‘Generational opportunity’: Invest in real estate as stock and bond returns shrink, according to $3.5 trillion JPMorgan Asset Management

JPMorgan Asset Management just issued a report with long-term projections for asset classes.

A pair of Wall Street juggernauts are getting slightly more skeptical about stocks and bonds, but a compelling investment opportunity may be hiding in plain sight.

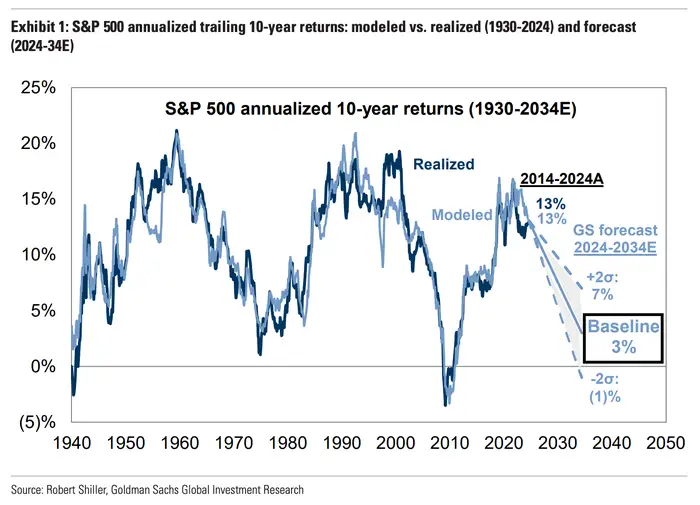

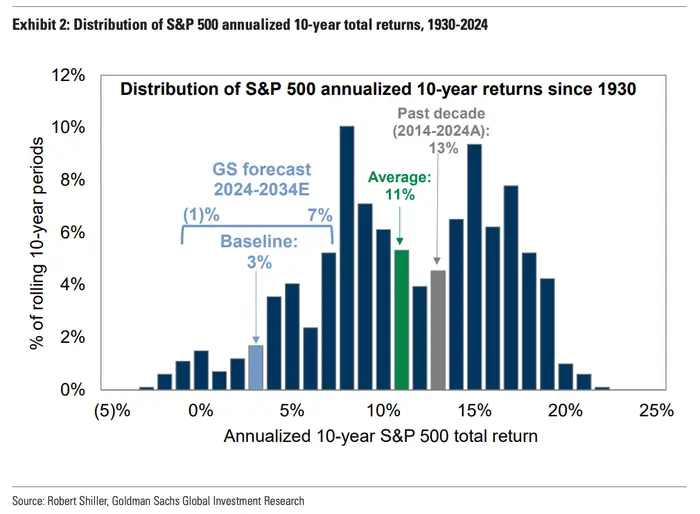

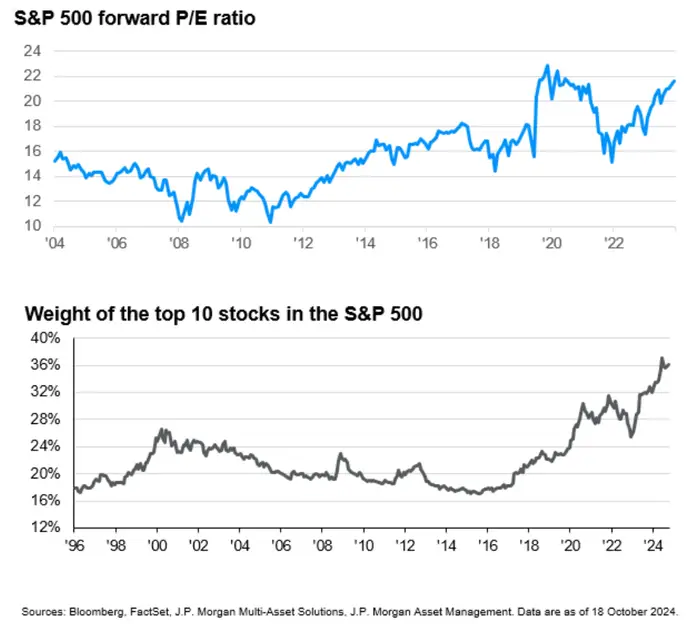

Goldman Sachs stole headlines recently by forecasting that US equities will only rise 3% a year in the next decade, down from an average annual gain of 13% in the prior 10 years. The firm’s rationale is based on a more challenging backdrop characterized by lofty valuations, an unusually high concentration in the market’s biggest stocks, increased recession risk, lower profits, and elevated interest rates.

Top minds at JPMorgan Asset Management (JPMAM) agree that stocks might not post the returns that investors have come to expect, though they’re not nearly as pessimistic.

The firm, which manages $3.5 trillion in assets, expects US large-cap equities to appreciate by 6.7% a year in the next 10 to 15 years, according to its yearly long-term capital market assumptions report released on October 21. For reference, JPMAM thinks global stocks will rise between 7.2% and 8.1% a year in that same span.

A mid-single-digit annual gain for US large caps is nothing to sneeze at, though it would be down substantially from 7.9% two years ago and 7% last year.

There’s a simple explanation for that marginally more tepid outlook: US stocks have been on a tear. And while some bulls are emboldened by the S&P 500’s excellent track record, JPMAM strategists worry that the market has pulled forward future gains.

“Near the bottom of all these pages, we put a little statement saying, ‘Past performance is not indicative of future returns.’ That’s actually not true,” said David Kelly, JPMAM’s chief global market strategist, at a press conference about the report. “Past great performance is indicative of a more difficult environment going forward.”

The S&P 500 is on pace to rise by at least 10% for the fifth time since 2018 and the 11th time since the financial crisis, including what’s been a 22.7% gain in 2024. That strength, combined with already-rich valuations, led JPMAM to cut its long-term projection for US large caps.

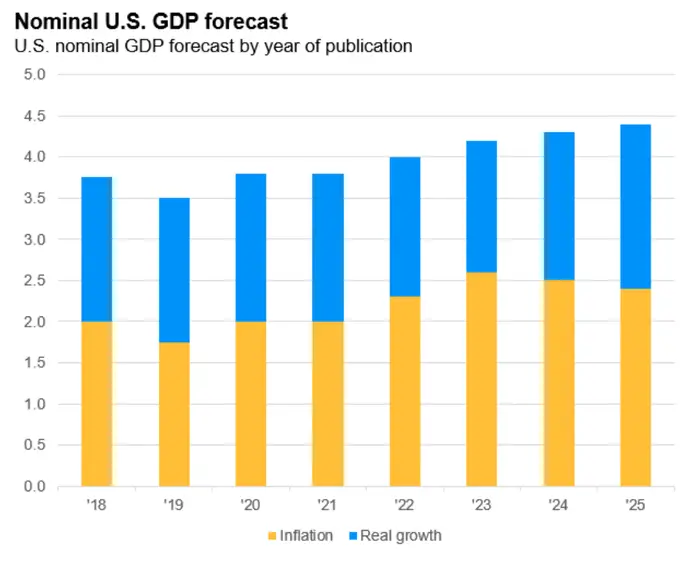

However, Kelly said the downward shift was gradual since the economic growth outlook is promising. The firm is calling for US real GDP of 2% in the long term, which is the highest mark since the pandemic, along with 2.4% inflation, which is down for the third consecutive year.

“The very good news is that we think that the foundations for the US economy and the global economy look better than they did a year ago,” Kelly said. “We got through some of our more significant worries on inflation; economic growth looks pretty solid.”

As the 60-40 portfolio loses steam, real estate can take the baton

Lower stock returns are expected to drag down the traditional 60-40 stock-bond portfolio, which JPMAM now says should fetch 6.4% a year for the next decade or so.

That forecast is down from 7% last year and 7.2% heading into 2023, though it’s higher than the 4.3% mark in late 2021, where US large caps were only expected to climb 4.1% a year in the long term after an outstanding rebound from the early pandemic lows.

Bonds, which make up the second half of that calculus, have a solid but unremarkable outlook.

US bonds broadly are expected to return 4.6% in the long term — down from 5.1% last year and the same as two years ago — while the US 10-year Treasury note is projected to fetch 4.2%, versus 4.6% last year and 4% two years ago. Meanwhile, high-yield bonds should deliver a 6.1% gain in the long term, compared to 6.5% last year and 6.8% two years ago.

After accounting for inflation, JPMAM expects the standard 60-40 portfolio to return less than 5% in the long term, and the same is true of large-cap stocks and bonds. While such gains may be satisfactory for some, it would take over 16 years for an investor to double their money.

Those looking for a more compelling investment opportunity should consider real estate, according to JPMAM. Unlike stocks and bonds, the firm’s projected returns for that asset class are steadily rising, from 5.7% two years ago to 7.5% in late 2023 to 8.1% this year.

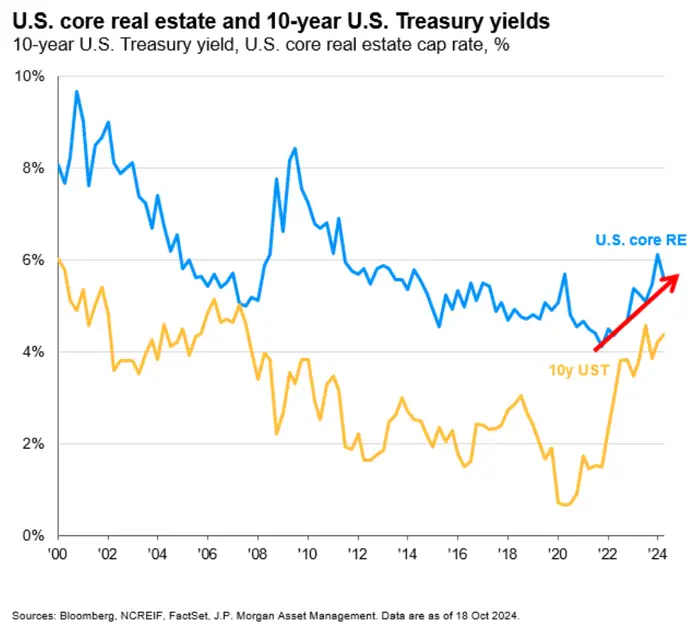

US core real estate is projected to yield close to 6%, up from just over 4% a few years ago and well above the 10-year’s yield of 4.2%. Real estate isn’t cheap based on capitalization rates, which measure how much money a property generates relative to its market value, but JPMAM believes the asset class is an exceptional value relative to other yield-generating investments.

“If you were to look at this on a spread basis, the cap-rates spread would tell you that real estate looks a little bit expensive,” said David Lebovitz, a global strategist for multi-asset solutions at JPMAM, at the conference. “But if you look at the all-in yield and think of that as your valuation and your starting point, we’re looking at a generational opportunity.”

Monica Issar, JPMorgan Private Bank’s global head of multi-asset and portfolio solutions, echoed that sentiment.

“This is absolutely the largest generational opportunity to invest in real estate in a long time,” Issar said at the conference.

Commercial real estate looks especially compelling, Issar said. Unlike residential real estate, which has held up well in recent years — as evidenced by remarkably resilient home prices despite still-elevated mortgage rates — office buildings have struggled to regain their value since the pandemic ushered in a new era of remote work for millions of Americans.

As companies reduced their physical presence or eschewed offices altogether, demand for commercial spaces has taken a massive hit. However, Issar thinks that risk is reflected in prices.

“All we’ve been reading about and all we’ve been seeing is price declines and discussions about empty buildings,” Issar said. “This is a time for investors to step in, move into attractive pricing, move into asset classes like non-core real estate.”

Investors can bet on a commercial real estate rebound by working with JPMAM’s team, or on their own through publicly traded real estate investment trusts (REITs). JPMAM didn’t outline any specific investments to make, but Issar threw out a few ideas to help investors brainstorm.

“Think of multifamily housing; think of student housing around campuses; think of cell towers and data centers,” Issar said. “That is the modernization of the new direct real estate that is going to be really attractive for investors in the future.”