Why the October jobs report on Friday could sink the market’s soft-landing narrative

The narrative around ongoing labor-market strength revived with September’s payrolls report, which topped economists’ expectations by over 100,000 jobs. But that could change on Friday, when the Bureau of Labor Statistics releases new jobs data.

Expectations for October’s headline payrolls number are already relatively low at around 110,000-120,000. Economists and investors are discounting the impact that Hurricanes Milton and Helene and the ongoing strike at Boeing are likely to have on the jobs numbers.

Even after accounting for these extraordinary events, however, some experts say a weak number below that consensus could counter the prevailing narrative that rapid Fed rate cuts slowed inflation without tipping the economy into recessionary territory — a so-called soft landing.

“If you get 50,000 or less, even with those potential disruptions, that does bring back some concerns about a slowdown,” Tom Essaye, the founder of Sevens Report Research, told B-17. “Also, it really counters this idea that there’s going to be no landing, that the economy’s just not going to slow at all. So I think it would move markets.”

Ben McMillan, the CIO of IDX Advisors, said the same about a jobs print well-below consensus, especially given how much investor sentiment about a soft landing has shifted to the upside in the last month.

“This could be a situation where many investors say to themselves, ‘Alright, maybe the economy is not as robust as we thought,’ things could be more prone to slowing down, and therefore investors revise their risk-on outlook appropriately,” McMillan told B-17.

Goldman Sachs estimates that the hurricanes will lower the number of jobs added by 40,000-50,000, meaning a potential jobs print of 200,000 would, in theory, be reduced to 150,000-160,000. Pantheon Macroeconomics says the impact is likely to be closer to 25,000 jobs. For the strikes at Boeing and other firms, the Bureau of Labor Statistics itself estimates that they’ll reduce job gains by 44,000.

But while various surveys of economists show muted expectations for October, some warn there’s a chance that job gains could be lower than the 110,000-120,000 consensus. Goldman is just under that with a 95,000 prediction, while Comerica is much lower at 30,000. Former Fed economist Claudia Sahm thinks the print could even be negative.

A print of under 100,000 would be the first since 2020.

The hurricanes and strikes, however, make it unclear where the threshold of worry is for investors in a significant miss to the downside. Michael Cuggino, the president and portfolio manager of the Permanent Portfolio Family of Funds, told B-17 on Monday that investors might be quick to disregard a poor number due to the temporary factors listed above. Plus, they may even cheer on the chance of larger rate cuts from the Federal Reserve, he said.

Bill Adams, the chief economist at Comerica, said in a note this week that while his expectations are very low, investors shouldn’t jump to conclusions.

“The October jobs report will likely show a severe but short-lived hit from hurricanes Helene and Milton,” Adams said. “The report will tell us little about the economy’s trend.”

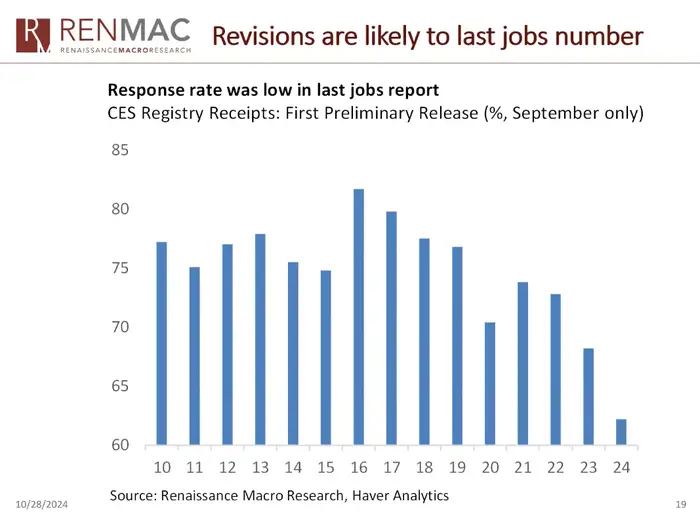

The headline number for October isn’t the only part of the report that could reset expectations, however. According to Renaissance Macro Research Chief Economist Neil Dutta, there is some evidence that September’s 254,000 jobs added could be creating a false sense of confidence in the strength of the economy.

For one, response rates to the BLS payrolls survey have been extraordinarily low this year, meaning revisions in subsequent months have been larger, he said.

And while there’s no guaranteeing what will happen with September’s data, 75% of revisions over the last 12 months have been negative, according to economist David Rosenberg. Rosenberg said in an October 9 note that ADP’s payrolls report is a more reliable survey to follow, and the firm’s estimate of jobs added in September was 143,000.

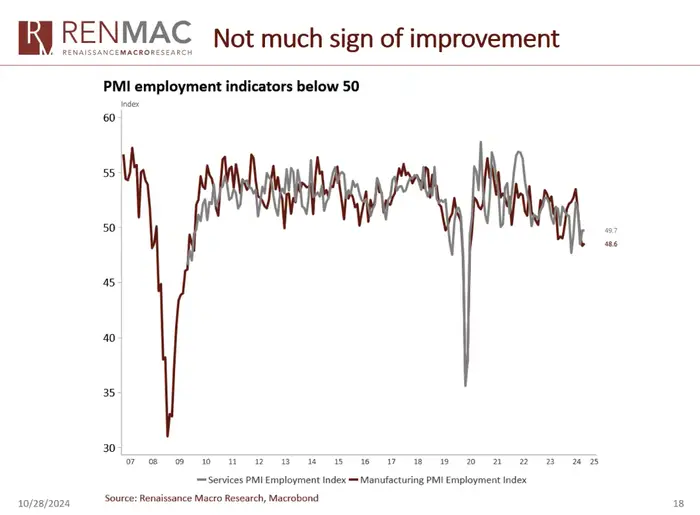

Another sign that September’s jobs numbers may have been overstated is that other employment indicators haven’t started to trend upwards.

“There’s really not much evidence that the labor market’s meaningfully inflected higher in September,” Dutta said in an October 28 video. “If you look at the PMI data, the employment components in both the manufacturing and [services] PMIs remain below 50.”