The cofounder of Fanhouse explains why she resigned from the startup and what she would have done differently if she started it today — including not raising VC funding

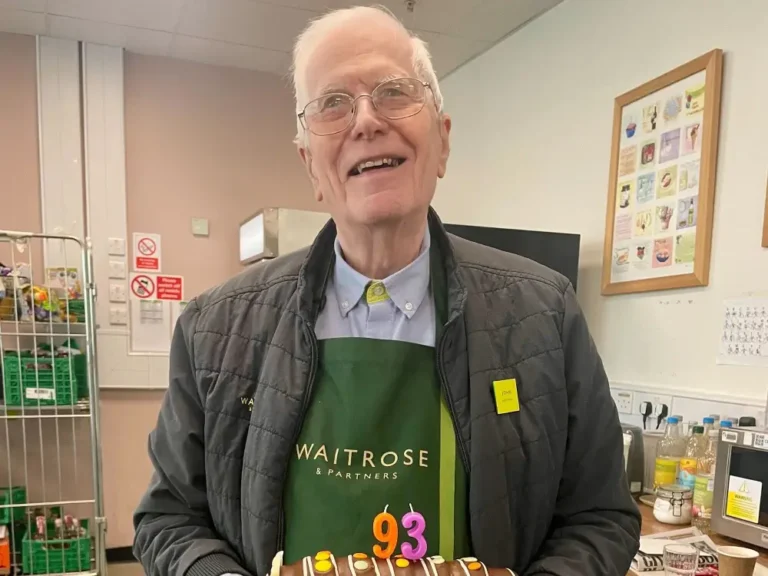

- Creator Rosie Nguyen started Fanhouse in 2020 with two other cofounders.

- She said the strings attached to venture-capital funds and cofounder dynamics led her to quit.

- Nguyen explains what she would do differently as a founder if she were building the startup today.

Rosie Nguyen is in the midst of a breakup, but it’s not with a romantic interest.

The industry was stunned when the 25-year-old influencer and Fanhouse cofounder announced her resignation from the creator startup on July 12, just hours before news broke that it had been sold to a company called Passes.

Passes founder and CEO Lucy Guo responded on Twitter to Fanhouse creators’ concerns about how this could affect the platform’s content guidelines.

In 2020, Nguyen launched Fanhouse as a subscription platform for creators to monetize their work, share exclusive behind-the-scenes content, and connect with top fans. The startup was inspired by her own experience as a Vietnamese-American creator who needed to earn enough money to support herself and her family.

“I didn’t really see a platform that captured the true monetary value of the average Gen Z creator, so I decided to build one,” the Los Angeles-based influencer, known on social media as @jasminericegirl, has said.

Because it was Nguyen’s first time launching a startup, she reached out to acquaintances Khoi Le and Jerry Meng, who brought expertise to the table that she lacked. She brought the knowledge of the creator, while they brought established connections to venture capitalists, or VCs, and engineering experience.

Following the platform’s launch in 2020, the three cofounders began serious fundraising efforts. However, Nguyen’s dynamic with her cofounders, as well as disagreements with VCs about the company’s direction, eventually led to her resignation, she said.

“Honestly, I wish I had left it sooner,” she admitted. “I took a lot more shit than I needed to, and it just led to a lot of unhappiness because I was the face of a company where I didn’t feel like I was a part of the decisions.”

Here are the things Nguyen would do differently if she were to launch Fanhouse today.

Letting in venture capitalists came with strings attached

Nguyen stated that she would not accept venture capital funds today because of the strings that come with accepting millions of dollars, which she struggled with while working at Fanhouse.

“From my experience, creator companies should not be VC funded because it is so difficult to align creator and investor incentives,” she said.

Nguyen and her cofounders raised $1.3 million in pre-seed funding a year after launching, led by Jeff Morris Jr. of venture capital firm Chapter One and Mantis VC, a firm founded by music duo The Chainsmokers. The startup received a $20 million Series A round led by VC firm Andreessen Horowitz in 2022.

The additional investments aided Fanhouse in a variety of ways, including hiring more staff and paying creators more money via the platform. Nguyen, on the other hand, stated that it made it much more difficult for Fanhouse to stay true to its original mission.

“As soon as you take VC money, the game changes entirely,” Nguyen explained. “It’s no longer about what the founders want; it’s now about investors who own a very large percentage of your company, sometimes more than you do, who decide how you run the business.”

She recalled squabbles with venture capitalists over issues such as Fanhouse’s 10% take rate, which represented the fees the company collected from transactions on its platform. Investors wished to raise that rate in order to increase the company’s profits.

Venture capitalists also wanted Fanhouse to experiment with technology such as Web3 and artificial intelligence.

Nguyen resisted these ideas because she did not believe they were in the best interests of the platform’s creators.

“From a creator standpoint, I thought our company was doing great, but investors didn’t, which is why they pushed for the sale of Fanhouse,” she explained.

Instead of attempting to raise funds from venture capitalists, Nguyen stated that she would raise funds from creators themselves, giving them a say in how the platform is run. She’d also use equity crowdfunding, as creator startup Gumroad has.

There wouldn’t be as much pressure to scale the business quickly without venture capital funding, which she says can come from suddenly having a lot more money to spend. She believes this will be detrimental to Fanhouse in the long run.

“We were much more productive as a team of five really charged, ambitious individuals than we were as a team of 25,” she explained. “I’d keep the team much leaner, which is easier to do when you don’t have VCs expecting rapid growth from you.”

Choosing a cofounder should be like choosing a romantic partner

If she were starting a company today, Nguyen said she would prefer to be a solo founder. If she needed more assistance, she would only enlist the assistance of one other person in whom she had complete trust and alignment.

“I’m so thankful for my cofounders, but at the end of the day, it was me, a woman, fighting against two men who were both engineers, knew each other, and were friends, so it was difficult,” she explained.

Nguyen, for example, recalled how she and her cofounders discussed equity shortly after launching Fanhouse. She stated that Le and Meng, who had designated themselves as CEO and CTO, wanted Nguyen to accept a small stake as an employee while they divided the remaining equity amongst themselves. She eventually took a 20% stake, she said.

“In hindsight, if I started Fanhouse again, I would have kept all of the equity for myself and just hired some engineers,” she said.

Nguyen also stated that founders should look at potential partners’ personalities as well as their skills, if not more so.

“Cofounding is really like marriage, and marriage is not just about love,” she explained. “You need to find someone who shares your values and with whom you can build a company for five, ten, or however many years, just as parents raise a child together.”