Boeing’s strike is over. Now, the hard work starts to turn things around.

A Boeing 737 Max, the latest version of the company’s most-sold plane.

The Boeing strike ended this week after 53 days, but the planemaker still has a long road to recovery.

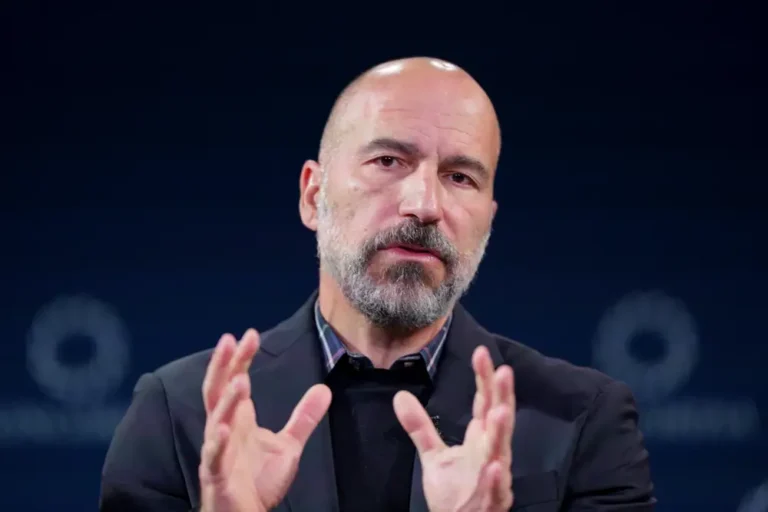

After it reported a $6.1 billion loss in the last quarter, CEO Kelly Ortberg said: “It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again.”

Reaching a deal with the union goes some way toward improving stability, part of Ortberg’s four-point plan, but it also requires a steady, increased output of aircraft.

In an earnings call last month, the CEO said it would likely take a couple of weeks to bring back staff after the strike, given recertification and retraining efforts.

A report from investment research firm Morningstar said it expects Boeing to “stretch into 2025 before manufacturing can resume in earnest.”

“While the strike ending and workers returning to the shopfloor is a meaningful step in the right direction, ramping back up will take time,” Bank of America analysts wrote in a Tuesday report.

Beyond Boeing’s own issues, the aerospace industry as a whole has been hampered by constraints on the supply of both skilled labor and raw materials. That’s left Boeing with a backlog of around 5,400 commercial aircraft worth roughly $428 billion.

Although this may be lower than rival Airbus’s 8,749, Boeing faces more obstacles to its production challenges.

Many of these challenges were prompted by January’s Alaska Airlines blowout, in which a 737 Max lost a door plug in midair. The incident shed light on Boeing’s production processes and led to heavy scrutiny from regulators and politicians alike.

The Federal Aviation Authority consequently limited Boeing’s 737 output to 38 a month until it implemented a safety and quality plan. Still, the planemaker has slowed beyond that as it works to overhaul its production processes. It delivered 92 such jets in the last quarter, around 30 a month.

CFO Brian West said in the earnings call that the planemaker had been preparing for 38 a month by the end of the year, but the strike impact means that target will take longer to hit.

Credit rating agencies have warned that Boeing’s bonds could be downgraded to junk status. Ben Tsocanos, S&P Global Ratings’ aerospace director, said Boeing’s equity raise provides a “cushion,” but its rating still depends on its ability to increase both production and quality.

“It will take time to work off the massive inventory that Boeing has today, but quality needs to improve as well,” said Peter McNally, global head of analysts at investment research firm ThirdBridge.

Additionally, Spirit AeroSystems, a key Boeing supplier set to be acquired by the planemaker next year, warned in a Tuesday regulatory filing that there is “substantial doubt” over whether it will be able to continue as a going concern.

It said its cash flow had been impacted by changes to Boeing’s production processes, such as no longer accepting deliveries that required out-of-sequence assembly.

This change likely arose because the fuselage of the Alaska Airlines 737 Max involved in January’s blowout was built by Spirit and arrived at Boeing’s factory with damaged rivets. Boeing’s work to fix this ended in the door plug not being secured, causing it to come off the plane in midair, per the National Transportation Safety Board’s preliminary report.

In other words, concerns about Boeing’s production quality came to a head due to the incident — resulting in reverberating effects on its production lines.

Several customers have voiced their frustration with Boeing’s delivery delays, but improving quality is paramount.

That can be helped by Ortberg’s four-point plan, which also involves changing Boeing’s culture, with company leaders spending more time on the factory floors. Ortberg has chosen to be based in Seattle, the planemaker’s hub and historic home, rather than in Virginia, where its corporate headquarters are.

The road ahead may be long, but many analysts have confidence in Ortberg’s ability to make Boeing “iconic” again.