9 charts show how buying a home has gotten harder for the average American

Feel like buying a home is tougher than ever? You’re not the only one.

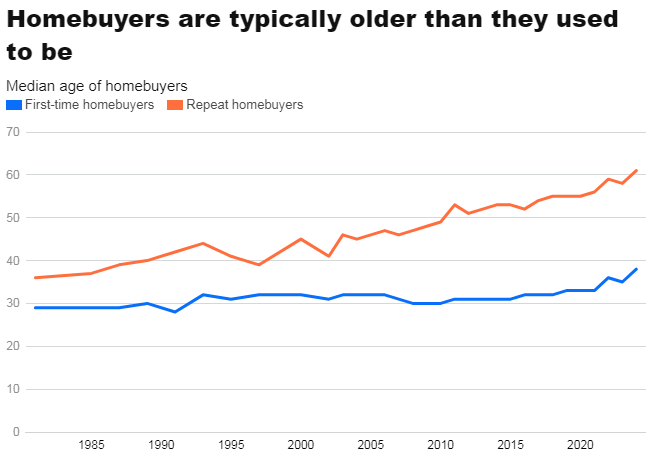

Homebuyers are older than ever, make more money, and are less likely to have young children at home, based on historical data on homebuyers from the National Association of Realtors, or NAR.

These trends have largely resulted from declining housing affordability over the past several decades, Brandi Snowden, NAR’s director of member and consumer survey research, told B-17

“We’re seeing that affordability is becoming increasingly difficult, with higher incomes needed to enter the market,” Snowden said. “Buyers are also facing limited inventory, so they often need to search longer to find the right home.”

Here are nine charts that show how the state of US homeownership has changed over the last several decades.

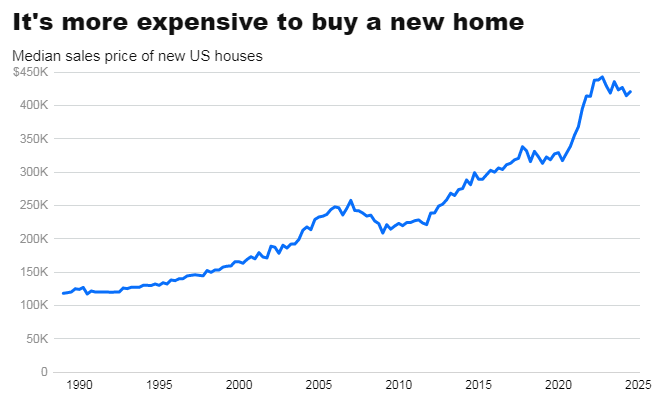

Data from the Census Bureau and the Department of Housing and Urban Development showed the median sales price of new houses in the US surged during the pandemic, reaching a peak of $442,600 in the fourth quarter of 2022.

Rising prices have made it more difficult for Americans, especially first-time homebuyers, to break into homeownership, as real median household income growth hasn’t kept up.

“We’ve seen that first-time homebuyers have needed to be wealthier in order to be successful homebuyers, especially with rising home prices and interest rates,” Snowden said.

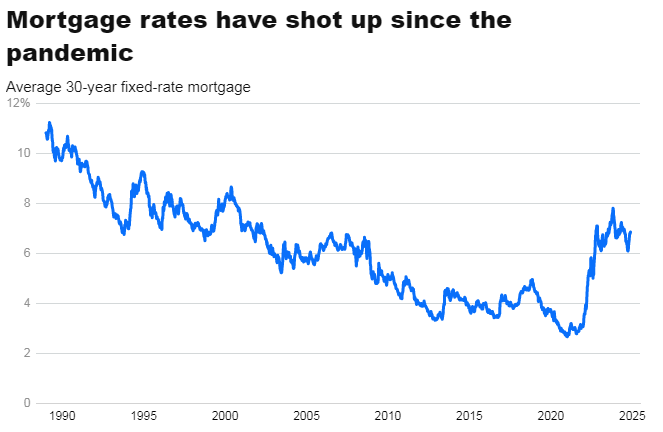

The average 30-year fixed-rate mortgage has generally been rising this fall.

It was 6.84% as of the week ending November 21. While that’s lower than a year ago and below the recent nearly 8% peak in October 2023, it’s still a relatively high rate.

A higher rate plus more expensive homes leads to bigger monthly mortgage payments.

“A challenge for first-time homebuyers is higher mortgage rates, especially over the last year,” Snowden said. “It could be a factor in their delaying a home purchase.”

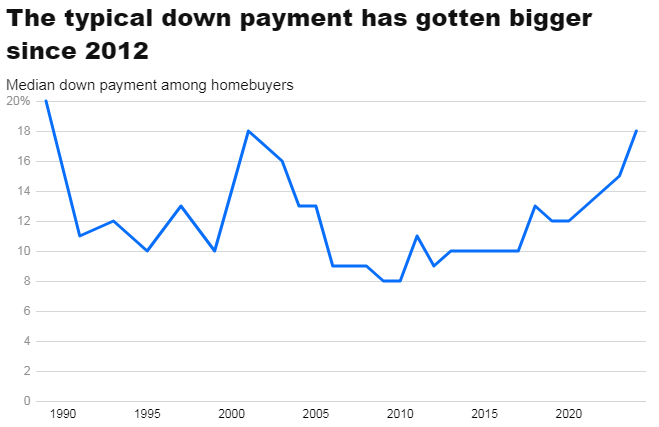

The typical down payment homebuyers put down has also been generally rising since the Great Recession.

The median down payment was 8% in 2009 and 2010. In 2024, though, it’s typical for a homebuyer to make an 18% down payment.

Down payments of this size are not unprecedented: The median hit 20% in 1989 and 18% in 2001.

“We see that a large share of homebuyers, especially first-time buyers, rely on gifts or loans from family and friends,” Snowden said. “They may also be tapping into stocks, bonds, or even their 401(k) for their down payment.”

Snowden said that homebuyers may opt for a larger down payment that can help offset the mortgage interest rate with a lower monthly payment.

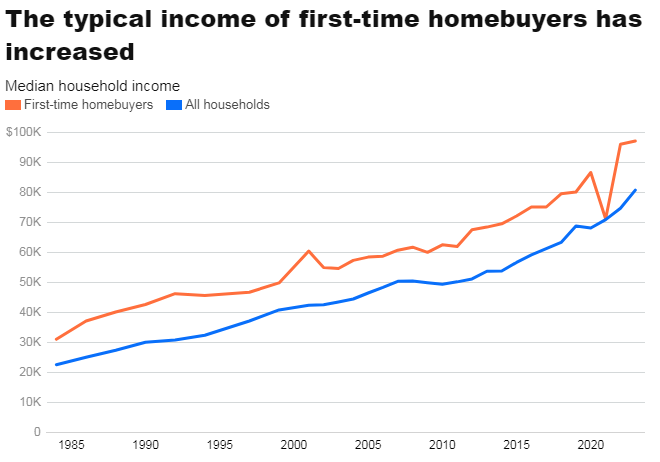

The climb in the median household income for people purchasing a home for the first time suggests Americans typically need to make closer to six figures to become homeowners.

In 1984, the typical household made $22,420 a year — or around $66,000 in 2023 dollars —while the typical first-time buyer made nearly $31,000 — or around $91,000 in 2023 dollars. In 2023, the median household income was around $80,600, and first-time homebuyers made $97,000.

Zillow research published earlier this year said people have to make over $106,000, 80% higher than what was needed in January 2020, “to comfortably afford a home.”

Median incomes for homebuyers dipped in 2021 in part due to the kinds of areas people were moving to.

“Lower median income may be a reflection of buyers purchasing in more affordable locations such as small towns,” a NAR report said, adding, “and an increased share of senior buyers who may be retired.”

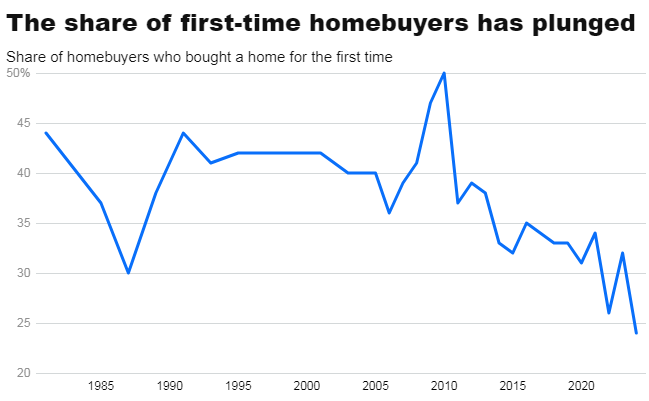

The share of first-time homebuyers dropped to just 24% in 2024, down from 32% in 2023 and a record 50% in 2010. This marks the lowest percentage since NAR began tracking the data in 1981.

The pullback in homebuying demand has been largely driven by the ongoing affordability crisis, compounded by a shrinking supply of entry-level homes.

There are fewer of these types of homes — typically smaller and more affordable for first-time buyers — on the market than there used to be, and the ones that are for sale are more expensive.

“We’re seeing that the most difficult step for successful homebuyers is finding the right property,” Snowden said.

In 2024, the median age of first-time buyers was 38, nine years older than in 1981. Meanwhile, the median age of repeat buyers increased from 36 to 61.

Unlike repeat buyers, who tend to be older and have more wealth or home equity, many would-be first-time buyers — often younger people, like Gen Zers and millennials — lack the financial resources needed to purchase a home.

Snowden said that many people are spending money on expensive rents, student loans, credit card bills, and car loans that they would otherwise set aside for a down payment.

As a result, many are postponing their plans to buy. Others may abandon dreams of homeownership altogether.

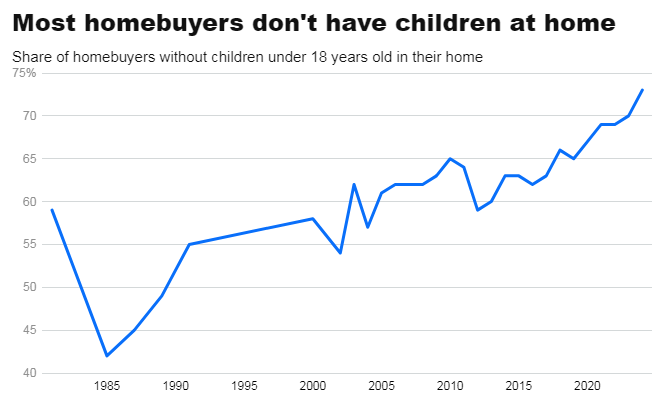

The share of homebuyers without children under 18 years old in their homes has widened to 73%, 10 percentage points higher than a decade earlier.

People without the financial demands of raising children tend to enjoy greater financial flexibility. Some can save thousands of dollars each year — which could be directed toward a down payment or other homebuying costs.

Married or cohabitating couples without children are often referred to as DINKS — an acronym for “dual income, no kids.” Data from the Federal Reserve’s Survey of Consumer Finances shows that DINKs typically have a median net worth exceeding $200,000.

In contrast, many households with children experience financial strain, as parents allocate a significant portion of their income to day care, medical bills, and school tuition — expenses that can make saving enough to buy a home more challenging.

In addition to couples who never had kids, many baby boomers and Gen Xers who had kids are now empty nesters and may be looking to downsize.

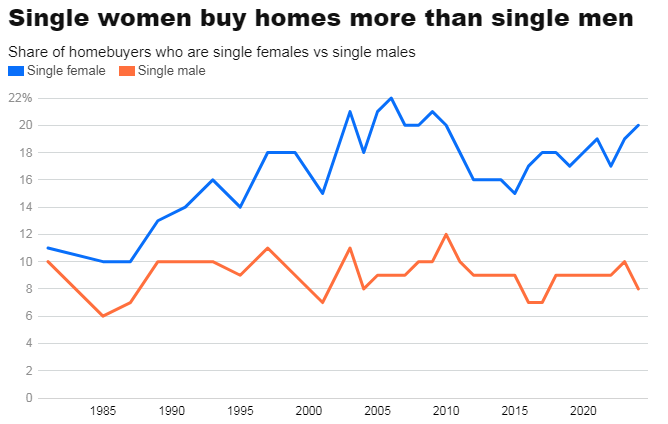

Since NAR started collecting data, single women homebuyers have outpaced single men homebuyers, but the gap has grown.

Single women made up 20% of all homebuyers in 2024, while the share of single men purchasing homes dropped to just 8%.

Snowden said single women are often drawn to homeownership for several reasons, including independence, divorce, and the responsibility of raising children.

Snowden said that single female buyers are typically older than their single male counterparts, with the median age for single women at 60 compared to 58 for single men. “These buyers could be recently divorced or purchasing a home for more than just themselves, but also for their children and parents,” she said.

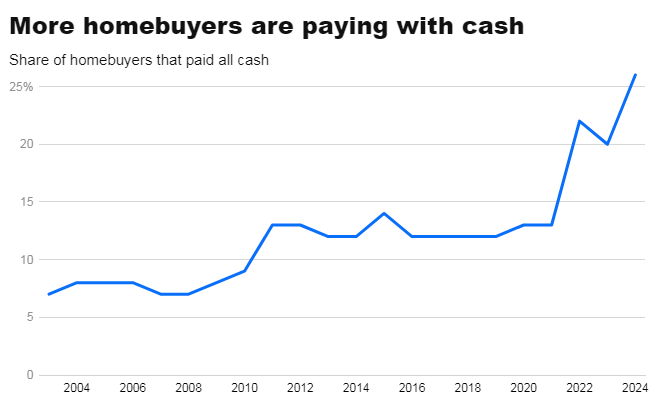

Jessica Lautz, NAR deputy chief economist and vice president of research, said in a news release that “current homeowners can more easily make housing trades using built-up housing equity for cash purchases or large down payments on dream homes.”

First-time homebuyers, meanwhile, tend to have to go through the process of taking out a mortgage, potentially losing their chance on a housing bid to those who have money ready for their next home.

The share of homebuyers who paid in cash climbed from 7% in 2003 to 26% in 2024. Snowden said this data is based on primary residences only, excluding investor properties.