A value fund manager who’s beaten 99% of his peers in the last three years explains how he avoids bad investments — and makes the case for 3 stocks he loves heading into 2024

- A top-1% fund manager over the past three years provided insight into his investing strategy.

- Large-cap stocks stand out for offering plenty of cash in a period of high interest rates.

- Here are three quality companies he says are worth investing in now.

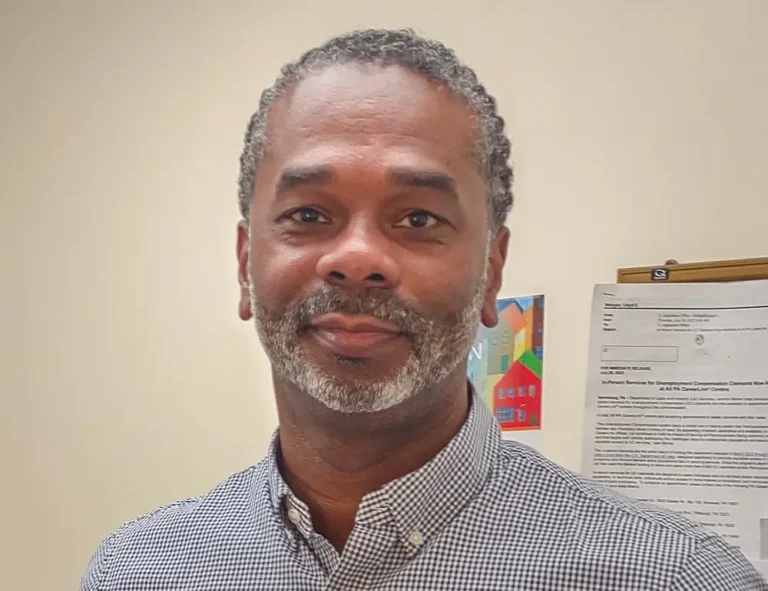

John Bailer, portfolio manager, has dominated for nearly 20 years without reinventing the wheel.

Since the beginning of 2005, when he co-managed the BNY Mellon Dynamic Value Fund (DAGVX), the 31-year market veteran has produced enviable results. According to Morningstar, his fund has risen an average of 11.5% per year over the last 15 years, and it has also been in the top 1% of its large-cap value category for the last three years.

That remarkable success is the result of a no-nonsense investing strategy outlined by Bailer in a recent interview with Insider.

How to Invest — and Avoid Common Mistakes

Bailer, like all value fund managers, refuses to overpay for stocks, no matter how appealing their businesses appear. Sticking to that principle has helped his fund weather market downturns, such as in 2022, when it managed a 2.8% gain while the S&P 500 fell 19.4%.

However, stock-picking entails far more than simply rummaging through the market’s bargain bin.

“It’s a philosophy that’s based on looking for stocks with great valuations, but not stopping with great valuations,” Bailer went on to say.

According to Bailer, companies in the BNY Mellon Dynamic Value Fund must have both quality fundamentals and improving business momentum. Many portfolio managers claim to want only stable, healthy businesses, according to Bailer, but those stocks rarely trade at fair prices.

“A lot of times, you can’t own quality companies because they’re too expensive,” Bailer told me. “We’re trying to find companies with good balance sheets that have good valuations, and sometimes these are hard to find, but we’ve actually had a lot of success.”

The highest-quality businesses are rarely sufficiently discounted, whereas the cheapest ones frequently deserve to be discounted. The trick is to find solid stocks that are still reasonably priced, according to Bailer, who does so by ensuring that the company has overlooked catalysts that can propel it forward.

On the other hand, it is critical to avoid companies in industries with significant long-term challenges.

“We think always focusing on the quality, always focusing on the momentum helps you avoid the value traps as a value manager,” Bailer went on to say.

“Our belief is that stocks have good valuations for a reason,” Bailer added. And some of those reasons may be secular in nature, and we don’t want to get involved with companies like that.”

For example, Bailer stated that he avoided newspaper stocks in the early 2000s, despite the fact that the sector was cheap despite producing cash and dividends. He hypothesized that the industry’s secular — or long-term — headwinds made it a risky bet, and he was proven correct over time.

Retailers are a modern-day example of this theory, according to Bailer, because they have recovered from the pandemic but are still being disrupted by e-commerce. While some have successfully adapted to the Amazon age, other once-dominant brick-and-mortar stores have gone bankrupt.

Firms that fit Bailer’s definition of quality have a lot of cash on their balance sheets, allowing them to survive in any economic environment while returning cash to shareholders through dividends and share buybacks.

Large-cap companies frequently fit this mold, according to Bailer, because many are cash cows that use their size and scale to produce goods and services at lower costs. Small- and mid-cap stocks with less cash flow, he says, aren’t nearly as appealing, especially with interest rates so high.

“We like large caps, especially now in this economic environment, because they tend to have much better balance sheets,” Bailer went on to say. “They’re generating consistent cash flows over time in more stable businesses.”

3 best value stocks to buy right now

High-quality, fairly valued companies can be difficult to find, but the fact that Bailer’s fund has 75 holdings demonstrates that it is possible for those who look in the right places.

As of September 30, the six largest stocks in the BNY Mellon Dynamic Value Fund were in one of two sectors: financials or healthcare. Bailer expressed particular interest in insurance companies and medical device companies among these sectors.

While Bailer is not alone in his admiration for Warren Buffett, he has put his money where his mouth is by making Berkshire Hathaway (BRK.B) his fund’s largest holding. The fund manager expressed confidence in the company’s upcoming Buffett and Munger successors. Furthermore, he admires Berkshire’s ability to generate cash and believes that its diverse businesses are undervalued by the market.

“There’s just so many good things that they currently own and that provide really strong businesses that can generate good returns over long periods of time,” Bailer said about Berkshire Hathaway. “We are very optimistic about Berkshire’s future leadership.” And we continue to believe the stock is undervalued and widely misunderstood.”

Another well-known financial institution, JPMorgan (JPM), has the second-largest weighting in Bailer’s fund. Although the portfolio manager is not overly optimistic about banks in general, this Wall Street behemoth is an exception due to its healthy deposit levels and rising net interest income.

“JPMorgan is an incredible bank that has a stable deposit franchise and actually growing net interest income,” Bailer went on to say. “A lot of banks are not growing their net interest income because they’re losing deposits, but JPMorgan has been gaining deposits from a lot of other banks because it’s viewed as very high quality.”

More reasons to love JPMorgan include its 9.3x forward earnings ratio, 2.9% dividend yield, and top-tier balance sheet with over $1.4 trillion in cash, according to Bailer.

Medtronic (MDT) is a medical device manufacturer that has lost 13% of its market value due to concerns about the rising popularity of weight-loss drugs such as Ozempic and Wegovy. The bear case for this stock is that these new medications will benefit millions of patients while decreasing demand for obesity-related medical devices and surgeries.

However, Bailer believes these concerns are exaggerated. He is optimistic about Medtronic’s future prospects, noting that earnings estimates are rising. Furthermore, shares are relatively cheap at 14.1x forward earnings for a company yielding 3.8% with a strong balance sheet and rising free cash flow.