More single women are buying homes than single men. 3 women share why they chose to pursue homeownership solo.

Jessica Chestler (left), Karla Cobreiro (middle), and Ayriel Von Schert (right) all purchased homes independently, without the help of a partner or spouse.

Karla Cobreiro, 33, lived with her parents for nearly a decade after college, diligently saving to buy her own home.

“I didn’t want to be house-poor or struggle financially,” Cobreiro, a publicist, told B-17. “I waited for the right moment — when I had a higher-paying job, had saved up a large down payment, and had built a solid emergency fund.

In 2022, she purchased a 900-square-foot condo in Downtown Doral, a Miami suburb, for around $400,000. She was 31 and single.

“I didn’t have a partner at the time, but I didn’t think that should stop me,” Cobreiro said. “So I went for it.”

As a single woman, Karla Cobreiro purchased a $400,000 condo.

Cobreiro is one of many single women in the US who haven’t let the absence of a relationship or marriage stop them from buying a home — an achievement long seen as a key milestone of wealth building and the American dream.

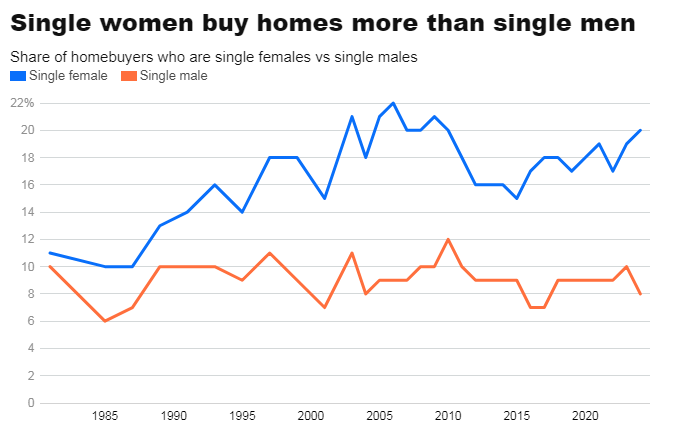

An analysis of data from the National Association of Realtors (NAR) shows that single women have consistently outpaced single men in homebuying since the organization began tracking data in 1981.

The chart below shows that since 2020, the share of single women homebuyers has continued to increase steadily, while the share of single men has declined.

By 2024, the gap has reached its widest, with single women representing 20% of all homebuyers, compared to 8% for single men.

Single women find independence in homeownership

So why are single women statistically more likely to purchase homes than single men?

Brandi Snowden, NAR’s director of member and consumer survey research, told B-17 that it largely comes down to lifestyle choices and women’s unique societal roles.

Snowden explained that many single women purchase homes because they desire independence, have experienced divorce, and are responsible for raising children.

NAR found that female buyers are typically older than their male counterparts, with the median age for single women at 60, compared to 58 for single men.

“These buyers may be recently divorced or purchasing a home not just for themselves but also for their children and parents,” Snowden said.

“It’s just me and this mortgage.”

Cobreiro said that buying a home without a spouse has its own challenges, such as settling for a smaller condo since she’s not part of a DINK household — an acronym for “dual income, no kids.”

Data from the Federal Reserve’s Survey of Consumer Finances shows that DINKs have a median net worth of over $200,000. This financial advantage enables them to more easily afford housing or spend their disposable income on luxuries like boats and expensive cars.

Despite the financial benefits of a two-income household, many women have chosen to live independently in an era of increasing financial and social autonomy.

Cobreiro is responsible for a 30-year mortgage, which includes $2,500 in monthly payments and an additional $1,000 in HOA fees — all of which fall entirely on her.

Cobreiro’s living room.

“Though I live comfortably, If I get laid off, break a leg, or face an emergency, I’m on my own, she said. “I always joke to my friends, “It’s just me and this mortgage.”

Still, she believes the benefits of sole home ownership outweigh the risks of waiting to purchase with a boyfriend.

“I’m glad I didn’t wait until I was in a relationship or married to buy a home,” she said. “Owning a home with someone you’re not committed to can get tricky, especially if you break up. There’s no prenup; if you disagree about selling, that can get messy.”

Some women say no prenup, no co-owning

New Yorker Jessica Chestler, 33, shares a similar perspective to Cobreiro.

In 2022, Chestler, a real-estate agent with Douglas Elliman and a business owner, purchased a three-bedroom condo in Williamsburg for $3.25 million.

She told B-17 that she viewed homeownership as an investment in her future, one she wasn’t willing to risk with someone she wasn’t fully committed to.

Realtor Jessica Chestler purchased this $3,250,000 Williamsburg condo as a single woman in 2022.

“When you’re buying a home with someone else, there’s obviously a lot more to consider, especially if you’re not married,” Chestler said. “There’s always that uncertainty: What happens if you break up — how do you divide the assets?”

Chestler, who also renovated her home, said the greatest benefit of owning solo is the ability to rely on herself and the freedom to live on her own terms.

“I only had to consider myself,” she said. “I didn’t have to worry about anyone else’s opinion. I loved the apartment, knew my numbers, and was confident I could make it work — That sense of comfort was really important to me.”

Women say they don’t need a knight in shining armor

Some single women who buy homes may have boyfriends but aren’t waiting for a ring to start building wealth through home equity.

Take real-estate agent Ayriel Von Schert, who, in February, purchased a 2,280-square-foot townhouse for $365,000 in Mesa, Arizona, without a cosigner.

Although Von Schert, 30, is in a long-term committed relationship, she wanted to take control of her financial future.

“I think many women feel the same way: Why wait for someone else to help you achieve your goals?” she told B-17.

Her decision to buy alone could pay off in the long run. Another unit in Von Schert’s complex is on the market for $410,000. If it sells for that price, her home will have appreciated by about $35,000 in one year.

Ayriel Von Schert purchased a townhouse in February, entirely alone — without a spouse or roommate.

“In a few years, I might sell this place or keep it and rent it out while buying another property,” she said. “My long-term goal is to build a real estate portfolio and earn residual income, and I feel like I’m definitely on the right path.”

For now, she and her boyfriend are living like roommates, equally splitting the bills for the home, including utilities and the mortgage.

She said it’s a win-win situation for both of them.

“I don’t think he minds because we no longer have a landlord telling us what we can or can’t do,” she said.