PayPal enters the ads game, led by an architect of Uber’s $1 billion advertising business

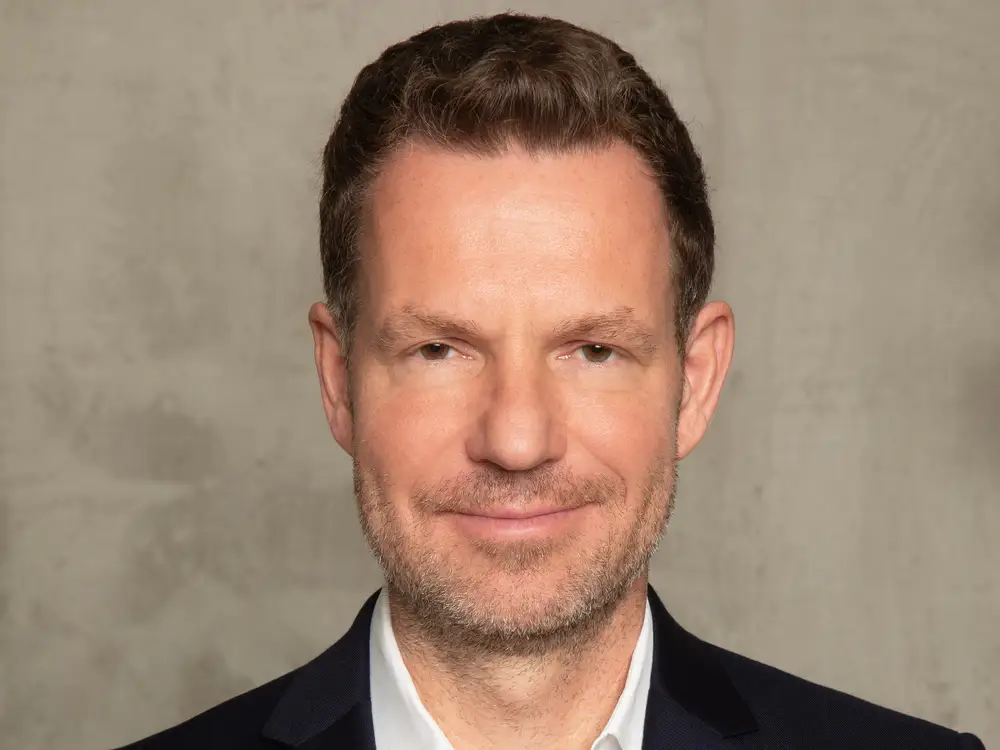

Mark Grether helped Uber build a $1 billion ads business. Now he wants to grow PayPal Ads.

PayPal is set to announce the official launch of PayPal Ads on Thursday. This new advertising business looks to help marketers tap into data on the billions of transactions that take place across its payments platforms.

Starting this year, brands and agencies in the US will be able to run ads across properties, including PayPal, the person-to-person payment service Venmo, and Honey, its coupon and cash-back tool.

Next year, PayPal also intends to let these advertisers purchase ads across the more than 30 million merchants that use its payment systems, opening up a much broader commerce-media ad network.

Mark Grether, the senior vice president and general manager of PayPal Ads, who joined the company this year after leading Uber’s now-$1 billion ad business, will make the announcement later on Thursday at the Advertising Week New York trade show.

In an interview with B-17, Grether said the company was looking to address a key pain point in the fast-growing retail-media-ad space. An avalanche of retailers, apps, and businesses have launched advertising businesses in recent months, but marketers typically can’t buy campaigns across multiple sites and instead must deal with each company individually.

“With our cross-merchant data, we are in a prime position to help the market to rationalize,” Grether said.

About $1 in every $7 US ad dollars is expected to be devoted to the retail-media space this year, according to Emarketer. Advertisers are particularly attracted to the space because they can get in front of consumers just as they’re about to make a purchase, and retailers can offer unique data about whether their advertising led to a sale. That means it’s a high-margin business for the sellers of retail-media ads because they can charge higher rates than the average web-display ad.

“The newest offering from PayPal underscores the importance of incrementality: While data and signals tied to consumer purchasing are not necessarily new, the opportunity to infuse incremental moments of influence throughout shoppers’ journeys opens up real-time engagement for advertisers,” said JiYoung Kim, the chief operating officer for North America at the media-investment company GroupM.

PayPal had 429 million active accounts as of June 30, a larger potential audience than most individual retailers — bar the likes of Amazon and Walmart, which are the leaders in the retail-media space.

Grether said PayPal would also be able to offer advertisers insights, such as the market share of their products across various retailers compared with their competitors.

“It’s really powerful not only for the CMO but also for the CFO to see how a retail-marketing campaign actually influences market share,” Grether said.

Users can opt out of their data being shared with advertisers, PayPal said.

PayPal’s other plans for next year include expanding from display ads to video, working on self-service ad software for its clients, and offering PayPal Ads in more territories, such as the UK and Germany. PayPal said the current ad stack was built using a mixture of third-party software and its in-house tech.

It made its foray into ads earlier this year, launching nontargeted in-app offers from brands like Nordstrom, Lyft, and Ticketmaster. It’s also recently launched a marketing push that aims to position PayPal and Venmo as rewarding payment methods.

PayPal’s advertising expansion follows the company’s appointment of CEO Alex Chriss, who has sought to make the company nimbler. Under Chriss, PayPal overhauled its leadership team, including hiring a former Verizon chief marketing officer, Diego Scotti, whom Grether reports to.

Robert Webster, the founder of the consultancy TAU Marketing Solutions, said PayPal’s transaction data put the company in a prime position to launch an advertising service. But he said it would need to tread carefully to avoid alienating and bombarding customers. Plus, it’s launching late into an already-crowded market.

“Mastercard already has a data business,” Webster said. “They will be somewhat also competing with other data vendors like Lotame, Dun & Bradstreet, Experian, as well as potentially competing with retail-media networks.”