The Biden administration is scrambling to send billions to chipmakers before Trump takes over

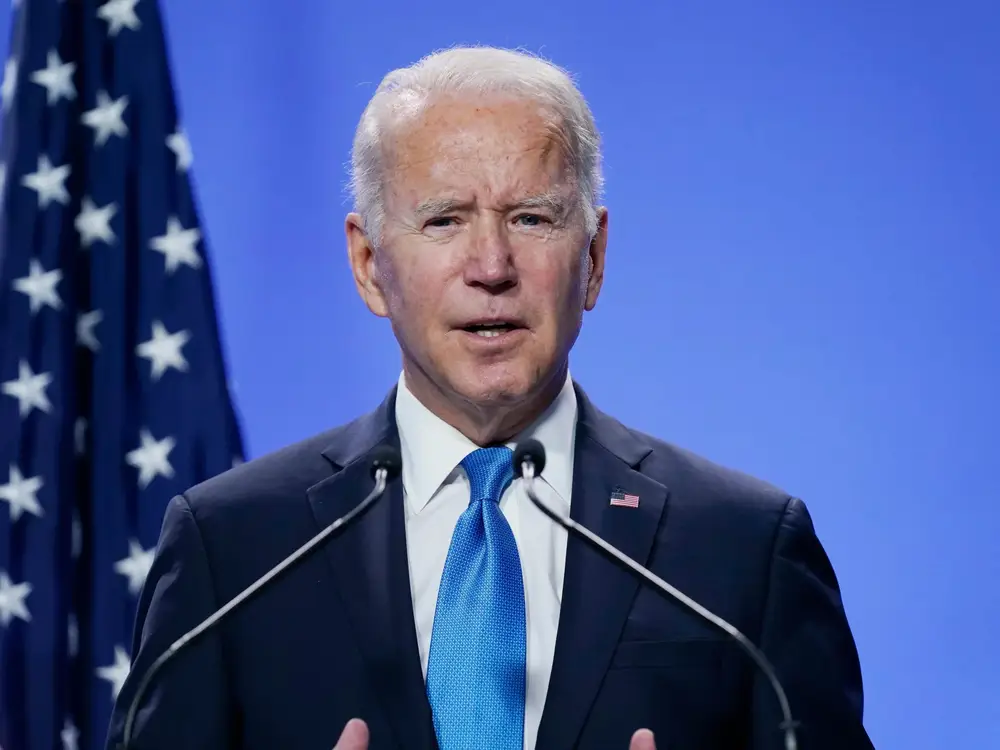

The Biden administration is working to finalize manufacturing incentives for US chip production before President-elect Donald Trump takes office.

The Biden administration is running out of time to finalize agreements that would secure billions in funding for US chipmakers.

In 2022, President Joe Biden signed the CHIPS Act into law, which included $39 billion in manufacturing incentives for chip production in the US along with $13.2 billion for semiconductor research and workforce development. In addition to creating US jobs, the administration hoped to secure supply chains and make the US less reliant on advanced chips from Taiwan.

Over 90% of the subsidies have been allocated, Bloomberg reported. But that money hasn’t been fully secured yet. Of the 24 semiconductor manufacturers and suppliers that have been allocated funding, only two binding agreements have been announced — which include about $6.6 billion in combined funding — the Commerce Department told B-17.

The Biden administration is working to finalize agreements before president-elect Donald Trump — who has criticized the CHIPS Act — takes office in January. In April, Commerce Secretary Gina Raimondo told CNBC that the administration would allocate all $39 billion of the subsidies before the end of the year. The administration is also expected to finalize at least a couple more agreements in the coming months, Reuters reported.

The most recent update came on November 15, when the Commerce Department announced that it had finalized a $6.6 billion subsidy for the Taiwan-based chipmaker TSMC. The company is expected to receive at least $1 billion of this funding by the end of the year.

Locking in CHIPS Act agreements could make it more difficult for the Trump administration to slow down the funding process if it chooses to shift semiconductor policy from subsidies to tariffs. A Commerce Department spokesperson told B-17 that finalized CHIPS Act agreements are binding contracts: After an agreement is finalized, the funding can’t be rescinded unless the company fails to comply with the terms of the deal. Absent that, they said rescinding funding would require an act of Congress.

In an interview with podcaster Joe Rogan in October, Trump said tariffs would have been a better way to motivate chipmakers to invest in the US. And in November, House Speaker Mike Johnson said Republicans may try to modify the CHIPS Act by removing certain “costly regulations” and environmental requirements.

Trump “will implement the promises he made on the campaign trail,” Karoline Leavitt, Trump-Vance transition spokeswoman, told B-17. However, she did not answer questions about whether Trump’s approach to CHIPS Act funding could differ from that of the Biden Administration.

Jeff Koch, an analyst at the semiconductor research and consulting firm SemiAnalysis, told B-17 that the Trump administration is likely to favor trade restrictions like tariffs over subsidies for chipmakers when trying to boost domestic chip manufacturing.

While Koch thinks an outright appeal of the CHIPS Act is unlikely, he said the Trump administration could slow down the funding process, which is among the reasons the Biden administration is trying to get the ball rolling now.

“This had the ancillary benefit of pushing the Biden administration to cut through red tape and disburse CHIPS Act funds while still in power, and it appears they are trying,” Koch said.

A variety of factors are holding up the finalization of more CHIPS Act agreements. For example, Intel — the largest potential recipient of CHIPS Act funding — has been in conversations with the US government over the benchmarks it must hit to receive funding once its agreement is finalized, The New York Times reported in October.

“We are disappointed by how long and how slow the dispensing of funds has been and it’s well over two years at this point,” Intel CEO Pat Gelsinger told Bloomberg on October 31.