The Fed’s rate cuts will spark a $2 trillion exodus from money market funds, Apollo chief economist says

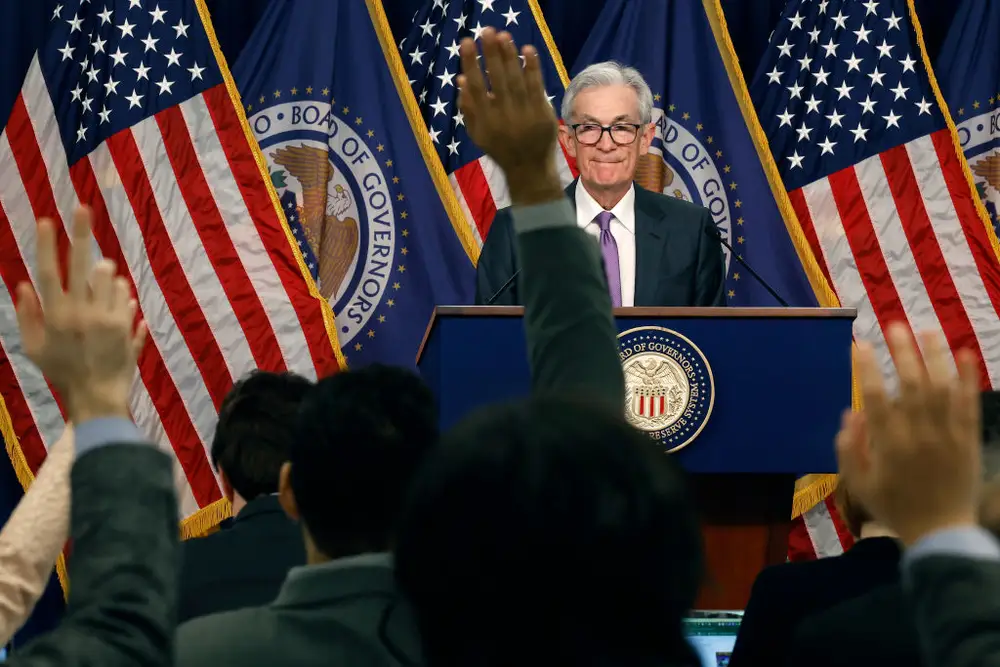

Federal Reserve Chair Jerome Powell

The Federal Reserve’s easing cycle is set to fuel a huge move out of money market funds, Apollo’s Torsten Slok said.

The firm’s chief economist said the Fed’s interest-rate hikes pumped $2 trillion into money market accounts from March 2022 to September 2024. Funds held in money market funds hit an all-time high of $7 trillion this month.

Now that the central bank has started cutting rates, that money will likely rotate out of those accounts and into higher-yielding assets, Slok said.

However, the rotation won’t necessarily benefit stocks, but will instead result in inflows into the credit markets, Slok said.

“Where will the $2 trillion added to money market accounts go now that the Fed is cutting? The most likely scenario is that money will leave money market accounts and flow into higher-yielding assets such as credit, including investment grade private credit,” Slok wrote in a Tuesday note.

In an earlier note, Slok said credit markets appear well-positioned for further inflows after the election.

“We expect credit fundamentals to remain robust. This combined with elevated all-in yields and steep yield curves should continue to attract inflows into credit, which should support valuations even though room for further compression is getting more limited,” Slok wrote earlier this month.

Slok’s prediction could disappoint stock bulls who were hoping the rotation out of money market funds would fuel a fresh rally for equities.

Goldman Sachs, meanwhile, said recently that investors should still favor stocks over bonds as Fed easing and a strong economy support a pro-risk, late-cycle environment.

“During late-cycle backdrops, equities can deliver attractive returns driven by earnings growth and valuation expansion, while credit total returns are usually constrained by tight credit spreads and rising yields,” the analysts said in a note last month.