Morgan Stanley says these 23 top dividend stocks offer a combination of growth and stability for investors desperate for returns after a market pullback

- New research from Morgan Stanley shows that dividend-paying stocks outperform non-dividend stocks.

- CIO Mike Wilson said dividend stocks can also provide stability during a market pullback.

- Morgan Stanley’s top 23 dividend stock picks have stable, steadily growing dividend yields.

Finding stocks that consistently outperform the market is something of a holy grail for investors — something that is widely sought but never found.

Finding stocks that can provide stability in a market roiled by renewed recession fears can feel like a win these days.

However, Morgan Stanley’s chief investment officer Mike Wilson recently published new research revealing that dividend-paying stocks can provide investors with both stability and strong returns over time.

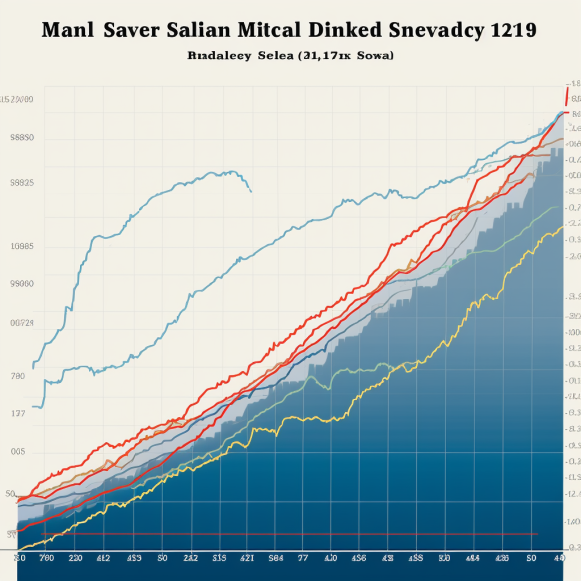

Wilson explained in a note to clients that “dividend paying stocks have outperformed non-dividend paying stocks across all large cap sectors since 2000, with the exception of consumer discretionary.”

In fact, the only two sectors of the market where dividend stocks underperformed their non-payout peers were consumer discretionary and small caps. Wilson believes this is due to the high-growth nature of both, though he points out that dividend-paying stocks outperform non-dividend competitors even in the growth-focused tech sector.

Dividend stocks not only outperform non-dividend-paying stocks on a consistent basis, but they also outperform during market downturns. Wilson cited dividend-paying stocks outperforming the market during pullbacks in 2000, 2008, 2015, and 2020 due to their consistent returns courtesy of dividend payments, as well as the high quality of the companies that tend to pay dividends.

The best dividend stocks gradually increase payouts.

The only question is deciding which dividend stocks to buy.

To maximize their returns, many investors will simply put their money into dividend stocks with the highest yields. However, Wilson contends that dividend growth, rather than high dividend yields, produces the best results.

“Slow and steady wins the race and that’s how we view dividend growth compared to high dividend yield,” Wilson wrote in a blog post. “High dividend yield tends to outperform on market recoveries following a downturn but during most other periods, it underperforms relative to consecutive dividend growers.”

While a September downturn could very well turn into a market recovery, benefiting high-dividend-yielding stocks, Wilson advises investors focused on long-term returns not to bite the bait.

“High dividend yield tends to be mean reverting over time, meaning that reaching for the highest yielding stocks should only be a tactical trade and not a long-term holding,” Wilson wrote in an email.

Investors should instead concentrate on more defensive, late-cycle dividend-growth stocks. Stocks with stable dividend growth outperform in late economic cycles like 2018 through 2020, according to Wilson, and have done well in 2023 as the big tech rally fades and investors seek safety.

Wilson explained that when looking for these stocks, investors look at more than just dividends. “When selecting dividend payers, we recommend taking a holistic, fundamental approach.” In addition to idiosyncratic industry factors, valuation, leverage, and volatility should be considered.”

You could also delegate the task to Wilson. He polled Morgan Stanley analysts who cover high-dividend industries, asking them for their top dividend-paying stocks in their fields of expertise. Wilson noted that the 23 stocks below “combine yield, growth, and stability measures and look attractive on a 3-5 year basis from a dividend yield perspective.”

The ticker symbol, Morgan Stanley analyst rating, industry, last closing price, and Morgan Stanley’s estimated 2024 dividend yield are all listed alongside each company’s name.