Elections have little impact on stock prices. Here’s what investors should focus on instead.

The outcome of the Presidential election in November should have little impact on the direction of stock prices, according to Bank of America.

In a note on Friday, Bank of America strategist Savita Subramanian highlighted that the stock market rarely cares about which political party controls the White House.

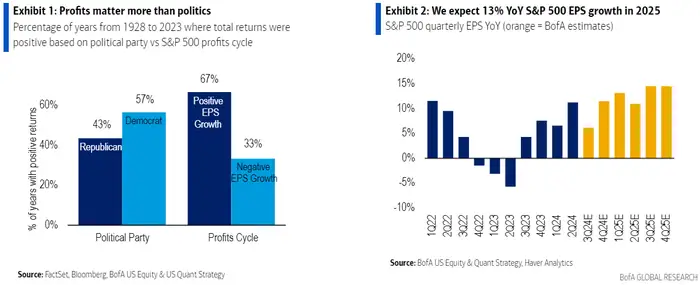

Instead, investors’ focus should be squarely on profit growth.

“Profits accelerating are far more important than who is sitting in the Oval Office,” Subramanian said.

Furthermore, targeted policies from lawmakers on Capitol Hill can often have the opposite impact on a sector than investors would have thought.

For example, when former President Donald Trump took office in 2017, energy stocks were seen as a likely winner due to his friendly stance towards oil drilling, while renewable energy stocks were seen as a likely loser.

Instead, the energy sector was the worst-performing sector when Trump was in office, losing 29% even as the S&P 500 surged 83%. Meanwhile, the clean energy sector rose 306% during Trump’s presidency, according to data from YCharts.

When President Joe Biden took office in 2021, many investors viewed the traditional energy sector as a likely loser due to the Democrats’ typical unfriendliness toward oil companies, while clean energy stocks were seen as potential winners.

Today, the opposite is true: traditional energy stocks have been the best-performing sector during Biden’s presidency, rising 139%, while the clean energy sector is the worst-performing sector, down about 55%.

“Even directed policies have sometimes had opposite outcomes vs expectations,” Subramanian said, adding that “there are nuances.”

This time around, Subramanian said investor expectations of stock market implications based on who wins the Presidency could once again fall flat.

For example, while a Republican sweep of the White House and Congress may be viewed as favorable for Tesla stock, as CEO Elon Musk has warmly embraced Trump and the Republican party, it could actually be a negative because electric-vehicle tax credits would likely be at risk.

Ultimately, Subramanian and her team expect the stock market to rise in 2025 regardless of who wins the election in November.

That’s because she expects 13% year-over-year growth in the S&P 500’s earnings per share next year, and profit growth has historically been the biggest driver of stock market gains.

“Profits matter more than politics,” Subramanian said.