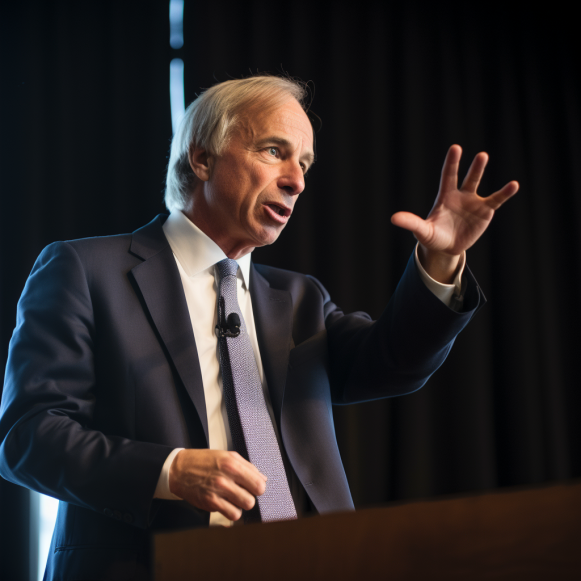

Ray Dalio explains why the surging Treasury yields crushing stocks still have further to run — and details how investors should approach the AI trade

- Ray Dalio says the 10-Year Treasury yield could rise even further to more than 5%.

- The highest yields since 2007 have been a major source of pain for the stock market.

- He also says any diversified portfolio should include exposure to foreign currencies and assets.

According to Ray Dalio, the primary source of pain for stocks will worsen before improving.

He’s referring to the 10-year Treasury yield, which is already near 4.75%, its highest level since 2007. In his opinion, it will rise to 5%, if not higher.

Soaring Treasury yields have been a major headwind for equities, whose appeal has been eroded by the ever-increasing risk-free return offered to bond investors. Why would you risk your money on the S&P 500 when you can get a 5% return with no risk?

The delicate balancing act between how high bond yields can go is the main point Dalio tried to make in a packed room at the Greenwich Economic Forum on Tuesday.

“We sit at a moment in those bonds that it would seem like something like a 5% rate,” Dalio said in an interview. “Nothing precise about that.” But in that neighborhood, the risk is probably about right.”

Investors compare the risk-free rate of bonds to the risk-free rate of equities: the higher the yield, the less likely they are to take on risk in stocks. He noted that high yields are bad for economic growth.

Dalio believes that the Federal Reserve’s 2% target for sustainable inflation is still too low. He believes the proper range is 3% to 3.5%, and achieving that would necessitate the higher-for-longer interest-rate outlook that has frightened stock investors.

But there’s another issue: demand for US bonds is dwindling as investors consider their attractiveness, he said. Buyers of bonds are less likely to purchase them when the government’s need to sell debt is considered, as well as inflation. Covid accelerated that because the government took on more debt by issuing checks to relieve the private sector, he added.

“Bond buyers have gotten whacked,” Dalio said. “So, who are those bond buyers from around the world?” How many bonds do they have, and how crazy are they? They are financial institutions. They are known as central banks. Central banks have suffered significant losses.”

Foreign exposure and artificial intelligence

Dalio believes that in today’s economic environment, any properly diversified portfolio should include exposure to foreign currencies and their assets. These should come from countries with sound finances and no domestic or international geopolitical conflicts.

Dalio believes AI will have a “super huge” impact, but he is wary of a speculative bubble.

“There are those who are doing it, and then there are those who are going to use it,” he explained. “I think a lot of those who are doing it and inventing are in a bubble.” I mean, they’re very expensive, and they’ll be disrupted by others.”

Companies that use technology to gain a competitive advantage, on the other hand, will do well, he says. A recent Goldman Sachs note identified 50 stocks that are well-positioned to profit from the AI trade over time due to the productivity gains it provides.

According to him, AI could have a hugely beneficial productivity impact on the economy, depending on how it is used. For example, AI combined with robotics could replace people, which could be extremely beneficial for some but disastrous for those whose jobs are lost.