Stocks are gripped by ‘near-euphoric sentiment’ and the election may offer a chance to pull back, Citi says

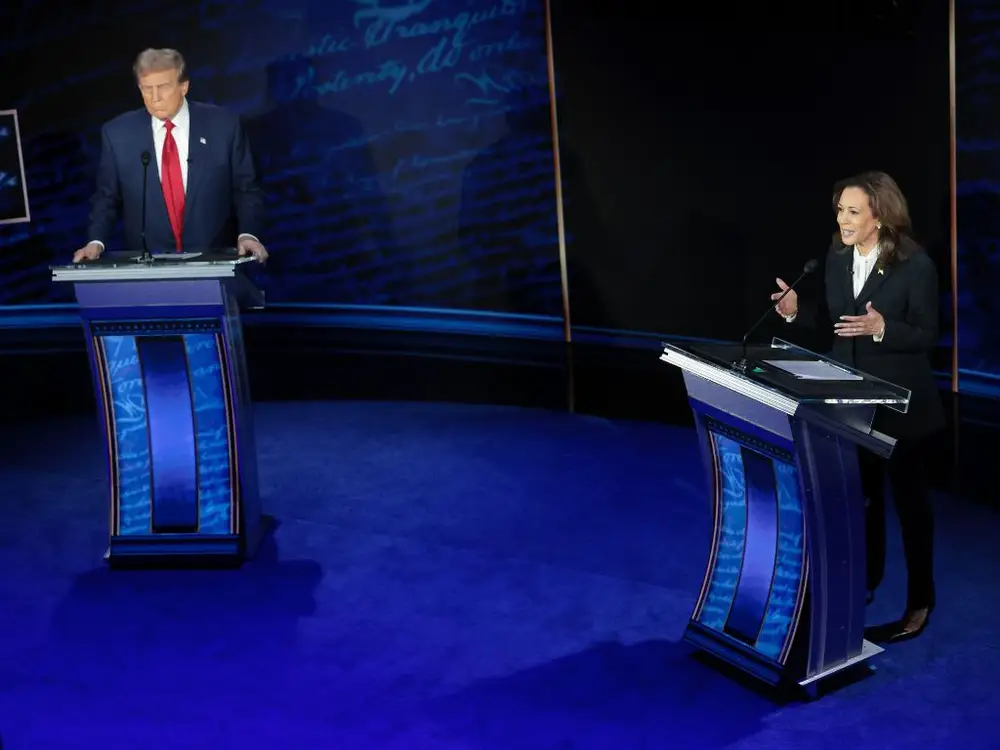

Donald Trump and Kamala Harris.

Citi strategists aren’t feeling great about either US presidential candidate’s impact on the stock market, but a Republican sweep, in particular, might prompt investors to rethink their exposure.

Citi analysts noted that while many attribute the recent surge of bullishness to climbing odds for a Donald Trump victory, rising market optimism may be linked to other factors.

“All told, we maintain a view that both candidate platforms are incrementally negative to equity fundamentals,” the analysts said in a note on Tuesday. “Generally, we are inclined to lighten into any further Trump tailwinds post-election.”

The Citi strategists said that valuations and “near-euphoric sentiment” in the S&P 500 have more to do with things other than the election that have been influencing stocks for most of this year.

“We read it more about soft landing sentiment, ongoing AI-influenced growth tailwinds, along with a pivoting Fed.”

That means investors should avoid piling into a market rally fueled by a Trump win, since it could slow considerably after the initial euphoria wears off in the coming months, the analysts said.

“Any further post-election follow through presents an opportunity to lighten into what may be a more confusing election-impacted fundamental picture early next year,” they wrote.

The analysts added that they see neither candidate as a particularly positive influence on the stock market, though a Trump win would likely be more beneficial. Trump’s deregulatory focus and lower corporate tax rates have largely been touted as more business-friendly and a boost to earnings, while his proposals for soaring tariffs on imports could pose longer-term downside risks.

But while the analysts see Kamala Harris’s higher corporate taxes as more negative for US equities overall, a Harris win could pose a short-term, buy-the-dip opportunity.

“On the other hand, while a Harris + split outcome may trigger some initial market pressure, our inclination would be to buy into related weakness,” they wrote.