Kamala Harris’ tax plan for small businesses sounds like it will cost a lot of money — it won’t

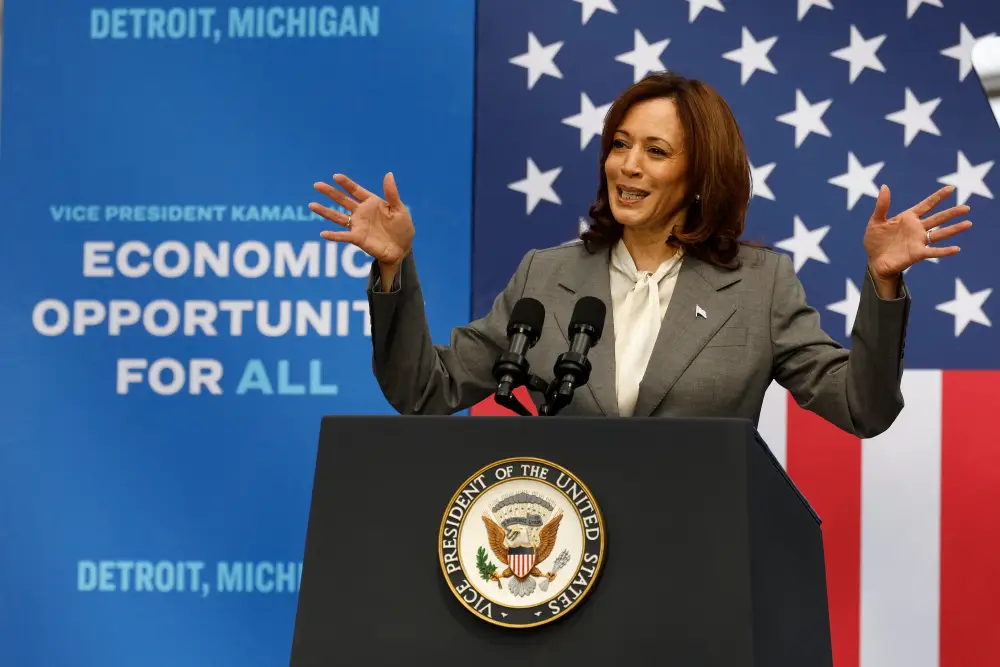

Harris has made supporting small businesses a key part of her economic proposal.

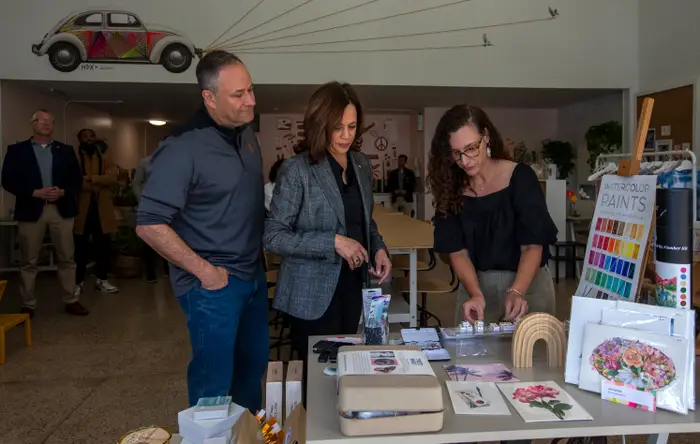

Patricia Oswlad, 55, and her husband have spent years building up their retirement fund. But when Oswald decided to launch a small business in the fall of 2022, the couple liquidated some of their assets to fund the company, throwing their financial planning to the wind.

With fewer than five weeks until Election Day, Vice President Kamala Harris is making a targeted pitch to entrepreneurs like Oswald, who are burdened by startup expenses. She even mentioned a key proposal in her opening answer at the presidential debate: expand the small business tax credit 10-fold, from $5,000 to $50,000.

In a pamphlet on her economic plan, dubbed the “Opportunity Economy,” Harris explains that she would let business owners take advantage of the $50,000 tax deduction right away or a few years after launching, to help lower taxes once they start turning a profit. The proposal, like many of her others, would need congressional approval.

Oswald told B-17 the credit would have been “invaluable” in getting Brisa Systems, which offers powered drying racks, off the ground.

Harris’ proposal shifts the tax timeline for entrepreneurs.

Tax experts told B-17 that enacting the credit would mean a change in timing more than anything else. Under current law, small businesses can deduct up to $5,000 in expenses immediately and must deduct any future expenses against their income over 15 years. Harris’ proposal would let entrepreneurs deduct more money quickly.

Owners have expenses before even launching their business, and the deduction would help cover those costs.

Rhett Buttle, the co-executive director of Small Business Roundtable and a former business advisor for President Joe Biden, told B-17 that startup costs accumulate in three primary areas: marketing, basic equipment, and hiring.

For Oswald, most early costs have been in manufacturing and intellectual property services. Taylor McCleneghan, who launched her product development company, Small Shop LLC, in 2018, named inventory and marketing as the biggest upfront costs. Both women are based in the Chicago area.

Harris has made supporting small business a key part of her economic agenda.

Brett Theodos, a senior fellow at Urban Institute who specializes in small business loans, told B-17 that entrepreneurs would “love” to be able to deduct more of those expenses right away. Moving up the timeline would, he said, make many feel less strapped for cash from the very outset.

And there’s another potential upside, according to Garret Watson, a senior policy analyst at the nonpartisan Tax Foundation. Small businesses would likely benefit from getting the deduction more quickly because of inflation, he said.

Many entrepreneurs are psyched about the effort. Theodos struggled to think of a reason why they wouldn’t want this, and Buttle said that those he works with are overwhelmingly excited about the plan.

McCleneghan, of the Small Shop, said having access to a $50,000 tax deduction early on would have allowed her to do better long-term planning. With the expanded tax deduction, Oswald said she might not have had to divest retirement funds or take out lines of credit.

“Getting money in the hands of entrepreneurs sooner is going to allow them to hire, to get equipment, to get a space, to pay off some debt, to pay themselves,” Theodos said. “So it’s meaningful to allow them to accelerate the deduction of startup expenses.”

But while small business owners may jump at the opportunity for more early cash flow, where this money would come from is more unclear. McCleneghan herself acknowledged that the details seem hazy.

Despite the flashy numbers, the proposal likely wouldn’t have a significant impact on the federal budget.

Though $50,000 sounds like a big-ticket promise, the experts B-17 spoke to said Harris’ proposal actually wouldn’t make a big dent in the federal budget. The Tax Foundation, where Watson works, examined cost estimates from prior expansions and found that the proposal would cost about $24.5 billion over 10 years.

“Relative to the federal government’s budget and spending, it’s very small,” Watson said. “This $25 billion number is in the context of a tax plan for the Harris campaign that would raise about $5 trillion over 10 years. So you’re talking about orders of magnitude more money on the tax hike side.”

Harris’ proposal would require congressional approval.

Some of the loss, he said, stems from the likelihood that certain entrepreneurs will use the deduction and then go out of business. Since the proposal changes when businesses can deduct rather than how much they deduct, it will cost some money, but not “big money,” Theodos said.

And the proposal could help spur growth, if it becomes law. According to a study from the Pew Research Center published in April 2024, small businesses employ nearly half of the country’s private sector employees.

Theodos called small businesses “essential” for the US economy, and Buttle said they’re a crucial source of innovation. But the tax experts said the full potential economic impact of the proposed expansion is still up in the air.

“The question is, will this significantly contribute to a startup boom or really change the needle there or move the needle there? I think that’s a reasonable question. It’s up for debate, particularly because this is such a narrow provision,” Watson told B-17, while noting that giving businesses deductions is generally a good policy.

If the policy did spur more development, though, Mary Hansen, an economics professor at American University and co-director of the nonpartisan Institute for Macroeconomic and Policy Analysis, said it would eventually have a net positive impact on government revenue.

As of now, Harris’ promise is just that — a promise.

Should she win the election, Congress would need to pass legislation to turn her expanded tax deduction idea into a reality. Despite the prevailing congressional gridlock, all of the experts B-17 spoke with said small businesses are a rare point of potential bipartisan agreement. Watson predicted that lawmakers would likely tie the proposal to their actions on the expiring 2017 tax provisions.

Harris’ proposal would disproportionately impact entrepreneurs with less access to capital, namely women and people of color.

Should Congress ever pass the expanded tax deduction, all startups and small businesses would access the same amount of money — but the experts told B-17 that some would feel the impact more than others. Entrepreneurs with less initial cash flow would disproportionately benefit from the change, they said.

Buttle said it would help women and people of color who have a harder time accessing capital. The Pew Research study found 61% of small businesses are majority-owned by men and, as of 2021, 85% were majority-white owned.

“We’re talking about community businesses, micro-businesses, businesses where the founder doesn’t have as much net worth,” Theodos told B-17. “Everybody can benefit from $45,000, but the question is, who is that making the critical difference for?”