‘Too many charged-up bulls’: These 4 indicators could signal a stock-market pullback early next year

Sometimes, good news is bad news in the stock market — especially when it comes to indicators like investor sentiment.

That’s how Edward Yardeni, contrarian investor and president of the financial research firm Yardeni Research, sees it anyway.

Contrarian investing is exactly what it sounds like — it’s an investing strategy that deliberately trades in opposition to the prevailing investor outlook. Contrarian investors sell in a bull market and buy during a bear market. Warren Buffet aptly summarized the ethos of the strategy with his famous quote: “Attempt to be fearful others are greedy and to be greedy only when others are fearful.”

Contrarian investors believe that following the herd can be misleading, as so-called animal spirits can overpower fundamental valuations and drive irrational investment decisions. While many investors are celebrating the S&P 500 continually hitting new highs, Yardeni thinks there’s reason for pause.

“There may be too many charged-up bulls,” Yardeni wrote in a recent note. “Contrarian indicators are turning bearish, suggesting the new year might start with a stock market pullback.”

Below, he shares 4 bullish indicators signaling runaway optimism in the market.

Be careful of these bullish signals

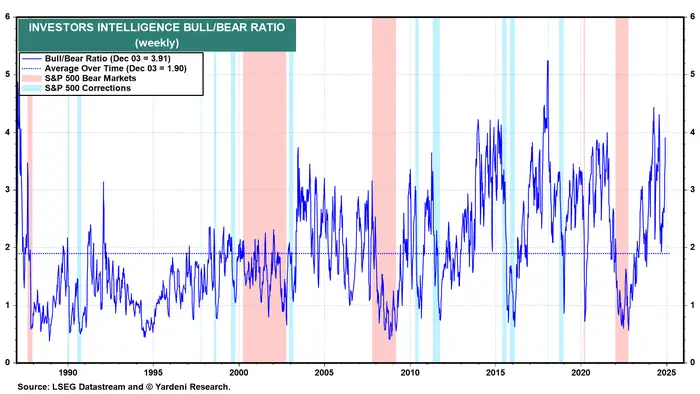

First, the Investors Intelligence Bull/Bear ratio, an economic indicator measuring the proportion of financial advisors taking a bull or bear stance, is currently standing at 3.9, with 62.9% of advisors in the bull camp. That’s up from 2.3 in mid-October. While it seems counterintuitive, elevated Bull/Bear Ratio levels are bearish, indicating an excess of bullish sentiment.

Additionally, the S&P 500 is trading well above its 200-day moving average. As of December 4, it was trading 11.2% above its average closing price in the last 200 days. A stock or an index advancing well beyond a moving average can be a sign that its rally is unsustainable. Yardeni flagged S&P 500 financials in particular as one of the most overbought sectors of the market, as the sector is trading 15.5% above its 200-day moving average.

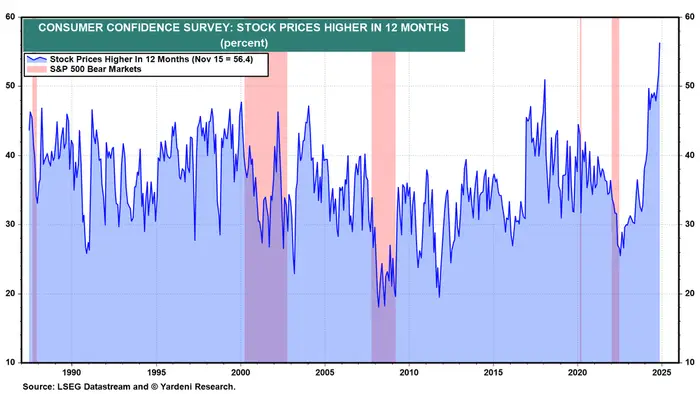

It’s not just market experts who are ebullient about the market — average consumers are, too. According to the Conference Board’s Consumer Confidence Index (CCI), a record-breaking 56.4% of consumers expect stock prices to increase in 2025.

“That’s even more bullish than ahead of the tech wreck in 2000,” Yardeni wrote, referencing the dot-com crash.

Jeff Buchbinder, chief equity strategist at LPL Financial, agrees with this perspective. “When measures of bullishness or complacency get too stretched, they can be precursors to market selloffs,” he wrote in a recent note.

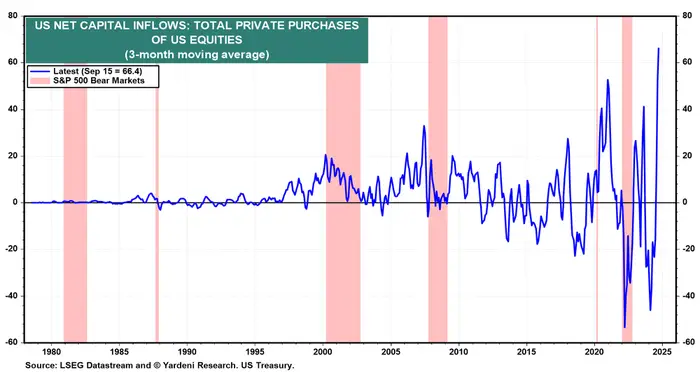

Lastly, foreign buying of US stocks is elevated. In September, the 3-month moving average of foreign private purchases of US stocks hit a record high.

Why is foreign buying a contrarian indicator? “Historically, foreigners have been poor timers of the US stock market, tending to chase rallies into blow-off tops,” Yardeni wrote.

Buy the dip

Investors shouldn’t be concerned about a potential January pullback, according to Yardeni. We’re in one of the most richly valued markets of all time right now. A pullback would be a great opportunity to add stocks to your portfolio at bargain prices.

Market fluctuations in the new year could be due to investors rebalancing their portfolios for more favorable tax treatment on capital gains, Yardeni said. With President-elect Donald Trump taking office next January, investors are expecting more favorable tax legislation in the future and are likely to hold off on rebalancing their portfolios until fiscal year 2025.

The US economy is also fundamentally strong, meaning there’s little risk of a long-lasting correction, according to Yardeni. Last week’s jobs report showed better-than-expected job gains in November.

“It shouldn’t last very long and would be a buying opportunity,” Yardeni said of a potential January drawdown.