A couple on track to retire early in San Francisco break down their $140,000 annual budget

The Nader family resides in San Francisco.

When Andre Nader sat down to calculate his “enough number” — the amount of money that would allow him to never have to earn another dollar and give him the option to retire early — the first thing he did was analyze his spending.

From there, he could work backward and estimate how much he’d need to sustain his family of three’s lifestyle in retirement.

Members of the FIRE (financial independence, retire early) community typically use the “4% rule,” which suggests that you can safely withdraw 4% annually from your nest egg. For example, if you retire with $1 million, you should be able to withdraw $40,000 from your retirement funds each year without running out of money. To figure out your number using this rule, you simply multiply your annual spending by 25. Nader prefers to use a more conservative 3% safe withdrawal rate, which you can calculate by multiplying your annual number by 33.33.

He and his wife, who works as a designer for Uber, had been preparing to retire early together. They were on track to do so until Nader was affected by Meta’s 2023 layoffs. The couple had enough between their savings and one tech income that Nader didn’t have to find another job, but he says he’ll consider himself “semi-FIRE’d” until his wife also walks away from her job.

They built a seven-figure net worth thanks to a variety of factors, including high incomes — “I won the income game by being in tech, by being a dual-income household,” said Nader — but they’ve also been disciplined savers and investors.

Nader, who describes himself as “naturally frugal,” said that he and his wife always kept their expenses low enough so that just one of their tech incomes could cover all of their household expenses. This allowed them to invest about half of their combined income in low-cost index funds.

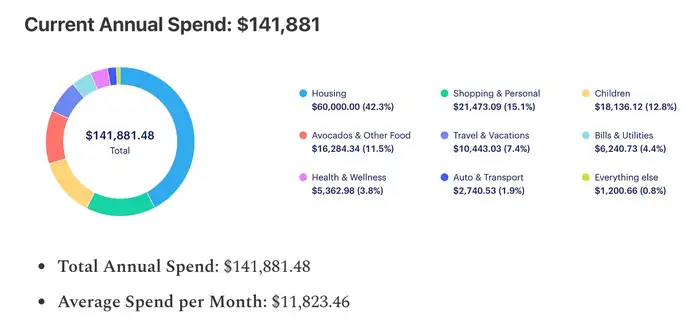

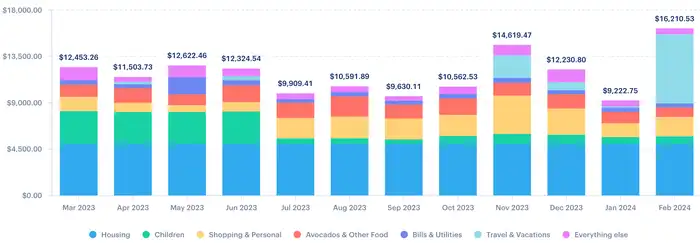

Between March 20203 and February 2024, the family of three residing in San Francisco kept their annual expenses around $140,000.

Nader, who writes about financial independence on his Substack, FAANG FIRE, broke down his family’s annual budget:

Housing: $60,000 a year ($5,000 a month). The biggest chunk of their budget (42%) goes toward rent. “Running the numbers for my personal situation, I have never been able to make home ownership pencil in within San Francisco,” he wrote on his blog.

Shopping and personal: $21,473 a year ($1,789 a month).

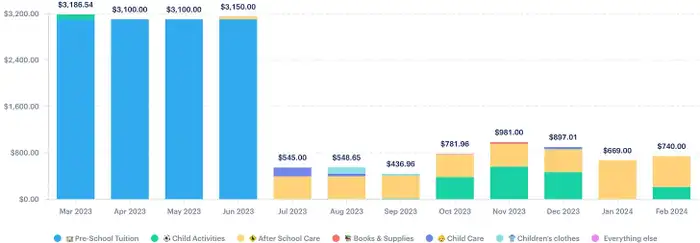

Children: $18,136 a year ($1,511 a month). This spending category, which includes education, childcare, activities, and necessities like clothing, decreased significantly after Nader’s daughter graduated from preschool and started at public school as a kindergartner.

He broke down the costs within this spending category between March 2023 and February 2024 in a separate chart.

Shopping and personal: $21,473 a year ($1,789 a month).

Children: $18,136 a year ($1,511 a month). This spending category, which includes education, childcare, activities, and necessities like clothing, decreased significantly after Nader’s daughter graduated from preschool and started at public school as a kindergartner.

He broke down the costs within this spending category between March 2023 and February 2024 in a separate chart.

Food: $16,284 a year ($1,357 a month).

Travel and vacations: $10,443 a year ($870 a month). Now that his daughter is getting older and travel is more manageable, Nader says he’s intentionally trying to increase spending in this category.

Bills and utilities: $6,241 a year ($520 a month).

Health and wellness: $5,363 a year ($447 a month).

Transportation: $2,741 a year ($228 a month). Nader and his wife share one fully paid-off car. They also are on a pre-paid maintenance plan for the next four years.

Miscellaneous: $1,201 a year ($100 a month.)

Increasing his budget heading into 2025

After being laid off in 2023, Nader is hyper-aware that life happens, and his expenses and circumstances will continue to change.

His spending has already increased since he ran his numbers in early 2024. Most notably, his family moved so that they could be within walking distance of their daughter’s school. The move bumped his rent from $5,000 a month to $8,000.

He’s thinking about 2025 as an experimental year and is doing some “boundary testing” on their spending, particularly while his wife is still working.

“It’s much easier to increase spend while someone in your house is working, so right now, we’re like, ‘Hey, what would it be like if we did live in a single-family home in San Francisco? Is that the life that we want?'” he said.

Andre Nader is the founder of FAANG FIRE.

His spending philosophy has shifted after reading Bill Perkins’ “Die With Zero,” he added.

The book was “a good counter for me,” he said. “I’m naturally frugal and naturally live within spreadsheets. ‘Die With Zero’ forced me to think about experiences more in the same way that I think about my finances: Just like my finances can compound, life experiences can also compound. That led me to prioritize travel to a higher degree.”

Nader doesn’t want to sacrifice a certain quality of life or experiences in his pursuit of FIRE. He recognizes that what he and his family value will shift over time, which is why he periodically revisits his spending and “enough number.”

“What ‘enough’ is in 2022 ended up being different than what I thought ‘enough’ would be in 2024,” he said. “I realized that I did want to spend more in certain places, so I explicitly forced myself to spend more on things like travel. I realized I was unnecessarily saving more than I needed to, and I wasn’t spending in a way that was bringing me happiness.”