‘A disaster waiting to happen’: A top 3% investor warns the ‘Trump bump’ is the icing on the cake of a euphoric stock market bubble that’s worse than the dot-com peak

A trader shouts orders in a telephone on the derivative market at the Paris stock exchange, October 28. The French blue-chip share index fell by more than 9 per cent which is the second biggest one-day fall since 1987 black monday.

When Bill Smead took his first job as a broker at Drexel Burnham Lambert in 1980, his dad asked him to place a trade that would benefit from a Ronald Reagan win later that year.

So he did, and after Reagan won, the investment jumped the day the results were announced — a continuation of the 29% rally that had endured since March of that year.

Unfortunately for his father, however, that was as good as the returns were for the next 18 months.

From November 1980 to July 1982, stocks entered a bear market, dragging the S&P 500 down 27% as a recession gripped the US economy. That was despite the market’s trailing 12-month price-to-earnings ratio sitting at a cheap 7.5 in 1980 versus a more expensive 24 today.

While no two market environments are the same, Smead — the founder of Smead Capital Management — cites the example as a cautionary tale to investors who have eagerly jumped into stocks following the election of Donald Trump to a second term earlier this week.

Just like Reagan, Trump touts a regulation-slashing, tax-cutting agenda that should boost the market in theory. But other factors are at play.

Smead warns market conditions are setting the market up for dismal returns going forward, and that stocks are in a bubble only made more extreme by the so-called ‘Trump bump’ this week, which saw the Dow jump 3.5% in a day.

“You’ve got an expensive market that just exacerbated itself,” Smead told B-17.

“It’s a disaster waiting to happen,” he continued. “We have put the icing on the financial euphoria cake and lit the candle on top.”

There is plenty of evidence that the market is historically expensive.

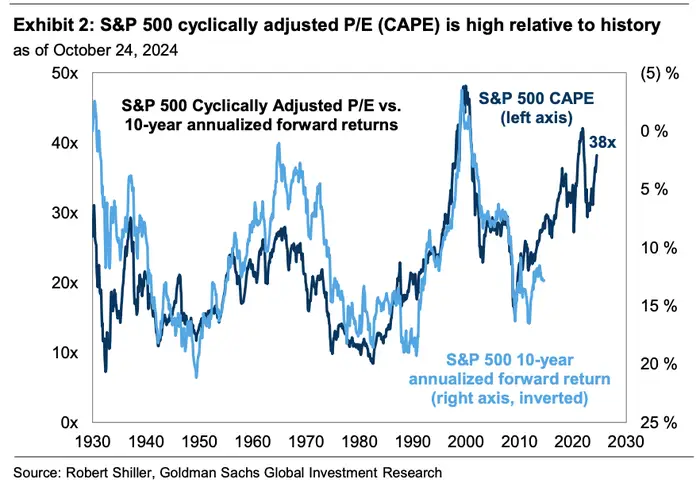

For instance, Goldman Sachs said last month that current levels of the Shiller cyclically adjusted price-to-earnings ratio (the dark blue line in the chart below) — rivaling prior bubbles — lead them to believe that the S&P 500 will deliver 3% annualized returns over the next 10 years. That’s less than the risk-free return that 10-year Treasury notes offer.

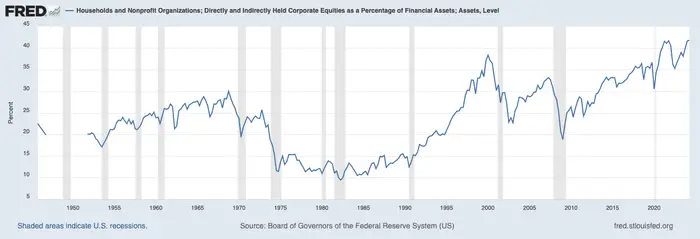

Beyond valuations, however, Smead points to signs of historically high investor enthusiasm, like the level of household equity ownership. Stocks make up around 42% of all household assets at the moment, the highest level in history.

Some of the most elevated levels of equity ownership came at the height of the dot-com bubble, the stock market top of 2007 before the Great Recession, and in 2021 before the market fell 25%.

Equity ownership levels also show that a lot of cash has come off of the sidelines, Smead said, a sign that dry powder may not be enough to help stave off a market decline. And much of the remaining funds in cash equivalents are held by Baby Boomers, who need the income and have too low of a risk profile to get back into stocks, he said.

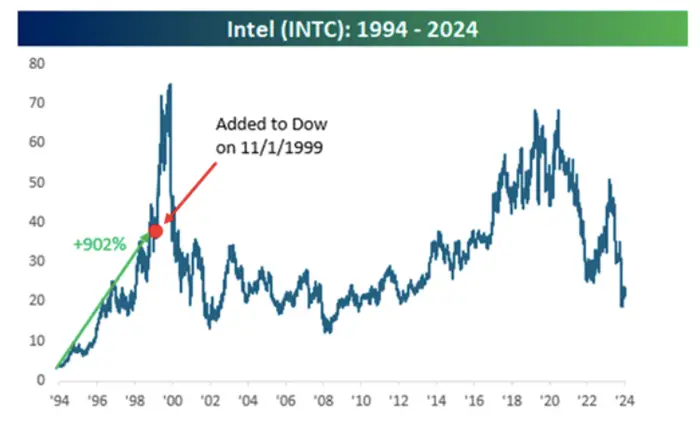

In recent months, Smead has said that investing icon Warren Buffett’s behavior — significantly trimming his stock positions and building a cash pile — resembles his approach leading up to the dot-com bust. Smead himself compared to the dot-com bubble earlier this week in a note, noting that chip giant Intel was added to the Dow Jones Industrial Average just four months before the peak in 2000. Dow Jones announced earlier this week that Nvidia would be added to the blue-chip index.

In Smead’s opinion, today’s bubble is worse than the dot-com era because of how far-reaching it is.

“Back then, it was mainly tech that was egregious. This time, it’s tech and almost anything growthy,” he said. “I promise you, Costco wasn’t trading at 53x earnings at the end of ’99.”

He added: “Anybody that’s been able to perpetuate their success trades at 30x-60x earnings.”

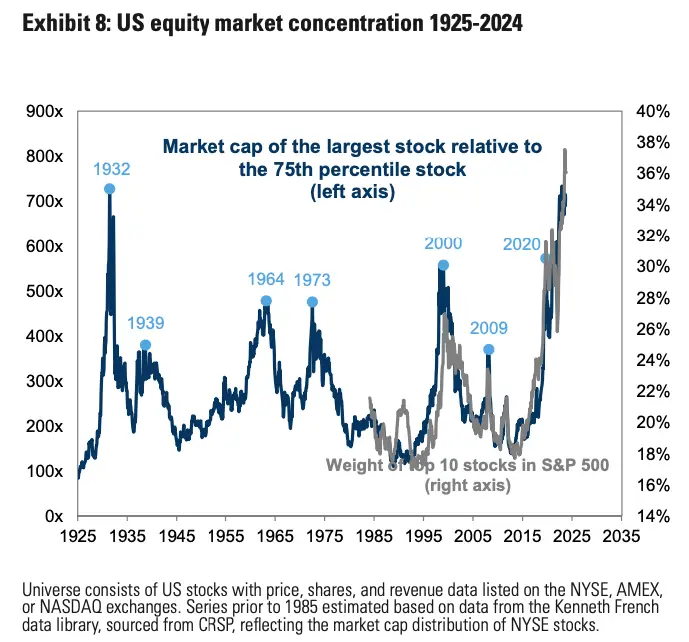

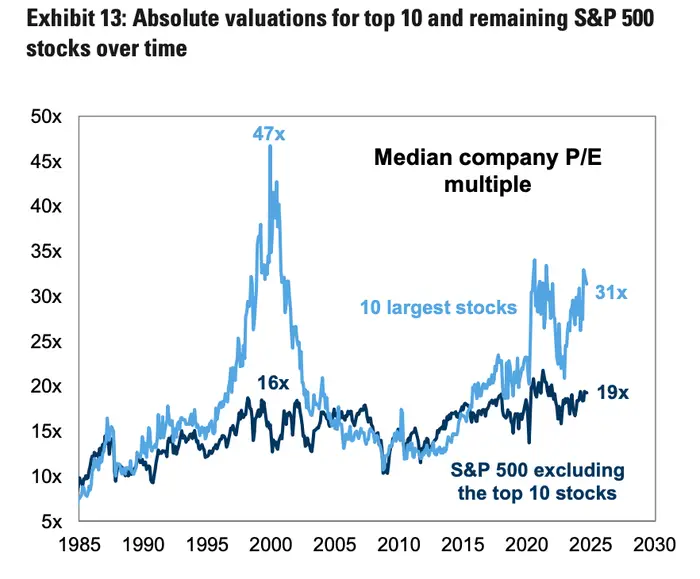

Goldman Sachs’ Chief US Equity Strategist David Kostin told B-17 in late October that the level of concentration in the largest stocks and the gap between their PE ratios and the rest of the market’s were last seen to this degree during the dot-com bubble. Both measures are shown below.

It’s debatable whether or not stocks are in a bubble. Many bears, including Jeremy Grantham, have warned of significant downside over the last couple of years while the market has catapulted to all-time-highs on a strong economy, falling inflation, and optimism about AI.

A fully Republican Congress next year may also provide enough fiscal stimulus through tax cuts to keep the rally going.

But like Smead, Dave Sekera, a senior US market strategist at Morningstar, said on Wednesday that investors should avoid making rash decisions amid the post-election rally and that current valuations are still likely to impact returns. Morningstar’s valuation model has the S&P 500 more expensive right now than it has been during 80% of the time since 2010, Sekera said.

In the short term, that might not matter. But over the next 10 years or so, as Goldman Sachs warned recently, valuations are likely to be a drag on returns, Smead said. And Smead’s long-term track record is nothing to scoff at. Over the last 15 years, his Smead Value Fund (SMVLX) has beaten 97% of similar funds, according to Morningstar data.

“You will not get rich from investing in the fourth huge financial euphoria episode in the last 100 years, in the S&P 500,” he said. “You will get poor, you will not get rich.”