Google worried its Gemini Workspace product lagged rivals like Microsoft and OpenAI in key metrics, leaked documents show

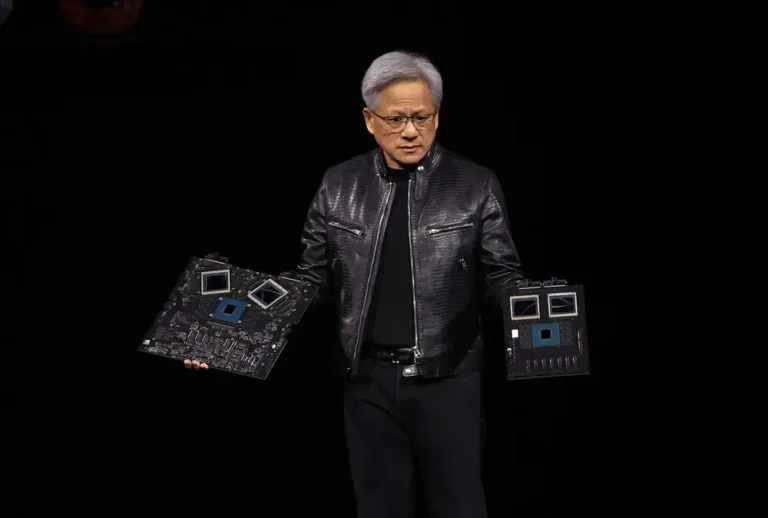

Aparna Pappu, former head of Google Workspace, onstage at Google IO 2023

As Google pours untold amounts of cash into AI, it’s banking on products such as Gemini for Google Workspace to turn that investment into revenue. An internal presentation reveals the company worried that Gemini lagged behind its rivals across key metrics.

Gemini for Google Workspace puts Google’s AI features into a handful of the company’s productivity tools, such as Gmail, Docs, and Google Meet. Users can have the AI model rewrite an email, whip up a presentation, or summarize documents filled with dense information. Google, which charges customers extra for these add-ons, claims the features will save users time and improve the quality of their work.

Gemini for Google Workspace trailed all its key rivals, including Microsoft, OpenAI, and even Apple, when it came to brand familiarity and usage, according to an internal market research presentation reviewed by B-17.

The data tracked Gemini’s brand strength during the first half of 2024 and included data on what percentage of audiences use and pay for Gemini for Google Workspace in certain segments.

One document seen by B-17 said that Workspace’s Gemini tools were “far behind the competition” but that a strong Q4 could help the company in 2025.

In a written statement, a spokesperson said the data came from a study tracking brand awareness during the brand transition from “Duet AI” to “Gemini” earlier this year and called the data “old and obsolete.”

“In the time since, we’ve brought Gemini for Workspace to millions more customers and made significant, double-digit gains across key categories, including familiarity, future consideration, and usage. We’re very pleased with our momentum and are encouraged by all the great feedback we are getting from our users,” the spokesperson added.

The internal data tracked Gemini’s brand strength across commercial, consumer, and executive groups. In the US commercial group, Gemini scored lower than Microsoft Copilot and ChatGPT across four categories: familiarity, consideration, usage, and paid usage, one slide showed. Paid usage was measured at 22%, 16 points lower than Copilot and ChatGPT.

Data for the UK in the commercial group also showed Gemini mostly behind its rivals, although it scored slightly higher than Copilot in paid usage. In Brazil and India, Gemini for Workspace fared better than Copilot across most categories but still fell below ChatGPT, the data showed.

“Gemini trails both Copilot and ChatGPT in established markets,” the document said, adding that it “rises above Copilot across the funnel” in Brazil and India.

In another part of Google’s internal presentation that focused on brand familiarity, Google’s Gemini for Workspace came in last place in consumer, commercial, and executive categories, trailing ChatGPT, Copilot, Meta AI, and Apple AI.

Familiarity was particularly low for the US consumer category, with Gemini for Workspace scoring just 45%, while Copilot scored 49%, ChatGPT and Apple both scored 80%, and Meta scored 82%.

‘We have the same problem as Microsoft’

Microsoft’s Copilot, which does similar tasks like summarizing emails and meetings, likewise struggles to live up to the hype, with some dissatisfied customers and employees who said the company has oversold the current capabilities of the product, B-17 recently reported.

“We have the same problem as Microsoft,” said a Google employee directly familiar with the Gemini for Workspace strategy. “Just with less market share.” The person asked to remain anonymous because they were not permitted to speak to the press.

Google’s data showed Apple and Meta’s AI products have much bigger market recognition, which could benefit those companies as they roll out business products that compete with Google’s.

Internally, the Workspace group has recently undergone a reshuffle. The head of Google Workspace, Aparna Pappu, announced internally in October that she was stepping down, B-17 previously reported. Bob Frati, vice president of Workspace sales, also left the company earlier this year. Jerry Dischler, a former ads exec who moved to the Cloud organization earlier this year, now leads the Workspace group.