4 investment strategies that will outperform the stock market in 2025, according to Goldman Sachs

On the surface, 2025 is looking good for markets. Interest rate cuts are progressing steadily, US GDP growth looks stable at 2.8% for the third quarter, and President-elect Donald Trump’s promised corporate tax cuts have injected a dose of additional optimism.

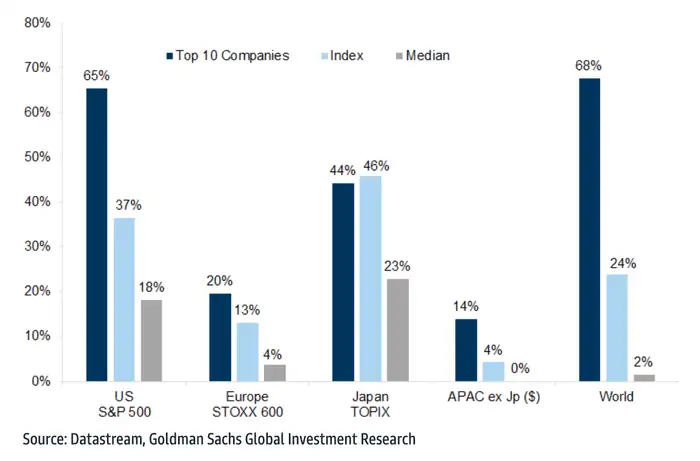

But there’s a slight catch: the stock market’s overly bullish bet on AI has stocks looking rich and overly concentrated. A small group of mega-cap names has pushed the S&P 500 up by 26% this year. That said, major indexes will have much to live up to following their solid year, and it’s not likely they can post stellar returns on a relative basis. An earlier note from Goldman Sachs projected that the S&P 500 could have muted returns at 3% annually for the next decade.

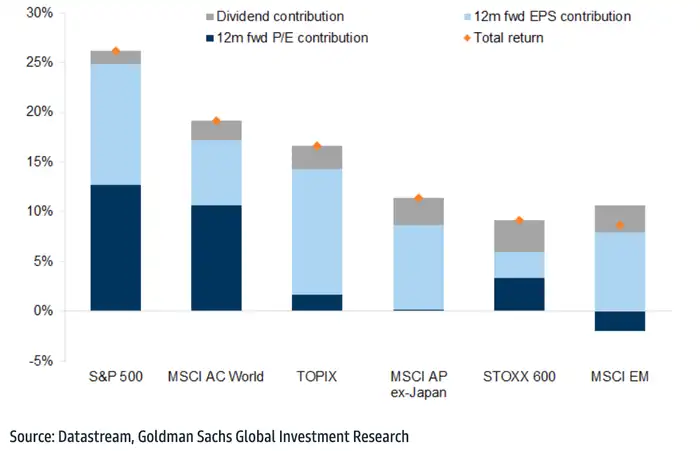

Investor bullishness was driven by hype and hyper sales growth, both difficult to maintain long term. While some of those gains are riding on solid footing following strong profit growth, half of 2024’s global equity returns was a result of valuation expansion, especially for US stocks, which are at record highs relative to the previous two decades, according to a November note from Goldman Sachs. Positive sentiment around softening inflation and interest rate cuts also helped.

The chart below demonstrates the portion of returns based on price-to-earnings estimates, earnings per share, and dividends, indicating that valuation expansion was a bigger contributing factor.

However, history tells us that it’s not likely such a strong run will last. Over the past 40 years, only 3% of firms could grow sales at a rate of 20% over 10 years, read the note led by Peter Oppenheimer. It means that betting on the broader market and momentum is probably not the best strategy next year.

Instead, the investment bank suggests seeking alpha, a short way of saying returns above the broad market. The way through is by focusing on four key areas that include opportunities from a broadening out of the stock market, hunting for value, adding foreign stocks, and considering companies engaged in mergers and acquisitions.

Four areas to consider

As interest rates rose at the fastest pace in four decades, companies that relied on debt or had weaker balance sheets fell behind their larger counterparts that had stronger balance sheets to rely on. But as the rate cuts from this cycle take effect, smaller companies will have a chance to catch up.

Below is a chart from Goldman Sachs that shows how the major indexes, which rely on some of the largest global firms, performed against the broader market since the first Fed hike in March 2022.

The note recommends rotating as rates create a more favorable environment for smaller cap companies by shifting away from the S&P 500 and toward the equal-weight S&P 500, which tracks the same companies but holds a fixed equal weight across the names. Another option is the S&P 400, which tracks US midsize companies.

If you’re bullish on AI, Goldman suggests considering what it refers to as “phase three” of the trade, which encompasses companies that could see revenue growth from using the technology for this, such as increased productivity. The investment banks expect that capital expenditure for AI will increase next year.

Finally, consider growth stocks that aren’t pegged to technology, such as Eli Lilly, Honeywell International, Vertex Pharmaceuticals, and Chipotle, among others.

But growth overall is still expensive, the note read. Therefore, investors should top off their exposure by adding value stocks, seeking out firms with higher yields and increasing shareholder returns through solid dividends. Key sectors for this play include US materials and utilities.

Geographic diversification is another area where alpha could be found. Consider foreign markets, specifically Japan. Goldman Sachs is overweight on Japanese equities due to its positive outlook driven by EPS growth rather than multiple expansion, a trend expected to continue due to a weak yen.

As for other parts of the world, while they may not be as attractive, some opportunities could be found within specific companies. For Europe, companies not reliant on exports, such as telecommunications and real-estate firms, or those where half their revenues are earned within the US market but are cheaper than their American counterparts, are a good bet.

Finally, capital markets activity is expected to see an uptick. That said, Goldman suggests looking for names involved in mergers and acquisitions.