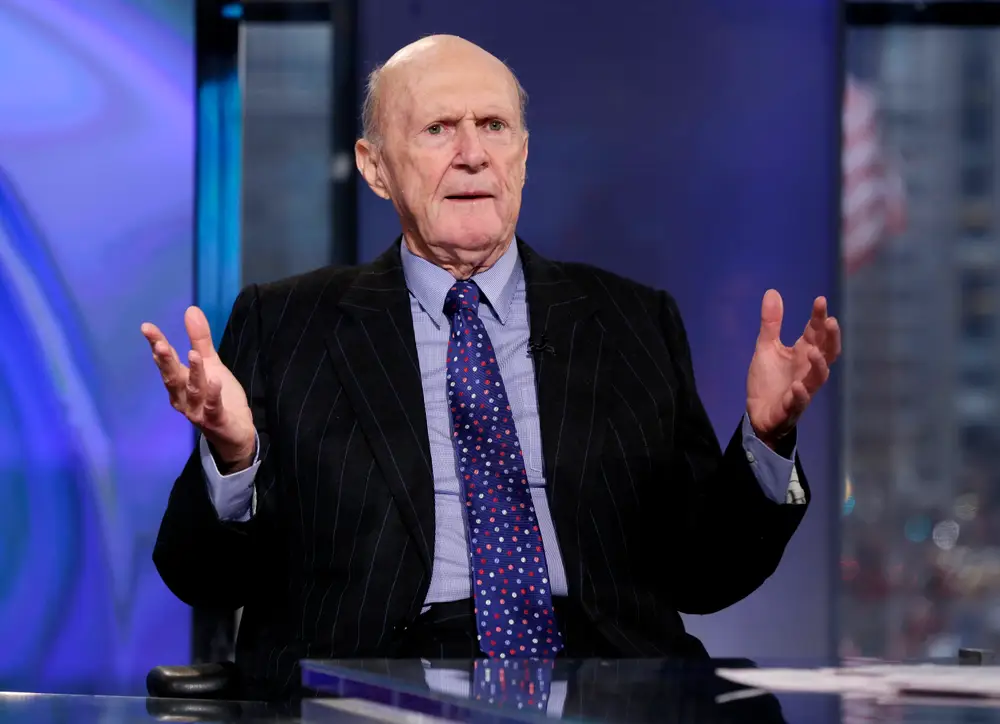

The late Julian Robertson’s Tiger Management is in a legal fight with one of the hedge funds the billionaire seeded

Billionaire Julian Robertson died in August 2022.

Tiger Management and Hound Partners are fighting like cats and dogs.

The pair have sued each other over a profit-sharing agreement that traces its roots back to Hound’s genesis. Hound, a New York-based $4 billion hedge fund run by Jonathan Auerbach, was seeded with $15 million from Tiger Management’s late billionaire founder Julian Robertson in 2004 and received an additional $8 million investment later on.

As a part of that seeding agreement, Hound promised a portion of the firm’s performance fees would be given to Tiger every year, legal filings state. In 2011, the agreement was reworked and promised Tiger 12% of the firm’s gross performance fees going forward — even in the event of Robertson’s death. The billionaire died in August 2022 at the age of 90.

Hound’s lawsuit, filed in New York State Supreme Court on Monday, pushes for the termination of the arrangement and claims that a key part of the agreement was marketing assistance from Tiger. Auerbach’s firm said fundraising help was provided for more than a decade but has fallen off since 2016. Hound claims that Tiger has received more than $155 million in payments over the years.

Tiger also filed a lawsuit in the same court Monday, claiming that Auerbach is using Robertson’s death to try to kill its agreement.

Tiger Management, which returned outside capital in 2000 and focused on backing promising young fund founders, is still one of the most prominent brands in hedge funds. Tiger Cubs, managers run by former lieutenants of Robertson, are tracked closely, including firms like Viking Global, Coaute, and Tiger Global.

Tiger’s lawsuit said the profit-sharing agreement funds Robertson’s foundation, now run by his son, Alex Robertson, and backs academic scholarships, medical research, and more.

Inside the legal claims

Hound’s suit states that since 2016, Tiger has made five introductions to potential investors, compared to nine and 14 in 2015 and 2014, respectively.

“Since 2021, Hound has repeatedly objected to Tiger’s failure to fulfill its marketing obligations. Tiger has responded by refusing to make marketing efforts while simultaneously denying — against all observable reality — that there is anything wrong with its lack of effort,” Hound’s suit states.

When Hound sent a notice in August of the agreement’s termination, Tiger responded, “against all evidence, that it had complied with the Agreement’s marketing obligation,” Hound’s suit reads.

Tiger states in its lawsuit that the agreement is still valid, as Hound still uses Tiger’s “imprimatur” in its marketing materials to lend credence to the firm, which had a multi-year stretch of poor performance. Hound saw assets fall from $4.6 billion at the end of 2017 to $1.8 billion at the end of 2022, according to Tiger’s suit.

Improved performance and the launch of new strategies have bumped Hound’s assets to more than $4 billion again, according to a regulatory filing from July. However, Tiger still states in its suit that it’s helped the firm’s reputation in the industry in recent years, even if it wasn’t introducing Hound to potential new investors.

Tiger’s suit notes that it helped Hound and a large endowment reach “an amicable resolution” in 2023 when the allocator wanted to redeem all of its capital. Tiger said it has stuck up for Auerbach in the industry “despite the general sentiment within the investing community that Mr. Auerbach can be arrogant and challenging to partner with.”

“There is no instance of which Tiger is aware where Mr. Auerbach sought a positive reference for his funds that Tiger declined to provide,” Tiger’s suit states.

Hound’s use of Tiger’s brand in marketing even “went so far as to identify that relationship as part of its ‘DNA,'” the suit read. Auerbach did not work for Robertson’s fund but was seeking capital to start his fund in 2004 when he met the billionaire.

Tiger declined to comment. A spokesperson for Hound said the firm is “disappointed” that Tiger’s suit makes them out to be “villains, Making personal attacks on our character, and somehow claiming that we are exploiting Julian Robertson’s death.”

“While Julian Robertson was a one-of-a-kind, amazing human being, and Tiger will not be the same without him, this is a simple dispute about Tiger’s failure to fulfill its contractual obligation, which has nothing to do with his passing. The facts showing Tiger’s contractual breach are substantial, unmistakable, and speak for themselves,” the spokesperson said in a statement.