Airlines are building ‘business-class-lite’ to generate more revenue and increase demand for the luxe seats

Flying Delta One on a Delta Air Lines Boeing 767-400.

The unbundled, pay-as-you-go experience of basic economy is coming to business class.

In recent years, international airlines such as Air France, KLM, Emirates, Finnair, and Qatar Airways have launched discounted “Business Light” tickets. These fares can vary but generally do not include traditional business-class amenities like lounge access or advanced seat selection.

Now, Delta Air Lines, a close partner of Air France and KLM, may be the first to bring it to the US.

Delta executives have hinted as much on recent earnings calls. In response to a question about “unbundling” the front cabin in July, Delta President Glen Hauenstein said the airline didn’t have anything to share yet but that its investor day in November “should be very exciting.”

On Thursday’s call, executives continued to drum up excitement for premium product announcements in November. A Delta spokesperson declined to give any additional details.

During the third quarter, Delta’s premium offerings, which include Delta One business class, domestic first class, and premium economy, generated $5.3 billion in revenue compared to $6.3 billion for the economy cabin despite occupying a mere fraction of tickets sold.

Demand for international business class and other high-margin premium cabins at the front of the plane have struggled to return to pre-pandemic levels. Still, Delta executives said its premium demand is now outperforming the main cabin.

The carrier expects that momentum to continue through the end of the year and beyond, noting that its corporate sales increased by 7% in the third quarter. A recent survey found that 85% of companies expect to increase spending in 2025.

For airlines, the business light strategy can help further stoke demand to fill the front of the plane and generate additional revenue. For customers, it may be a relatively cheaper way to access the luxe seats and offer them more choice.

“Delta can unbundle business class and then resell those previously inclusive privileges for a fee,” industry analyst Henry Harteveldt told B-17 on Thursday. “I’ll give Delta credit for looking for new ways to find value for their customers.”

‘Business light’ is popular overseas

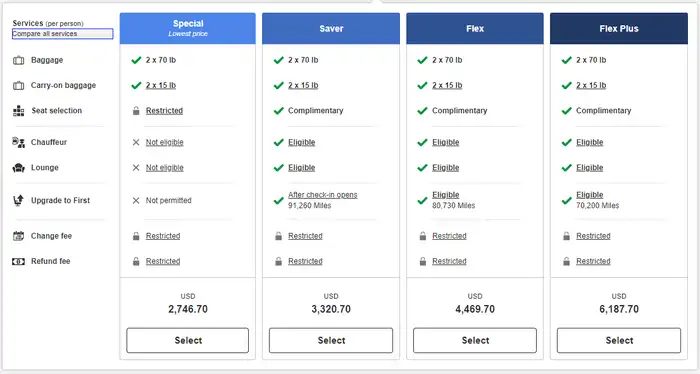

Qatar Airways’s unbundled “business class bite” fare requires additional payment for lounge access. Those traveling on a Finnair Business Light ticket will also have to pay extra for checked luggage.

Emirates’s “business special” fare does not include add-on amenities like chauffeur pickup, lounge access, open advanced seat selection, and upgrades to first class. Passengers must buy the pricier “Business Saver” fare for those amenities.

Screenshot of Emirates’ various business class fares on a one-way flight from New York to Dubai in February.

Given the profitability of premium cabins like business class, airlines are keen to squeeze every profit from both the seat and its ancillary amenities.

However, the ultimate effect on consumers remains unclear. Like basic economy, an unbundled fare means consumers who want guaranteed seats or other add-ons would likely pay extra to get it.

“It’s like insurance, in a way,” Harteveldt said. “If you want the certainty that you have a specific seat, then you will pay for it, presuming the price is right.”

In practice, Harteveldt estimates fares for the new unbundled ticket would be similar to current business-class prices — with the price of a full-fledged business seat steadily increasing.

On the other hand, Harteveldt said the new strategy could be good for corporate customers because they can ensure business travelers get good rest and food on the aircraft, even if they can’t access the lounge or board first.