A battle over the future of US retirement is playing out in Pennsylvania as the election looms

Maureen, 67, is planning to vote for former President Donald Trump in November because she believes he’ll be more beneficial to her finances now that she’s retired.

The northeast Pennsylvania resident, who requested her last name be withheld to protect her privacy, said she approaches each election with an open mind and has previously voted for both Republicans and Democrats. Like many Americans, this time around, Maureen’s deciding factor is her perception of the economy.

“I’m just looking back over the past eight years, and my 401(k) grew in the four years Trump was in office,” Maureen told B-17. “Do I like his personality? Heck no, I don’t. But my 401(k) went up, interest rates were low, unemployment rates were low.”

Maureen’s view highlights a common theme among American voters, particularly those carefully watching their retirement nest egg: they hold whoever is president accountable for how they feel about their finances. Despite the fact that stocks have enjoyed significant gains under both Biden and Trump and even though the Federal Reserve — not the president — dictates benchmark interest rates, Maureen still blames the current administration for her dissatisfaction.

Marjorie Klein, 80, lives in Philadelphia and is also retired. Similar to Maureen, she’s concerned about financial security for older Americans — but she will be supporting Vice President Kamala Harris.

“He says that he’s going to keep Social Security, but you never know with him,” Klein told B-17 of Trump.

Americans like Maureen and Klein may decide the election. A Morning Consult poll conducted from October 6 to 15 found Harris leading Trump in the swing state of Pennsylvania by just one point. However, among voters aged 50 and over in Pennsylvania, a recent poll from AARP found Trump leading Harris by eight points.

“We’re a pivotal state for this presidency,” Bill Johnston-Walsh, state director of AARP Pennsylvania, said. “Whoever wants it is going to have to go through us.”

Pennsylvania is a case study for the role the federal government will play in supporting the US’s aging population over the next few decades through programs like Social Security and Medicare. Pennsylvania voters and economists told B-17 it’s vital that the next presidential administration plan for a future when retirees greatly outnumber younger Americans to ensure the economy and workforce can function effectively. As a swing state, it’s critical for their campaigns that Harris and Trump listen to older Pennsylvanians’ concerns.

Social Security and Medicare in the hot seat

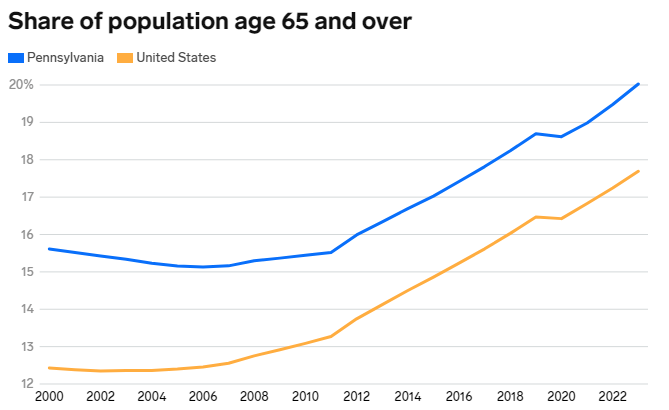

Pennsylvania is aging rapidly; it has nearly 2.5 million residents over the age of 65, the fifth-highest total in the country. Nationally, the population of adults over 65 is expected to surge by 20 million between now and 2040.

The state’s residents rely heavily on federal government income, mainly through Social Security and Medicare, with two rural counties — Fayette and Cambria — among the most reliant in the nation, a report from the bipartisan Economic Innovation Group found.

Benjamin Glasner, a coauthor of EIG’s report, told B-17 that the most reliant counties were generally in older, poor, and more rural communities. Cambria, for example, needed more government aid after steel plant closures in the 1980s. Residents’ incomes still haven’t recovered.

“You can only receive so much from Social Security. Medicare can only cover so much, and Medicaid can only cover so much,” Glasner said, adding that creates “a thin level of economic prosperity” reliant on the program’s generosity.”

Mike Crossey, 73, has seen the limits of government aid firsthand in his work as an advocate for retirees. The Pittsburgh-area resident wants the next president of the US to strengthen Social Security, protect pensions, and expand Medicare. He said he knows too many older Americans who live off Social Security alone, which averaged $1,921 nationally for retirees in September.

“I run into people every day who are still making decisions about, ‘Do I take my prescriptions today or do I have lunch today?’ And that just breaks my heart,” Crossey said.

While Trump has denied that he would cut Social Security and previously criticized GOP lawmakers who proposed raising the retirement age to 70, the Committee for a Responsible Budget said that Trump’s policies could force cuts to Social Security benefits in as little as six years. Harris has proposed strengthening Social Security by ensuring the wealthy and big corporations pay what they owe in taxes.

With the Social Security and Medicare Board of Trustees report recently projecting that Social Security will only be able to pay out full benefits for the next 11 years, the issue is growing more pressing, and not only for Pennsylvanians. Richard Fiesta, the executive director of the nonpartisan 4 million-member Alliance for Retired Americans, said that “Congress and the next administration needs to have a serious look at Social Security.”

Some retirees are able to live comfortably amid economic headwinds. However, Fiesta said the decline in defined benefit pension plans, or employer-subsidized retirement plans, contributes to a slump in average retiree savings.

This means that more and more Americans rely primarily on Social Security to help keep them financially afloat as they age. The previously mentioned EIG report found that income from government aid is the fastest-growing portion of an American’s income, and it is primarily driven by retirees, who make up a rising share of the total US population.

“And we’re just kind of seeing that now over the last 10 to 15 years as that generation ages into retirement,” Fiesta said.

An aging workforce creates job mismatches

The workforce in Pennsylvania is already starting to see imbalances as the younger population dwindles and the number of retirees grows.