arias offices in multiple states.

In a finding that would be ominous for any company that relies heavily on contract workers, the EEOC said that Arias had misclassified a list of eight job titles, from caller to agent to state general agent — potentially the entirety of its US salesforce — as independent contractors. The company’s “characterization of its workers as ‘independent contractors’ is inaccurate,” several of the letters reviewed by B-17 said.

A worker must be an employee in order to proceed with a discrimination claim at the EEOC, so the commission had to make this determination before proceeding with its sexual harassment investigation. In its most recent annual report, Globe said that if the company were required to reclassify agents as employees, it “could significantly increase our operating costs and negatively impact our insurance business.”

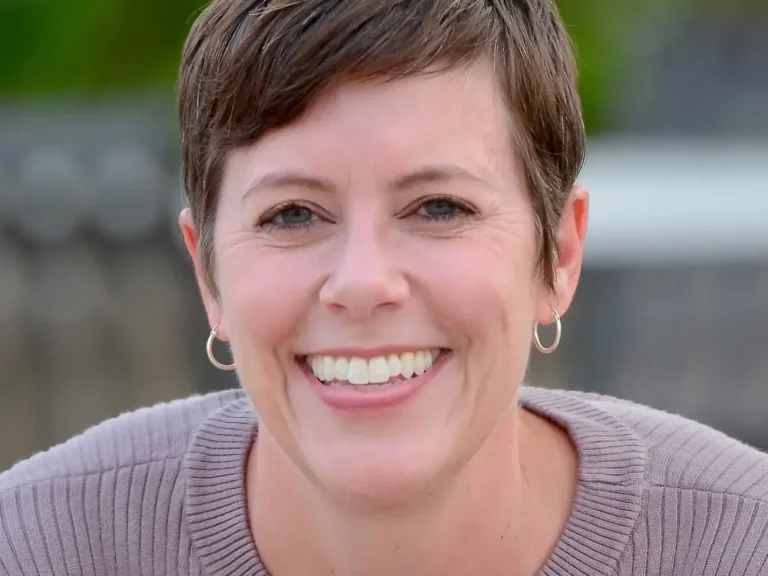

One of the six women who received letters from the agency was Renee Zinsky, a former Arias agent at Wexford headquarters who alleged that her boss, a former Arias supervisor named Michael Russin, had sexually assaulted her and demanded sex in return for a promotion. B-17 was the first to report on Zinsky’s claims. The EEOC investigation confirmed her version of events, finding that she’d been subjected to nonconsensual touch, “unwelcome displays of male genitalia,” and “acts of male masturbation and pornography.”

Zinsky told B-17 on Thursday that it had been a “brutal” journey fighting Globe. “I would never have thought that Arias and AIL would go to such lengths to continue to retaliate against me,” she said. “This is the first step toward putting it all behind me.”

Another woman who received a determination letter, Sarah Reay, who worked at an office in Morgantown, West Virginia, told B-17 that she had “felt defeated” after repeatedly reporting the discrimination, harassment, and fraud she experienced, “just to see the perpetrators be promoted.” It was a relief, she said, “to be finally heard and validated.”

This morning, B-17 reached out to Matthew D. Gailey, a lawyer for Russin; Arias spokeswoman Trina Orlando; Anne Rose Dana of King & Spalding, which represents AIL; and Globe Life spokeswoman Jennifer Haworth. None of them immediately responded to a request for comment.

B-17 first wrote about the toxic workplace at the Arias Organization, then called Arias Agencies, in February 2023, describing an intense masculine culture of sexual harassment, violence, and drug use where agents would abuse customers and open accounts in the names of dead people in order to pocket a commission. B-17’s reporting showed that top executives at Globe and AIL lavished praise on Simon Arias, the agency’s owner, who ran an operation where agents engaged openly in sexual harassment. At a Las Vegas convention in 2019, agents did drugs and had sex with one another while AIL’s CEO and president partied with agents nearby.

In subsequent articles, B-17 exposed a racist culture among top AIL managers, the launch of a Department of Justice investigation into the Arias Organization, and the EEOC’s decision to reopen two cases against Arias that it had previously closed.

In the wake of B-17’s coverage, three prominent short-sellers issued reports marshaling further evidence of potentially illegal sales practices, sexual harassment, and drug use at AIL. One of them, Viceroy Research, also raised the issue of misclassification, writing that Globe and AIL were calling agents independent contractors “despite having full control over their activities and enforcing non-competition clauses.” The Viceroy report saw “significant risk” that AIL would have to reclassify its agents and speculated that such a change could carry “a deep 9-figure price tag.”

In today’s SEC filing, Globe said it did not believe the commission’s enforcement actions would result in material loss to the company.

On April 11, Globe’s stock plunged 53% after the short seller Fuzzy Panda released a report calling AIL a “pyramid scheme” with an “exhaustive array of financial malfeasance.” The stock has recovered most of its losses, helped in part by an aggressive stock buyback program by Globe.

Globe’s Audit Committee hired the law firm Wilmer Hale to conduct an internal audit in the wake of the Fuzzy Panda report; the firm filed a statement with the SEC in July saying that the short-seller’s allegations of financial misconduct were not supported.

On an earnings call in July, Co-CEO Matt Darden said Globe “has reasonable and appropriate systems in place that are designed to detect and mitigate misconduct.”

The EEOC came to a different conclusion. In the agency’s letters yesterday to Zinsky and another woman, Abeni Mayfield, a former Arias agent in Columbia, Maryland, the commission said Globe had failed to implement or maintain “any reasonably diligent sexual harassment policy” and to this day does not maintain “any reasonable avenues for reporting sexual harassment or discrimination.”

During the July earnings call, Globe confirmed that two other federal agencies — the Securities and Exchange Commission and the Department of Justice — were also investigating the company.

The EEOC said in its determination letters that it would be contacting the women, Globe, AIL, and the Arias Organization to begin a conciliation process in order to reach a settlement. Any settlement, according to the letters, signed by area director Deborah A. Kane, will require EEOC sign-off.

In cases where conciliation fails, the EEOC sometimes files suit. Globe Life disclosed that risk in its filing this morning with the SEC and said it would fight any such lawsuit vigorously.

Amy Williamson, a Pittsburgh attorney who represents the six women, said it is “a breath of fresh air” to have the agency involved after a grueling three years of litigation in the courts and in private arbitration.