How Amazon revamped its AI-sales machine to compete with OpenAI, Microsoft, and Google

This summer, Amazon Web Services rolled out a new internal campaign.

The initiative, called “Find One, Launch One, Ramp One,” introduced goals, prizes, and other incentives for Amazon’s huge cloud-support teams across North America.

The ultimate aim was to sell more of the company’s new AI offerings. Sales architects, customer-success managers, and people in other roles were recruited into the broad push.

“This is a great time to partner with our sales teams for this #OneTeam effort,” AWS said in an internal memo obtained by B-17.

These AWS staffers were asked to find at least one sales opportunity each month for Q, Amazon’s artificial-intelligence assistant, and Bedrock, the company’s AI platform.

Then, the initiative asked employees to launch one Bedrock or Q customer workload.

The final requirement, the “Ramp One” part, pushed teams to generate real revenue from these workloads.

AWS created a leaderboard for everyone to see the top performers. With December 1 as the deadline, the company dangled prizes, including an evening of pizza and wine at an executive’s home (with guitar playing as a possibility).

A race for AI supremacy

This initiative is just one example of AWS trying to squeeze more out of its massive sales and support teams to be more competitive in AI. There’s more pressure and urgency to sell AI products, along with new incentives, according to several internal documents and more than a dozen current and former AWS employees.

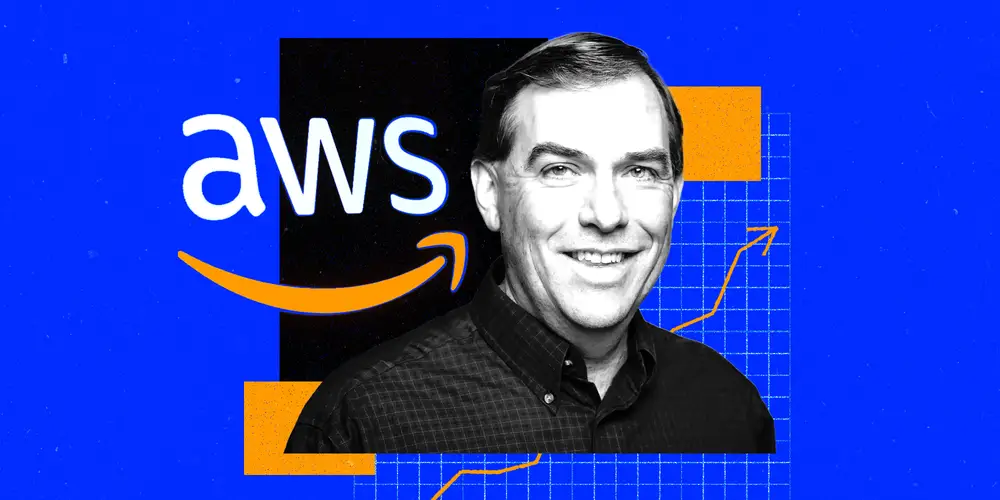

Messaging from AWS CEO Matt Garman, previously the cloud unit’s top sales executive, is to move even faster, these people said. They asked not to be identified because they’re not authorized to speak with the press. Their identities are known to B-17.

Much is at stake for Amazon. OpenAI, Microsoft, and Google, alongside a slew of smaller startups, are all vying for AI supremacy. Though Amazon is a cloud pioneer and has worked on AI for years, it is now at risk of ceding a chance to become the main platform where developers build AI products and tools.

More pressure

The revamped sales push is part of the company’s response to these challenges. As the leading cloud provider, AWS has thousands of valuable customer relationships that it can leverage to get its new AI offerings out into the world.

Many AWS sales teams have new performance targets tied to AI products.

One team has to hit a specific number of customer engagements that focus on AWS’s generative-AI products, for instance.

There are also new sales targets for revenue driven by gen-AI products, along with AI-customer win rates and a goal based on the number of gen-AI demos run, according to one of the internal Amazon documents.

Another AWS team tracks the number of AI-related certifications achieved by employees and how many other contributions staff have made to AI projects, one of the people said.

Hitting these goals is important for Amazon employees because that can result in higher performance ratings, a key factor in getting a raise or promotion.

More employees encouraged to sell AI

Even people in roles that traditionally don’t involve actively selling products are feeling pressure to find opportunities for AI sales, according to Amazon employees who spoke with B-17 and internal documents.

AWS software consultants, who mostly work on implementing cloud services, are now encouraged to find sales opportunities, which blurs the line between consultants and traditional salespeople.

The Find One, Launch One, Ramp One initiative includes AWS sales architects. These staffers traditionally work with salespeople to craft the right cloud service for each customer. Now they’re incentivized to get more involved in actual selling and are measured by the results of these efforts.

“Customers are interested in learning how to use GenAI capabilities to innovate, scale, and transform their businesses, and we are responding to this need by ensuring our teams are equipped to speak with customers about how to succeed with our entire set of GenAI solutions,” an AWS spokesperson told B-17.

“There is nothing new or abnormal about setting sales goals,” the spokesperson added in a statement. They also said that AWS sales architects were not “sellers” and that their job was to “help customers design solutions to meet their business goals.”

There are “no blurred lines,” the spokesperson said, and roles and expectations are clear.

Selling versus reducing customer costs

One particular concern among some AWS salespeople revolves around the company’s history of saving cloud customers money.

Some staffers told B-17 that they now feel the company is force-feeding customers AI products to buy, even if they don’t need them. The people said this represented a shift in AWS’s sales culture, which over the years has mostly looked for opportunities to reduce customers’ IT costs.

In some cases, salespeople have also been asked to boost the attendance of external AWS events. Several recent AWS-hosted AI events saw low attendance records, and salespeople were told to find ways to increase the number of registrations by reaching out to customers, some of the people said.

AWS’s spokesperson said customer attendance had “exceeded our expectations for a lot of our AI events” and that the number of participants at the re:Invent annual conference “more than doubled.”

The spokesperson also said the notion that Amazon had moved away from its goal of saving customers money was false. The company always starts with “the outcomes our customers are trying to achieve and works backwards from there.”

A hammer and a nail

Garman, Amazon’s cloud boss, hinted at some of these issues during an internal fireside chat in June, according to a recording obtained by B-17. He said there were sales opportunities for AWS in “every single conversation” with a customer but that AWS must ensure those customers get real value out of their spending.

“Too often we go talk to customers to tell them what we’ve built, which is not the same thing as talking to customers,” Garman said. “Just because you have a hammer doesn’t mean the problem the customer has is the nail.”

AWS’s spokesperson said the company is “customer-obsessed” and always tries to consider decisions “from our customers’ perspectives, like their ROI.” The spokesperson added that some of AWS’s competitors don’t take that approach and that it’s a “notable contrast,” pointing to this B-17 story about a Microsoft customer complaining about AI features.

More pressure but also more rewards

Amazon is also doling out bonuses and other chances for higher pay for AI-sales success.

AWS recently announced that salespeople would receive a $1,000 performance bonus for the first 25 Amazon Q licenses they sell and retain for three consecutive months with a given customer, according to an internal memo seen by B-17. The maximum payout is $20,000 per customer.

For Bedrock, Amazon pays salespeople a bonus of $5,000 for small customers and $10,000 for bigger customers when they “achieve 3 consecutive months of specified Bedrock incremental usage in 2024,” the memo said.

Some AWS teams are discussing higher pay for AI specialists. Sales architects, for example, in AI-related roles across fields including security and networking could get a higher salary than generalists, one of the people said.

AWS’s spokesperson told B-17 that every major tech company provides similar sales incentives. Amazon continually evaluates compensation against the market, the spokesperson added.

Fear of losing to Microsoft

Satya Nadella, Microsoft’s CEO.

Inside AWS, there’s a general concern that Amazon was caught off guard by the sudden emergence of generative AI and is playing catch-up to its rivals, most notably Microsoft, the people who spoke with BI said.

Some Amazon employees are worried that Q is losing some customers to Microsoft’s Copilot because of a lack of certain AI features, B-17 previously reported.

Microsoft has an advantage because of its wide variety of popular business applications, including its 365 productivity suite. That may make it easier for Microsoft to show customers how AI can improve their productivity, some of the Amazon employees told B-17. AWS, meanwhile, has struggled to build a strong application business, despite years of trying.

AWS’s spokesperson challenged that idea by noting that AWS has several successful software applications for companies, including Amazon Connect, Bedrock, and SageMaker. The spokesperson also said Amazon Q launched in April and was already seeing robust growth.

It’s “no secret that generative AI is an extremely competitive space,” the spokesperson added, saying: “However, AWS is the leader in cloud and customer adoption of our AI innovation is fueling much of our continued growth. AWS has more generative AI services than any other cloud provider, which is why our AI services alone have a multibillion-dollar run rate.”

More speed

A major AWS reorganization earlier this year hasn’t helped the AI-sales effort, some of the people who spoke with B-17 said.

The big change switched AWS to more of an industry focus rather than a regional one. That caused confusion inside the company, and some large customers lost their point of contact, the people said. AWS is still figuring out how to run as a more cohesive group, which has resulted in a slower sales cycle, they added.

AWS’s spokesperson said it’s inaccurate to say its sales process has slowed, adding that year-over-year revenue growth accelerated again in the most recent quarter and that the business was on pace to surpass $100 billion in sales this year.

In his June fireside chat, Garman stressed the importance of speed and told employees to “go faster.”

“Speed really matters,” Garman said. “And it doesn’t necessarily mean work more hours. It means: How do we make decisions faster?”