Wall Street is laser-focused on Nvidia’s new Blackwell chip as the AI titan heads into 3rd-quarter earnings

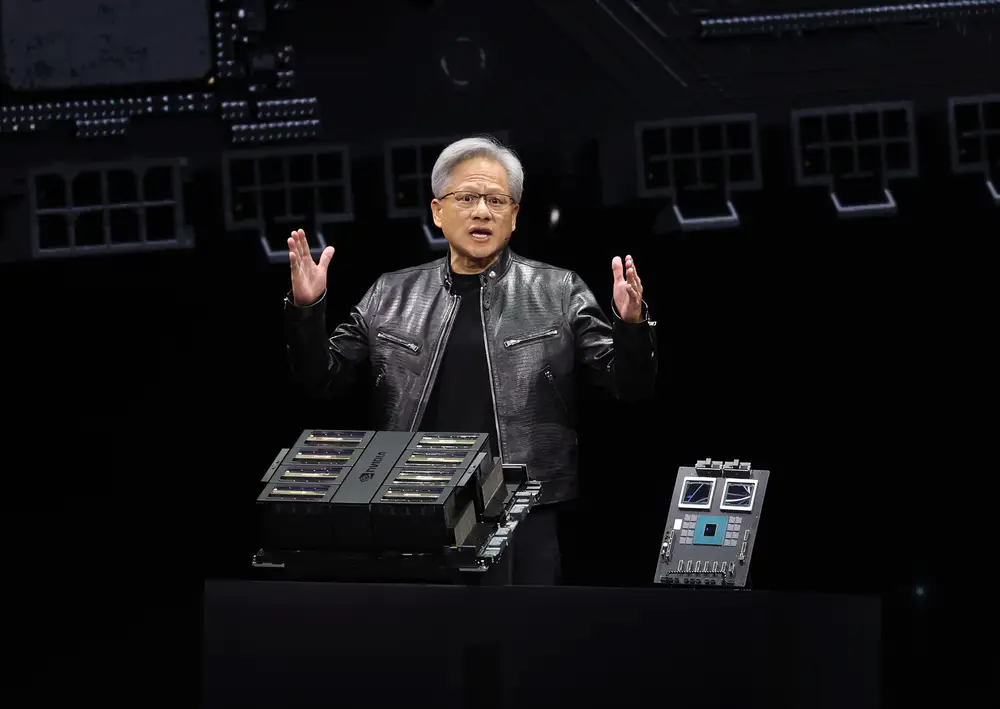

Jensen Huang presenting at a Nvidia event in San Jose in March.

Nvidia is set to report third-quarter earnings results after the market close on Wednesday, and all eyes are on its next-generation Blackwell GPU chip.

While Nvidia has guided that its Blackwell production won’t be fully ramped until early 2025, Wall Street is looking for clues about how many orders it has received for the product.

Early indications suggest that Nvidia could register incremental revenue from its Blackwell chips in the quarter, as it begins early shipments.

According to estimates, that, combined with continued sales of its H100 and H200 GPU clusters, is expected to help Nvidia deliver third-quarter revenue of about $33 billion, representing 83% year-over-year revenue growth.

Here’s what Wall Street is saying about Nvidia’s upcoming earnings report.

CFRA Research: ‘Temper expectations for Blackwell’

According to CFRA Research analyst Angelo Zino, investors should tamp down expectations that Nvidia will offer strong guidance for its highly anticipated Blackwell launch.

“We caution investors to temper expectations for Blackwell inclusion for the Jan-Q outlook (we conservatively look for $3B-$5B in sales), limiting upside to consensus views in the near term as NVDA likely takes a somewhat conservative stance to provide itself with a buffer,” Zino said in a recent note.

Still, Zino expects Blackwell chips will be sold out for much of 2025.

“We expect Blackwell to be supply constrained through CY 25, given heightened demand from hyperscalers to support next-generation data centers. In addition to Blackwell expectations/performance concerns that will likely dominate NVDA’s Q&A session on the call, we expect investors to dissect any comments on tariffs/Sovereign AI after Trump’s victory,” Zino said.

CFRA Research rates Nvidia at “Buy” with a $160 price target.

Goldman Sachs: ‘We expect strong demand’

Analysts at Goldman Sachs said they’re hyper-focused on Nvidia’s guidance for the fourth quarter, which they expect should confirm their bullish thesis on the stock.

They added that they expect the company’s “break out” quarter to be the first quarter of 2025 as the Blackwell product launch ramps up.

Goldman Sachs expects Nvidia to deliver $34.3 billion in revenue for the third quarter, with adjusted earnings per share at $0.79, which is above consensus estimates.

“We expect strong demand for Nvidia’s Hopper-based GPUs (i.e. H100 and particularly the H200) and Spectrum-X (i.e. Ethernet-based Networking product) to drive strong double-digit (%) Data Center revenue growth,” Goldman Sachs said.

The strong expected earnings results, combined with Nvidia’s current valuation, suggest to Goldman that the stock should perform well going forward.

“With NVDA still trading well below its past 3-year median P/E multiple relative to our broader coverage universe, we believe the stock is set up well to sustain its outperformance,” Goldman said.

Goldman Sachs rates Nvidia at “Buy” with a $150 price target.

Wedbush: ‘Expect another ‘Drop the Mic’ report’

Long-time Nvidia bull Dan Ives of Wedbush expects Nvidia to deliver the goods when it reports earnings on Wednesday.

“We expect another drop the mic performance from Nvidia tomorrow after the bell as right now Jensen & Co. are the only game in town with $1 trillion+ of AI Cap-Ex on the way for the next few years with Nvidia’s GPUs the new oil and gold in this world,” Ives said in a Tuesday note.

Ives said he expects Nvidia to beat revenue estimates by $2 billion and to deliver revenue guidance that beats estimates by $2 billion.

“Blackwell production and demand appear robust and we expect very bullish commentary from Jensen on the conference call which will be a focus of the Street that sends the bears back into their caves and hibernation mode,” Ives said.

Ives added that he is encouraged by the “cloud numbers and AI data points” offered by cloud hyperscalers like Microsoft, Amazon, and Alphabet during their recent earnings calls.

Bloomberg Intelligence: Expect gross margins above 73%

“Nvidia is likely to solidly exceed 3Q revenue consensus more than it did in the past two quarters and the company will likely raise 4Q guidance, driven by greater adoption of its Hopper family, even as hyperscaler customers await the Blackwell ramp-up in 2025,” Bloomberg Intelligence analyst Kunjan Sobhani said in a recent note.

Sobhani highlighted that Blackwell delay concerns were likely solved in the third-quarter, setting up the expectation that shipments “to key customers” will begin in the fourth-quarter.

“Increased capex guidance from hyperscalers has further boosted confidence in near-term sales. We expect small volume shipments of Blackwell in fiscal 4Q, reaching full speed in 1Q26, though supply remains constrained,” Sobhani said.

Sobhani said he expects Nvidia’s gross margin to decline, yet remain above 73%.