The Israel-Hamas war threatens to derail Middle Eastern investment in US media and entertainment

- The Israel-Hamas war could derail the Middle East’s media and entertainment ambition and investments.

- Some deals are moving forward, but some Hollywood stakeholders are shying away from the region.

- A wider war could slow the flow of money to Hollywood at a time when funding is hard to come by.

American producers, filmmakers, and stars made a strong showing at last year’s Red Sea Film Festival in Saudi Arabia. Even if the celebrities in attendance were mostly elderly, and some were reportedly paid to attend, the second annual festival in Jeddah signaled the Saudi kingdom’s massive investment in its local film industry and ambitions to become a global player in entertainment.

Critics saw the event as a form of arts-washing, an attempt to improve the image of a regime whose recent social reforms have yet to erase its poor human rights record and role in the murder of Washington Post columnist Jamal Khashoggi in 2018. Nonetheless, the US presence highlighted the region’s growing ties with Hollywood, as Saudi, Qatar, and the UAE have made significant investments in Western media, entertainment, and sports entities in recent years.

However, for this year’s third Red Sea festival, some observers are wondering if fewer Western celebrities and stakeholders will walk the red carpet.

The Israeli assault on Gaza in retaliation for Hamas’s October 7 attacks has roiled Hollywood internally, exposing an ideological divide in a community long thought to be aligned with Israeli interests, if not all of the country’s policies. However, the war has made many in the industry wary of working with the Mideast’s oil-rich nations — and closely monitoring their governments’ responses to the conflict.

Saudi Arabia had been working to normalize relations with Israel, but it appeared to some business leaders that it was blaming Israel for the October 7 attacks. The UAE, which normalized relations with Israel in 2020, demanded an immediate ceasefire on October 7 and condemned the Hamas attacks the next day. And Qatar, a close US ally in the region, has aided in the release of hostages. It has also been chastised for holding Israel “solely responsible” for the escalation of violence and for providing safe haven to Hamas leaders.

“I would think that some people will reconsider traveling into that region for festivals, et cetera, in the coming weeks and months,” Christian Knaebel, founder of the Germany-based consultancy Global Media Consult, told Insider in an email.

Even before October 7, US entities receiving Middle Eastern investment were hesitant to speak publicly about those relationships. Some are now pressing pause, while others are continuing or even accelerating efforts — in the short term, Knaebel predicted that some Middle Eastern investors would move quickly to seal deals with Western companies before continued hostilities made such moves politically untenable.

Insider spoke with investors, producers, and other media and entertainment stakeholders about the future of Hollywood’s relationships with Middle Eastern supporters. The landscape appears risky enough for at least one media investor to cancel a recent trip to Saudi Arabia on behalf of a client.

“I just don’t think it was a good look,” said the investor. “Some people are digging their heels in and treating it as business as usual, but I would be pretty nervous right now.”

Mideast funding has been difficult to resist.

To the surprise of some industry insiders, some deals between US media and entertainment companies and the Middle East have moved forward in recent weeks. With interest rates rising and other sources of funding drying up, regional funding has been difficult to resist.

“They’re still proceeding with investments; no one’s canceled meetings, to my surprise,” said a second investor with direct knowledge of Mideast transactions. “They’re all competing to get the prize assets.”

On October 24, Saudi Arabia’s Film AlUla, the agency in charge of attracting international productions to the desert, announced a $350 million partnership with Greg Silverman’s independent production company Stampede Ventures to bring ten productions to the region. Silverman was a longtime Warner Bros. film executive who was behind “Harry Potter” and Chris Nolan’s “Batman” series before launching Stampede in 2017.

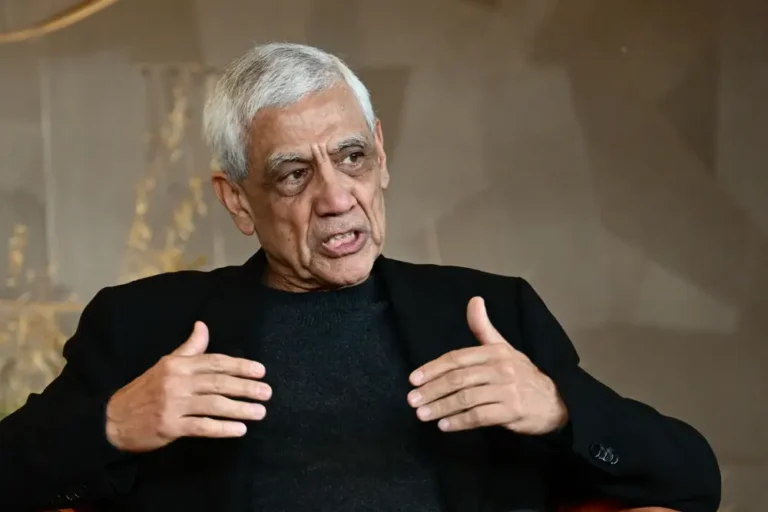

Silver Lake is attempting to take US sports and entertainment company Endeavor private with the assistance of Abu Dhabi’s Mubadala sovereign fund. Ari Emanuel, the CEO of Endeavor, has been vocal in condemning the attack and calling for Hamas’ annihilation; he also returned a $400 million investment to Saudi Arabia following Khashoggi’s murder.

Although there haven’t been any recent major deals in Qatar, Peter Chernin and Providence Equity’s production roll-up The North Road received $150 million from the Qatar Investment Authority earlier this year.

In October, the UAE-backed RedBird IMI (led by former CNN CEO Jeff Zucker) invested in sports-industry news outlet Front Office Sports.

LIV Golf, backed by Saudi Arabia’s $620 billion Public Investment Fund, is in the process of merging with the PGA, though some observers have speculated that Israel’s war could put a halt to the deal.

Knaebel suggested that if the crisis is resolved quickly, trade and manufacturing activity in the region could resume. “If it lasts longer,” he said, “there will be an impact on local productions in that region.”

But it’s not just a matter of how long the conflict will last; if hostilities spread beyond Israel and Gaza, these countries’ positions may shift and become lightning rods for debate.

“The political nature gets more complicated,” an industry insider observer said, noting how countries like Qatar are making headlines for their role in the situation. “It’s clear who sits where, way more now.”