Buy these 12 high-quality stocks that are up to 42% below their fair market value as Fed rate hikes begin to hit the economy hard, according to Morningstar’s chief strategist and economist

- Rising rates, economic uncertainty, and spiking yields have caused the market to sell off.

- The economy will slow until mid-2024, according to Preston Caldwell.

- Investors should be overweight in value stocks, says Dave Sekara.

Rising interest rates, increased economic uncertainty, and spiking 10-year Treasury yields have caused the market to sell off.

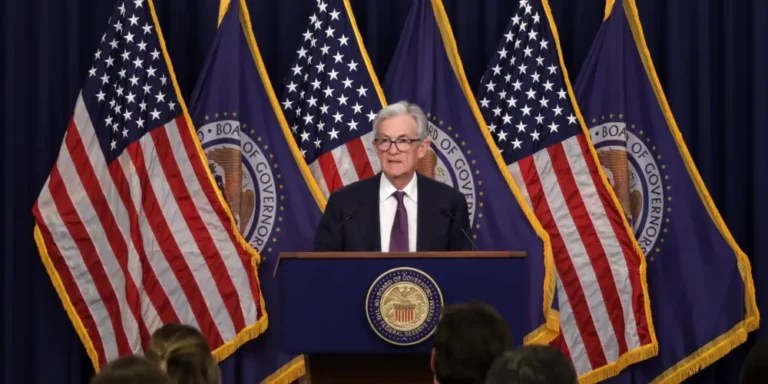

However, the pain of a tightening market is not yet over. According to Preston Caldwell, Morningstar’s chief US economist, the Federal Reserve’s rate hikes will have a significant impact on the economy.

There’s a good chance that the effects on the real economy — housing, bank lending, and so on — haven’t yet been fully felt, and those effects are what he refers to as “known unknowns.”

“In other words, we know there’s something out there lurking in the economy that is in the financial system that’s vulnerable, but we can’t pinpoint what it is in advance,” he said. “I think the US financial system and its balance sheets were constructed for an era of much lower interest rates, and they aren’t prepared.”

Higher interest rates will begin to be felt as debt is progressively refinanced. For the time being, the economy is gradually losing steam. Caldwell noted that household excess savings are depleting and will be depleted sometime between mid and late 2024. This will cause consumers to be extremely frugal with their spending.

According to Dave Sekara, chief US market strategist at Morningstar, economic growth in the fourth quarter is expected to be roughly half of what it was in the third quarter. According to the firm, the rate of economic growth will decelerate sequentially over the next three quarters before accelerating.

As a result of weak growth and easing inflation, the Fed is expected to begin aggressive rate cuts as early as March. As a result, Caldwell expects real GDP growth to slow in mid-2024 before picking up in 2025 as a result of the rate cuts

Despite the bleak outlook for the near term, Morningstar’s forecast is slightly more optimistic than the consensus. Sekara told Insider that his company is still against a recession and anticipates a soft landing as a best-case scenario.

Looking for a bargain

While the situation appears to be dire, it is not.

According to Morningstar’s coverage of 700 stocks trading on US exchanges, the stock market is trading at a 13% discount to fair value, according to Sekara. The firm calculates fair value based on its forecast of a company’s future cash flows and their predictability.

But that doesn’t mean everything is on the market: If investors want to mix and match, this isn’t the time. Growth stocks trade at about a 12% discount to fair value, while core stocks, which have some of the characteristics of both value and growth, trade at only an 8% discount to the market, according to Sekara. As a result, investors should be overweight in growth and underweight in these sectors.

According to Sekara, the best opportunities are now in value stocks trading at a 22% discount to fair value.

According to Sekara, the real estate sector is currently the most undervalued, with REITs trading at a 26% discount to fair value. However, within this category, investors should avoid urban office space.

Instead, they should invest in areas that have consistent demand, such as healthcare facilities. Sekara’s pick in this category is Ventas (VTR), which is trading at a 42% discount with a 4.24% dividend yield.

Simon Property Group (SPG) is trading at a 31% discount to fair value for Class A shopping malls, and it pays a high yield of 6.92%.

Then there’s data center real estate, which is benefiting from artificial intelligence. Sekara likes Digital Realty Trust (DLR), which is trading at a 9% discount to fair value. It has a yield of 3.92%.

Finally, American Tower (AMT) trades at a 24% discount to fair value. It has a yield of 3.64%.

According to Sekara, the communications industry as a whole is the second-most undervalued sector. Alphabet (GOOGL) stands out as an undervalued stock among the magnificent seven. It is currently trading at a 24% discount to fair value.

AT&T and Verizon are two other five-star stocks that remain significantly undervalued, trading at a 35% discount to fair value. Their dividend yields are very high, at 7.21% and 7.57%, respectively.

“The investment thesis there is that we think that going forward, the wireless sector is going to start operating more like an oligopoly, meaning that they will not compete as much on pricing as they have in the past,” Sekara said in an interview. “So we’re expecting operating margins over the next couple of years to expand in that area.”

Clorox (CLX) is a brand that gained popularity during COVID-19 as people scrambled for cleaning supplies. At the height of the pandemic, investors piled into the stock and then sold it. It is currently trading at a 30% discount to its fair value. It has a yield of 4.08%.

Finally, while the financial sector, particularly banks, is still suffering, three names stand out for being deeply discounted: Citigroup (C) is down 42%, PNC (PNC) is down 36%, US Bank (USB) is down 41%, and Wells Fargo (WFC) is down 36%.