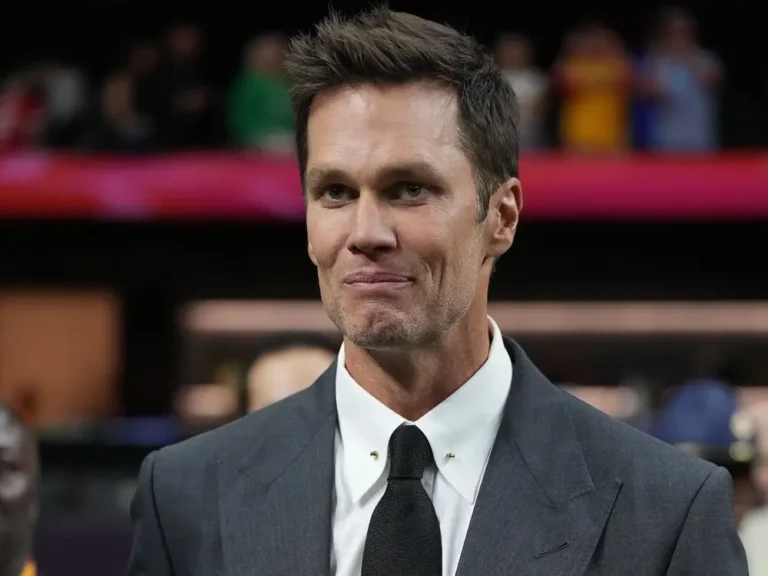

The co-founder of Thinkorswim breaks down a bargain-hunting options strategy he says offers the highest probability of profit — although 2 other experts say the unhedged trade isn’t for everyone

- Tom Sosnoff says covered calls are a popular strategy for beginner options traders.

- But he prefers a trade he says is more capital-efficient: a naked short put.

- Analyst John McGinn says beginner traders should only try this strategy if they have adequate cash.

Option trading has long been supported by Tom Sosnoff, co-founder of Thinkorswim and Tastytrade. He claims that if done correctly, investors can take advantage of asymmetrical opportunities where the upside risk outweighs the downside risk.

Options have the advantage of allowing you to trade expensive underlying securities for a fraction of the cost. It does not take $37,500 to buy 100 shares of Netflix at $375 per share. Sosnoff claims that an options trader can get the same exposure for as little as $250.

This feature makes options especially appealing to retail traders, with popular apps like Robinhood including the feature in their offerings. However, some options strategies are riskier than others, with the possibility of unlimited losses.

According to Sosnoff, covered calls are a popular options strategy for investors who are bullish on a stock in the long run but do not expect significant volatility in the short term. It entails selling a call option on a stock in which the investor already has a position. The strategy is intended to generate a steady income stream from a long-term bullish bet.

Sosnoff, on the other hand, prefers a riskier but more capital-efficient trade — one that he considers to be the simplest option strategy with the highest probability of profit. He refers to it as a naked short put, which is essentially a covered call.

This strategy is used by the investor to sell put options on an underlying security. In contrast to covered calls, the trader does not hold a position at the same time. The strategy is designed for investors who are comfortable with short-term volatility and want to bet on a medium-term increase.

Because a naked short put is essentially an unhedged bet on a security’s rise, an investor must look for market discounts — often after a sell-off — to limit the unprotected downside. Sosnoff says he seeks stocks with high implied volatility that are trading near recent lows. He believes that this type of bargain-hunting increases the strategy’s chances of success.

“You’d have anywhere between a 70 and 80% probability of profit on the trade because you’d be selling the money put on the downside,” he said. “So if the stock stays the same or goes higher or goes down small, you make money so you have an 80% chance of winning, let’s just say.”

It’s a common strategy among registered investment advisors who aren’t ready to enter the market but would buy a specific stock if it dropped by 20% in the next six months, according to Kris Sidial, co-chief investment officer at The Ambrus Group, a tail risk hedge fund that uses options.

Laffer Tengler Investments option strategist John McGinn agrees that a naked short put makes sense if you’re considering a stock that you believe will perform well in the long run but may experience a short-term correction.

In reality, you see a $10,000 vehicle that you want to buy, but at a lower price. So you make an agreement with the dealership that if the dealer decides to sell the vehicle to you, you will buy it for $9,500 at any time within the next four weeks.

The option is valuable because it benefits the dealer in two ways: it gives them some certainty on their balance sheet, and it allows them to force you to buy the car for $9,500 if its market value falls below that amount. In exchange, the dealer charges you a $40 one-time fee for that option.

You could, however, be bluffing and only want the $40 without actually buying the car. You agree to the deal because you don’t think the car’s price will fall much lower than $9,500.

However, if the car’s market value falls below $9,100 at any point, the dealer now has the option to sell you the car for $9,500.You must pay that price, and the risk is theoretically infinite.

Using this analogy, McGinn stated that the goal is to collect the premium up front in the hopes that the car will remain worth more than $9,500, causing the dealer to keep it.

The lack of downside protection is, of course, the main risk with this strategy. The value of a car — or the underlying security of an option, such as a stock — could theoretically fall to zero, leaving the investor holding the bag.

McGinn advises novice traders to use this strategy only if they have enough cash in their trading account to cover the cost of the underlying stock if the option is exercised.

“There are margin requirements that come along with that as well,” she said. “So what you may end up seeing is some people may say, ‘Hey, I want to sell a thousand naked puts’, and when the underlying is starting to move lower, and volatility is expanding, they may not have the margin requirements to offset that, and that’s where it could be pretty problematic.”

If a trader fails to meet the cash requirements by the due date specified by the brokerage, the account may be liquidated.

Sosnoff, on the other hand, points out that margin calls are extremely rare because they require an underlying move of plus two standard deviations, which occurs only 2% to 3% of the time.He noted that we are now in the 2% to 3% time range. In his opinion, those probabilities are simply too low to be statistically significant.