BlackRock is buying HPS, rounding out a year of blockbuster deals

BlackRock CEO and cofounder Larry Fink.

Larry Fink is looking to close 2024 as he started it — by announcing a big acquisition that brings BlackRock closer to dominating private market investing.

BlackRock is set to buy HPS Investment Partners, a private credit behemoth managing $150 billion, in an all-stock deal worth around $12 billion, the Wall Street Journal reported Tuesday morning.

Fink, BlackRock’s chief executive and cofounder, who built the world’s largest asset manager with $11.5 trillion in assets by packaging public markets into cheap funds for the masses, has been very vocal about the firm’s push into the profitable private markets.

This shift in strategy could lead to a more valuable BlackRock, which might just be enough for Fink, who turned 72 last month, to finally pass on the reins to his yet-to-be-named successor.

In January, the firm announced that it would buy private equity firm Global Infrastructure Partners, with about $170 billion in assets, for about $12.5 billion in cash and stock. The deal, its biggest one since it bought Barclays’s asset management business in 2009, closed in October. In June it agreed to buy data giant Preqin, which it hopes will help bring some of these more complex private strategies to a broader audience.

In addition to the HPS talks, the FT has reported that BlackRock is eyeing a stake in Izzy Englander’s $70 billion hedge fund Millennium Management.

BlackRock is not new to reshaping itself through acquisition. The Barclays deal gave the firm iShares and helped it become the passive investing giant it now is.

“I do not want us to be comfortable in our business model,” Fink said during the firm’s investor day last summer. “I want to make sure we’re questioning our business model and we are focusing on how to best serve our clients, and if we truly believe there is some great need that we need to do, we are going to reimagine who we are in our business model.”

Acquiring HPS could be another “transformational” deal for the company, helping it reach the same scale it has public equities and bonds in private markets. HPS will push its alternative assets to more than $600 billion, the WSJ reported.

Meet HPS Investment

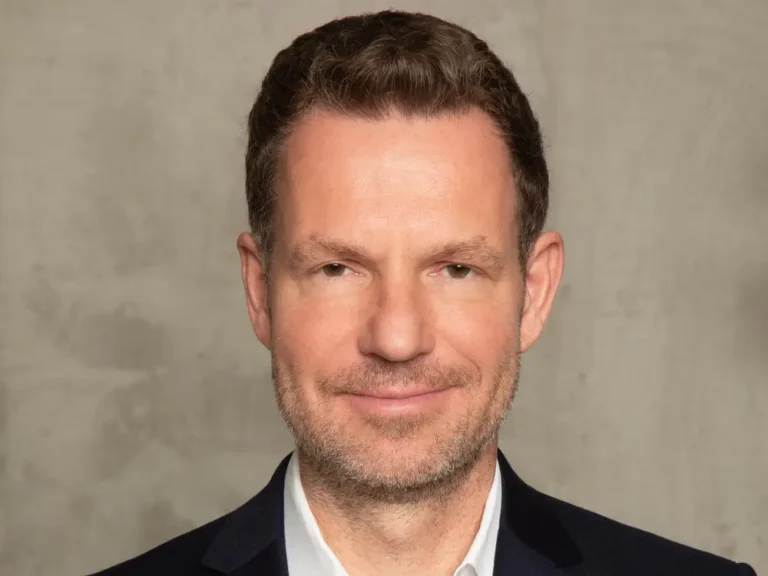

HPS was founded by CEO Scott Kapnick, Goldman Sachs’ former head of investment banking, along with Scot French and Michael Patterson in 2007 as a unit within JPMorgan called Highbridge Capital Management. Principals from the firm bought it out in 2016 after the bank’s appetite for high-risk loans waned.

The three will now join BlackRock’s global executive committee and lead a new unit combining HPS and BlackRock’s existing private credit business, according to the WSJ report.

HPS Investment Partners CEO Scott Kapnick.

The secretive firm has been at the forefront of the private credit boom, which resulted from the 2008 financial crisis and banks’ withdrawal from risky lending. Private players moved in to make loans to companies when Wall Street giants were reluctant to.

“Our competitors refer to us as the nerds of private credit and we take no offense,” French told Bloomberg in an interview last November.

The firm, which was previously working toward an initial public offering, caters to mostly institutional investors and has more than 760 employees in offices around the world, according to its website.

How it fits with BlackRock’s ambitions

BlackRock brought in more assets in the third quarter than ever before, mostly down to its index funds, but in its October earnings call the firm’s leaders were already focused on its future growth engine — GIP.

GIP is expected to add $250 million in management fees in the fourth quarter alone.

“This is a revenue growth story,” Martin Small, BlackRock’s chief financial officer said during that call.” Private equity and credit investments are much more expensive than BlackRock’s usual roster of funds and are in high demand from institutions like pensions and endowments as well as ultra-wealthy investors.

While BlackRock has long had an alternatives investing unit, until recently, its private markets assets were meaningfully smaller than those of the main players in the space, such as Blackstone, Apollo, and KKR.

It’s tried growing through acquisition in this space in the past. In 2018, BlackRock bought a small credit manager, Tennenbaum Capital Partners, which at that time had about $9 billion in committed client capital, but saw a number of investment professionals exit.