It finally looks like the US economy is sticking its soft landing

You might have heard the US is not in a recession, but the good news about the economy doesn’t stop there. A soft landing is on the horizon, too — or already here depending on who you ask — and recent data reinforces that.

Two of the most glaring signals of an economy still running hot — inflation and a strong labor market — showed signs of cooling in the past week. That’s fueled hopes of interest-rate cuts and a subsequent soft landing, generally defined as when interest rates successfully reduce inflation without causing runaway unemployment or hurting economic growth.

The data marks the firmest sign to date that the US economy — shepherded by the Federal Reserve’s interest-rate decisions — has successfully threaded the needle and avoided a sharp downturn.

“The economic rebalancing that we thought was necessary a couple years ago largely looks like it’s been achieved,” Joseph Briggs, an economist at Goldman Sachs said. “Provided that we stay on this current course, I expect that we will be increasingly transitioning to a more normal economic environment.”

Briggs also said achieving a soft landing would help avoid “some of the economic hardships that often come if you were to see the economy enter a more significant slowdown.”

A slowly cooling economy heading back to normal

The economy has been confusing because the labor market has stayed pretty hot and inflation has been stubborn despite the Fed trying to slow borrowing and spending down.

The Fed reacted to sky-high inflation a few years ago by quickly hiking interest rates and holding them at that elevated level. The next Federal Open Market Committee meeting is next week, and the CME FedWatch Tool shows as of Wednesday morning that traders think rates are overwhelmingly likely to stay at their current target.

Data does show the US labor market isn’t too hot, meaning the Fed is unlikely to go back to raising rates and keeping the door open for cuts later this year. There were 175,000 jobs added in April. March’s job growth was almost twice as large, with a gain of 315,000. Those figures could be revised in the upcoming report from the Bureau of Labor Statistics on Friday.

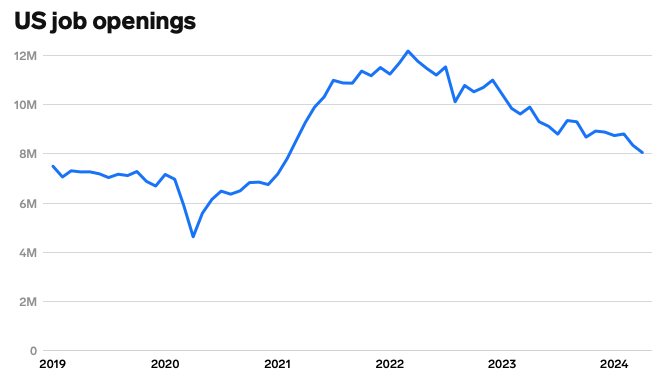

New job openings data out on Tuesday from the Bureau of Labor Statistics showed they continued their downward trend in April, suggesting that businesses are slowing their hiring plans. Plus, the number of job openings per unemployed person has been moving downward in 2024.

“The substantial decline in job openings in April, to the lowest level since February 2021, paints a clear picture of a job market that has essentially returned to its pre-pandemic balance and is on the cusp of a soft landing,” Nick Bunker, economic research director for North America at the Indeed Hiring Lab, said in recent written commentary.

Over the past two years, the US labor market has cooled off in a relatively painless way: fewer people are switching jobs while layoffs remain low,” Bunker said. “The result is that unemployment has been below 4% for over two years. But if the reduction in inflation stalls, then any further cooling off would mean higher unemployment.”

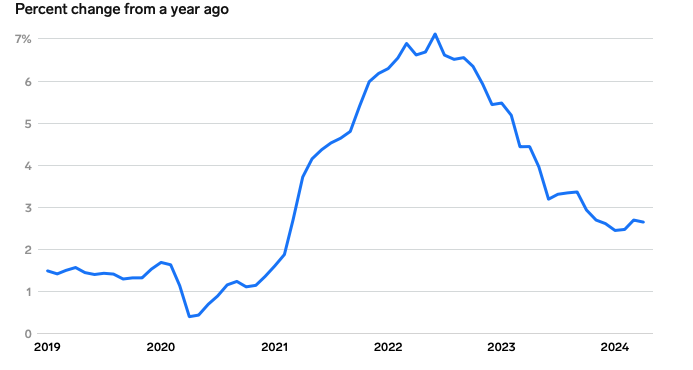

Data from the Bureau of Economic Analysis shows the year-over-year increase in the Personal Consumption Expenditures price index, one inflation measure, was 2.7% in April.

There has been a ton of moderation in this rate particularly when comparing recent changes to those seen in 2022, another sign pointing to a soft landing.

Personal Consumption Expenditures price index

GDP growth also hasn’t been negative; the last time the change in the US real GDP was negative was in the second quarter of 2022, a strong sign the US is avoiding a recession.

Another data point we can look at is the commonly followed ISM manufacturing index, which tracks activity in US factories. UBS noted in a new post that the index fell more than expected in May “with both the new orders and production components falling.”

“This is in line with our expectation of a gradual slowd

The soft landing might already be here

David Kelly, chief global strategist at J.P. Morgan Asset Management, believes the US has already achieved a soft landing.

“To me, a soft landing is when the unemployment rate has hit its full-employment level, and the inflation rate is gradually coming down to a rate that’s acceptable,” Kelly said. “With this Friday’s jobs report, we expect a 30th consecutive month in which the unemployment rate is at or below 4%.”

“It sounds to me that the plane landed two and a half years ago, and it’s just been cooling down ever since,” Kelly said, adding that “the economy continues to grow, but it’s been in a soft landing for some time.”

Jason Draho, head of Asset Allocation Americas of UBS Global Wealth Management, said in a new note that the “differences of opinion between investors on the outlook for the US economy are getting smaller” — but also noted some forecasters think a recession isn’t out of the picture. Draho said the consensus is “Growth is slowing but not cracking, inflation is stubborn, but the trend is still lower, and the bar for Fed rate cuts is low while hikes are effectively off the table.”

“In other words, a fairly comfortable soft landing with occasional turbulence,” Draho added.

It’s still a tough economic environment for many people.

“I think it’s a very good economy for the top 10% of households, not quite so good for everybody else,” Kelly said.