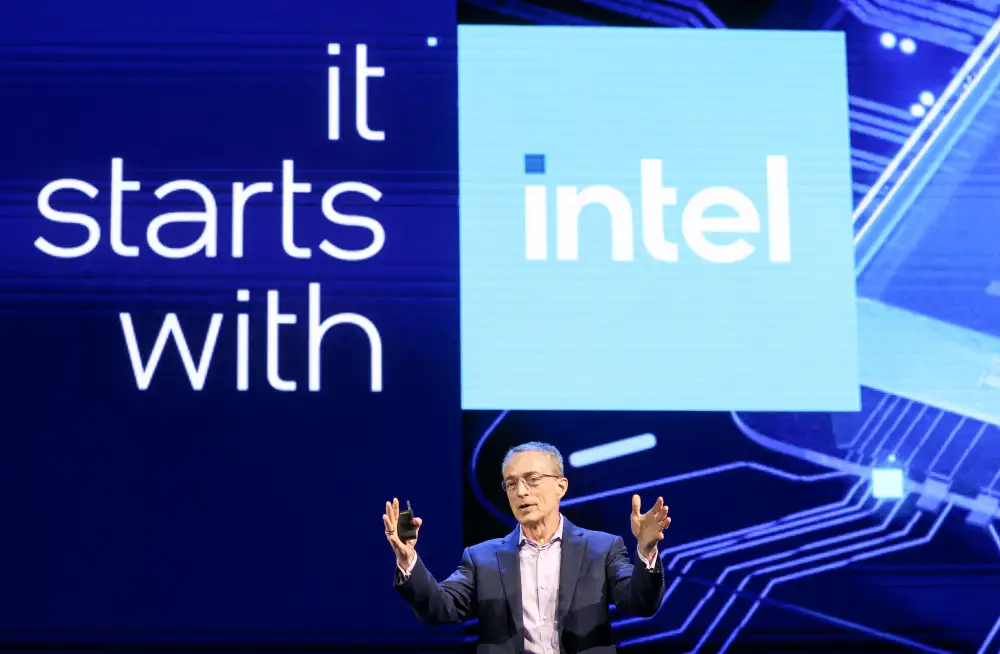

In an all-hands meeting, Intel’s new leaders emphasized outgoing CEO Pat Gelsinger’s ‘personal decision’

Intel CEO Pat Gelsinger delivers a speech at Taipei Nangang Exhibition Center during Computex 2024, in Taipei on June 4, 2024.

On Monday morning, Intel employees joined an all-hands meeting after receiving an email invite at 5 a.m. PT.

Accompanying the invite was the news that the company’s CEO Pat Gelsinger had stepped down as of Sunday, and would be temporarily replaced by co-CEOs David Zinsner, Intel’s chief financial officer for nearly three years, and Michelle Johnston Holthaus, the new CEO of product.

Gelsinger’s move came without warning. He isn’t staying on to transition out slowly or help with the search for his replacement. Come 9 a.m. the pair of fresh co-CEOs were bombarded with questions.

Why did Gelsinger leave so suddenly? What kind of CEO is Intel trying to get now? How can employees trust leadership after repeated missteps?, employees asked.

The man at the center of the conversation was not there. Being CEO of Intel was Pat Gelsinger’s dream since he joined the company as a teenager in 1979. He achieved it improbably after being ousted once already.

“He was the prodigal son returning,” described Alvin Nguyen, senior analyst at Forrester. Gelsinger returned a savior, but now he’s retiring at 63 and Intel is far from saved. Multiple outlets reported Monday that Gelsinger’s departure is the result of board rancor, with Bloomberg reporting that the CEO was given the choice to retire or be removed from the job.

Gelsinger’s departure was a “personal decision”, executives repeated in the all-hands, according to a current employee in attendance.

Intel’s interim leadership brings deep knowledge of the company’s finances, products, and customers.

Zisner has overseen the recent cost-cutting effort, and Holthaus has been steeped in Intel for nearly 20 years. But no one at the top has the technical expertise of Gelsinger, which Intel employees pointed out in their questions. Yet despite his technical prowess as Intel’s first chief technology officer, Intel remains in critical condition.

The leaders emphasized that the company goals would not change: employees would improve efficiency and, reduce costs, and the company would need to execute better with products and with the crucial 18A process.

Holthaus told employees on the call that her leadership style is direct and transparent, according to the employee in attendance. She reminded them that she has worked at Intel for many years.

Intel declined to comment, but a spokesperson pointed to Gelsinger’s departure press release.

Contending with Intel’s many misses

Intel has more than 65% of the market for traditional PCs and 85% of the server market, according to Edward Jones. Yet critical missteps plague the company. Zisner and Holthaus likely can’t wait for an executive search to conclude to address them.

Supporting the passage of the CHIPS Act and obtaining its promised funding has been a major focus of Gelsinger’s nearly 4-year term as CEO. However, the funding is contingent upon hitting execution benchmarks, with which the company has struggled.

Last week, the Department of Commerce finalized its direct funding for Intel under the CHIPS Act, totaling $7.865 billion. Said funding fell short of the original amount of $8.5 billion announced.

“While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence,” Frank Yeary, now Intel’s interim board executive chair, said in a statement.

Intel’s overall fall from grace is most apparent in the context of the rise in the importance of accelerated computing and AI.

In 2021, when Gelsinger took over as CEO, shares of Nvidia were trading below $30. The GPU designer’s recent rise to one of the most valuable companies in the world has put a spotlight on Intel’s relative absence from the accelerated computing race that Nvidia has come to dominate. Median pay at Intel has remained stagnant the last five years compared to other competitors as employee cuts continue.

Gelsinger said last month that the company would miss its target of $500 million in sales this year of its AI chip, Gaudi 3. But analysts told B-17 that 18A, the company’s most advanced manufacturing node, is actually more important to Intel’s resurgence than making a splash in AI.

“Intel has ostensibly ‘bet’ the company on 18A for salvation,” Bernstein analysts wrote.

The costs of bringing this node online are likely to increase further, and it is “still to get any external validation from large fabless customers,” according to Bank of America analyst Vivek Arya. But this expensive work is essential to bring Intel back to the cutting edge and make it an attractive partner for bleeding-edge chip designers like Nvidia.

“The importance of bringing manufacturing back in-house can’t be overstated,” Futurum Group CEO Daniel Newman told B-17. The fate of the company, and the legacy of Gelsinger rides on it.

“The cornerstone of Pat’s tenure as CEO was built upon Intel achieving process leadership or at least parity and if they cannot execute with 18A, then it was all for naught,” Logan Purk, senior research analyst at Edward Jones, told B-17. Given slow-moving technological progress and cost-cutting, and fast-moving competitors, Intel’s next CEO may be inheriting a harder job than Gelsinger did.

“It was a tough situation when Pat showed up, and things look much worse now,” Bernstein analysts wrote in a note to investors.

No one has been a closer witness to this roller coaster than Intel employees, who have seen multiple waves of layoffs and buyouts.

Monday’s meeting had the distinct flavor of “damage control”, according to the employee.

Intel shares were down 60% Monday, compared to the day Gelsinger took the CEO job. However, shares jumped slightly upon Monday’s announcement of Gelsinger’s retirement.