Morgan Stanley says these 10 small-cap stocks have at least 50% upside

Small-cap stocks had their moment in the sun this July, with the Russell 2000 jumping 11.5% in the span of a week.

Since then, the index has generally moved sideways. But Morgan Stanley says the trade could be set for another surge in the months ahead if the economy shows signs of momentum.

“We recently upgraded Small caps to neutral vs Large caps after a persistent 3 ½ year period of underperformance. This decision came on the back of the strong September jobs report and the Fed’s decision to deliver a 50bp rate cut at last month’s FOMC meeting,” Nicholas Lentini, an equity strategist at the bank, said in an October 16 note.

“For us to get outright bullish on Small caps, leading macro indicators would likely need to reflect a clear acceleration in growth,” he added.

Data shows that small-caps tend to outperform at the beginning of a new economic cycle, Lentini said. Evidence that a new cycle is beginning include indicators like improvement in small-business optimism, positive revisions to GDP, and widespread positive revisions to earnings, he wrote in the note.

In anticipation of a potential small-cap rally, the bank’s analysts put together a list of 40 of their favorite small-cap picks. All of them are rated “overweight” by the bank.

Below, we’ve compiled the 10 stocks on the list with the highest upside to their Morgan Stanley price targets.

10.American Airlines

Ticker: AAL

Upside to MS price target: 51.6%

9.Dyne Therapeutics

Ticker: DYN

Upside to MS price target: 56.1%

8.Alaska Air

Ticker: ALK

Upside to MS price target: 56.6%

7.Viking Therapeutics

Ticker: VKTX

Upside to MS price target: 59.5%

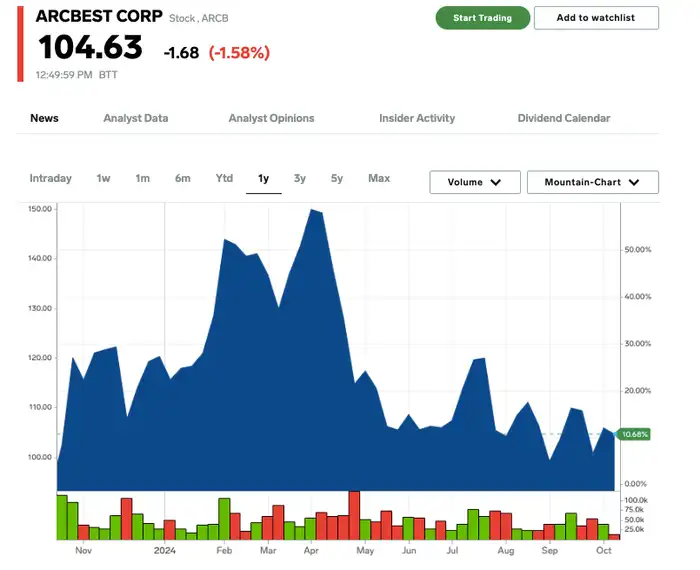

6.ArcBest

Ticker: ARCB

Upside to MS price target: 64.6%

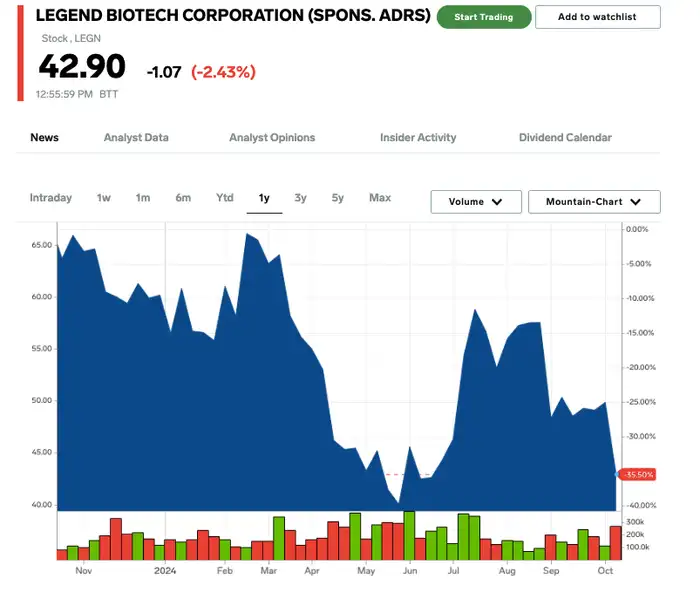

5.Legend Biotech

Ticker: LEGN

Upside to MS price target: 65%

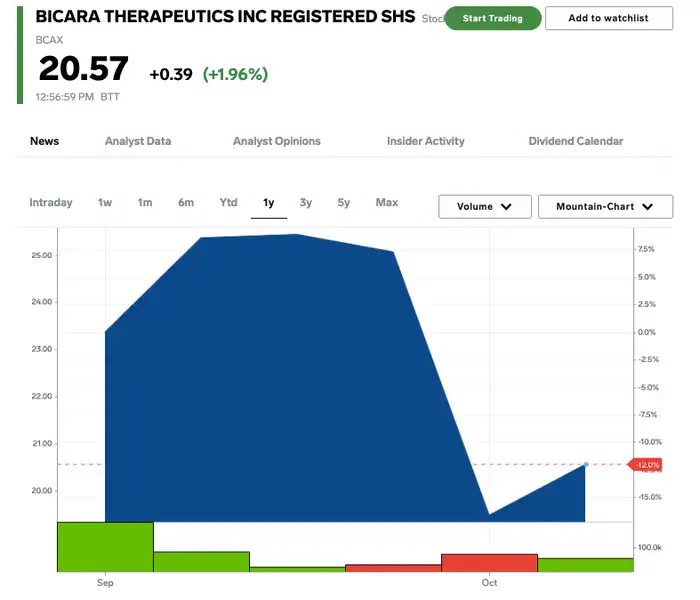

4.Bicara Therapeutics

Ticker: BCAX

Upside to MS price target: 75.2%

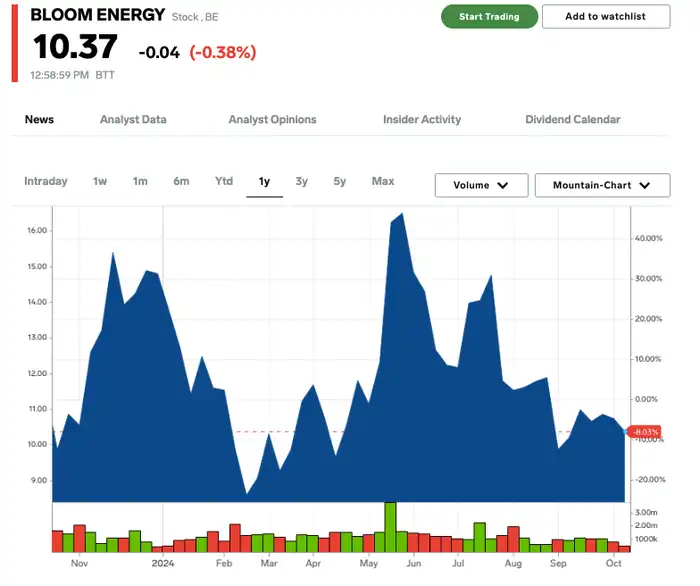

3.Bloom Energy

Ticker: BE

Upside to MS price target: 110.1%

2.10X Genomics

Ticker: TXG

Upside to MS price target: 182.7%

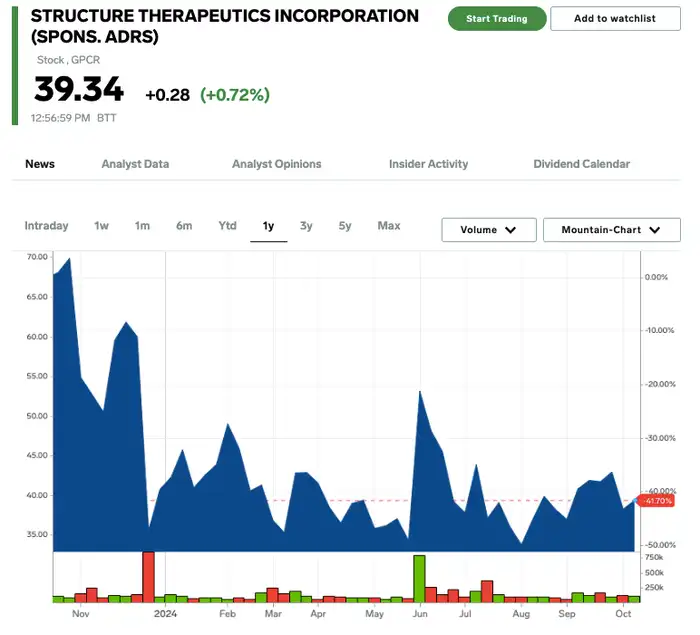

1.Structure Therapeutics

Ticker: GPCR

Upside to MS price target: 222.2%