Bank of America says it’s time to skip the S&P 500 and opt for these stock sectors instead

Bank of America expects a solid 2025 for equities with a target for the S&P 500 at 6666 by year-end, a 10% gain from where it was Wednesday at 6049, bolstered by an EPS growth forecast of 13% next year.

Still, it won’t be a year when investors should just buy the index. Instead, it’s an environment ripe for sector rotation, said Savita Subramanian, head of US equity and quantitative strategy, during the bank’s 2025 outlook call.

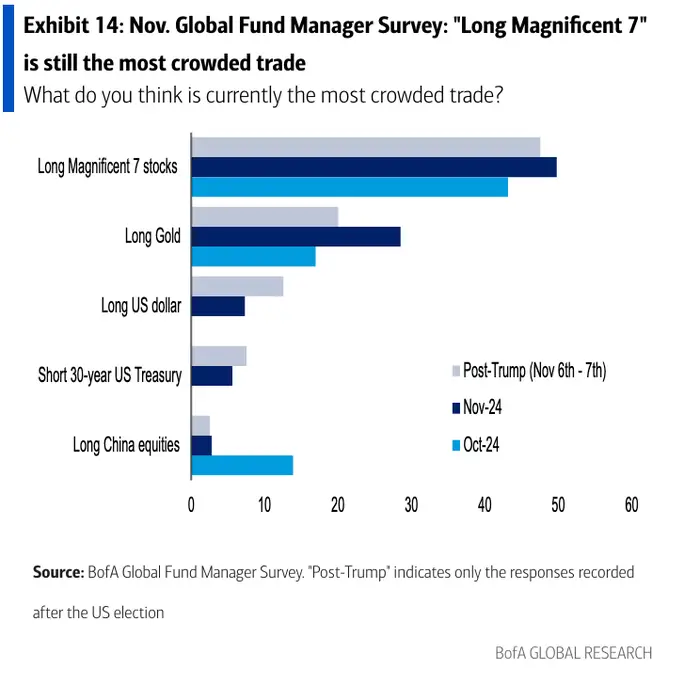

The average stock is expected to be more attractive than the overall index, which is looking a bit rich from euphoric sentiment led by mega-cap tech. Subramanian said that the difference in valuations between the equal-weighted S&P 500 and the cap-weighted S&P 500 is near record extremes, and that gap is expected to narrow.

Meanwhile, a November 26 report from the bank notes that earnings for the Magnificent 7 are expected to decelerate, as opposed to the average company, which is expected to accelerate.

Below is a chart demonstrating that fund manager attitude toward the Magnificent 7 is overcrowded, which could indicate a lack of future buyers.

“So essentially, what I’m saying in English is that the average stock is actually pretty inexpensive, but the market itself is being dragged up in valuation by this handful of very, very large mega-cap tech companies that are still priced for much loftier expectations,” Subramanian said. “We like the average stock, and we would be less bullish on the overall index.”

She’s specifically referring to cyclicals that are expected to take hold, even as investors remain positioned for a very dire economic environment in risk-off trades. Their fear is stagflation, but she said that rarely happens.

“They’re sitting at maximum defensive positioning when it comes to defensive versus cyclical sectors and are generally equity light and more aggressively overweight alternatives and illiquid asset classes,” Subramanian said. “So, we think that 2025 is a perfect setup for cyclicals to outperform defenses.”

She cited a few reasons for the positive sector outlook:

- A Trump administration would lean into pro-business, pro-old economy, and anti-regulation policies, which are the biggest benefits to value and cyclicals like financials, energy, and consumer stocks.

- The Fed is still cutting interest rates in an environment where corporate profits are accelerating.

- As we come out of a tight credit environment, companies are less leveraged and more asset-intensive.

All of which will push earnings higher.

That said, the looming risks under a Trump administration are inflationary policies and, in turn, higher long-term interest rates. Therefore, Subramanian suggested focusing on large-cap value stocks because they are the best offset for these risks as they offer inflation-protected yields through dividends.

Bank of America is overweight on financials, materials, real estate, and utilities as they tend to fall under large-cap value and benefit from capital expenditure and inflation. Meanwhile, financials benefit from deregulation. The bank is underweight in secular growth and defensive stocks, including consumer staples, healthcare, and information technology.