I’m a multimillionaire and father of 3. I’ll pay for my kids’ college, but I didn’t mind when my middle son decided it wasn’t for him.

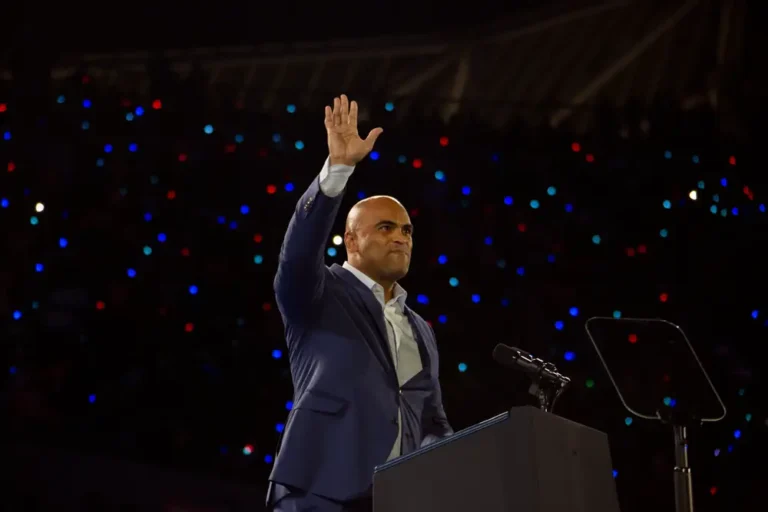

Greg Clement became a millionaire at 33.

I grew up in a paycheck-to-paycheck family. Anything beyond the necessities, I needed to find a way to pay for on my own. When I was old enough to drive I bought a car, then covered gas and insurance. Later, I paid for college by working and taking out loans.

My family worked in the construction industry, so I was handy. As a young adult I started finding old houses to flip. It wasn’t lucrative to start: my first flip earned me $600, after more than 100 hours of hard labor. But I learned quickly, and my next deal netted $40,000. I continued to build my real estate portfolio, and also created software to support others in the real estate business.

I became a millionaire when I was 33, through real estate investment. Today, at 50, my net worth is around $70 million. That comes with a lot of security. I have the financial freedom to spend my time doing what I want, with whom I want. But in many ways my life doesn’t look how people think a multi-millionaire’s would.

I still go to work

In addition to flipping real estate, I worked as a financial planner for seven years in my 20s, so I got to see behind the curtain into the lives of many high net-worth individuals. I was shocked that one of my richest clients still went to work. I thought, “I’m going to be different to you.” I figured if I had enough money I wouldn’t work.

Now, I still work even though I could easily retire, and I’ve realized a job is about a lot more than just money. I’m living a purpose-filled life that includes doing work I enjoy and am good at. I invest in real estate and run multiple companies, including a real estate investing course that uses software I developed. I’ve created a rhythm where work fits into a fulfilling day.

Greg Clement and his wife bought a farm in the town where they grew up.

I live on a farm, and teach my kids to think like farmers

I live on a 150-acre apple orchard in Ohio. It’s beautiful, but it’s also a working farm property. My wife and I grew up here and met during high school, and both came apple-picking on the farm as kids. We purchased the farm to keep it from being developed.

We also recognized the farm would be a tangible family business for that our three sons — who are now 16, 22, and 24 — could learn from. Many people today want instant gratification: to start something today and be making money tomorrow.

Our sons have been forced to grow up thinking like farmers. They understand that when we plant trees, it will be three years until they fruit. You need to work hard and wait before you can harvest, and that’s a lesson I want them to take into their lives.

I didn’t buy my kids cars

I could have easily purchased my sons’ first cars for them outright, but I wanted them to work toward that goal. When they were about 14, my wife and I explained that we would pay for half of their first vehicle, and they would be responsible for the other half. They would also have to buy their own gas.

I paid for college, and allowed my son to drop out

I told my sons I would pay for their college education. My oldest graduated with a degree in business. My middle son enrolled in college and completed two years before realizing college wasn’t for him.

We had an honest conversation, without emotion. I wasn’t frustrated and didn’t feel like I had wasted the tuition, because he needed those years to understand this wasn’t the path for him. As long as he continues moving forward, I have no problem that he doesn’t have a degree.

Money measures action, not worth

I’ve learned that money isn’t a currency of worthiness. Having money doesn’t make you good, and some people earn money through some pretty bad means.

For better or worse, money is attracted to action. There’s no such thing as a million dollar idea, unless you take action on it. When my son dropped out of college, my biggest concern was that he keep moving forward, because action is the path to success. He took my real estate investing courses, and I gave him free access to our software (which normally costs $100 a month) so he could build his real estate portfolio.

Health and relationships are just as important as money

Later in my career I started coaching others about how to make money in real estate. I was surprised to see that some of my most financially successful students were failing in other areas of their life: they were out of shape, mentally unhealthy, or had marriages that were breaking down.

My idea of wealth is being able to do what you want, with whoever you want. But for that to work, you need to have good health and rich relationships. People associate money with freedom, but health and relationships are just as important.