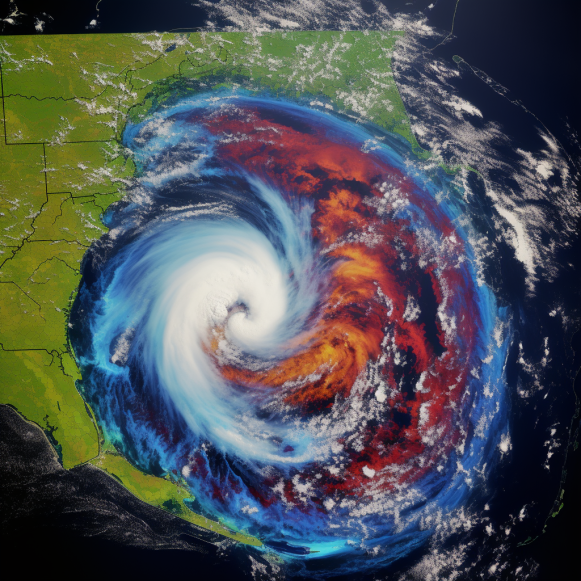

Florida’s already-volatile insurance industry is bracing for aftermath of Hurricane Idalia

The average homeowners policy is $6,000 a year and experts expect that to rise

New York City — Hurricane Idalia’s arrival in the disaster-prone Sunshine State may serve as a litmus test for Florida’s increasingly volatile and expensive insurance landscape.

Despite the fact that several insurance companies have left Florida, experts say residents are still mostly covered this hurricane season.

However, insurers are wary of Idalia. Experts say the state’s insurance industry can absorb potential losses for the time being, but an Idalia hit in a densely populated area could have an impact on those companies’ future prospects.

“This would be a very different event if it was going right into Tampa versus much less populated areas,” said Matthew Carletti, an analyst at JMP Securities. “Where it’s going now, there should be much less loss, but that could change.” Tampa is on the edge of the cone, but (the storm) could still end up there, which would have a significant impact on total loss. In that regard, it is still very early.”

It is expected to make landfall well north of Tampa in less-populated areas of Florida’s Gulf Coast, but a minor shift in the track could put the 3 million-person metro area at risk. After making landfall, it will most likely pass over Gainesville and Jacksonville, Florida’s largest cities. According to CNN, all three cities could experience maximum sustained winds of more than 50 mph and up to six inches of rain.

This is slightly weaker than Hurricane Ian, which made landfall as a major Category 4 storm in September 2022 with sustained winds of around 150 mph. According to the reinsurance company Swiss Re, Hurricane Ian caused up to $65 billion in insured losses. Ian was the most expensive storm to hit the state, with uninsured losses totaling $17 billion.

“If a hurricane strikes a major metro area rather than a rural area…it would certainly have a greater impact on losses and properties that are impacted,” said Mark Friedlander, a spokesperson for the Insurance Information Institute.

“Florida’s property insurance market remains very volatile, but the insurance industry is well-capitalized to pay Idalia claims,” he adds. “One of the most important reasons is that insurers were able to obtain adequate reinsurance policies this year.”

However, the consumer will most likely face higher insurance premiums. According to the Insurance Information Institute, one of the main reasons insurance companies are in a good financial position to pay claims this year is that insurers have been able to obtain satisfactory policies from reinsurance companies, which insurance firms use to cover some of their risks.

These reinsurance companies, however, are raising their premiums. “This hurricane season, the average cost of reinsurance increased by 40-70%.” “This means that (insurance companies) will have to pass those costs on to customers in the form of higher premium rates,” Friedlander explained.

According to III, Florida residents already spend $6,000 per year on home insurance policies, which is four times the national average.

While most homeowners will not be affected by the potential increases this hurricane season, the trickle-down effect will become more apparent as policy renewals approach. Some recent insurance company withdrawals from Florida will also have no effect on homeowners.

“No Farmers customer has lost their coverage for hurricane season this year,” Friedlander said.

According to III, 85% of Florida residents have wind damage coverage on their home insurance. Flood insurance is obtained through a separate policy, usually through the Federal Emergency Management Agency.

According to the most recent FEMA data, flood insurance enrollment has been steadily increasing since October 2022. There were 44,000 more active flood insurance policies in Florida as of July 31 than there were last August, before Hurricane Ian hit the state. Despite the fact that Florida has the highest flood insurance enrollment rate of any state, Friedlander claims that only 18% of residents have flood insurance through either federal or private insurers.

The-CNN-Wire

™ & © 2023 Cable News Network, Inc., both owned by Warner Bros. Discovery. All intellectual property rights are reserved.