A famed economist who called the 2008 recession warns the Fed is behind on rate cuts — and that a downturn is coming despite ‘off the charts’ investor sentiment

Massive downward labor-market revisions are the latest sign that the US economy is heading toward a recession and the Federal Reserve is behind on interest rate cuts, according to the famed economist David Rosenberg.

Rosenberg, the founder of Rosenberg Research who called the 2008 recession when he was chief economist for Merrill Lynch, pointed out in client notes this week that the downward revision to payrolls data by 818,000 for the March 2023-March 2024 period is the largest since the Great Recession. That means trouble for the US economy, he believes, with the Fed having held rates in restrictive territory due to what it thought were stronger job numbers.

“Incredibly, the Fed raised rates 500 basis points under a false presumption — by over one million — of just how robust the jobs market was,” Rosenberg said.

He added that Fed policy “has been too tight, and for too long, to avoid causing an economic slowdown.”

In addition to the yearly revisions, monthly payroll revisions from the Bureau of Labor Statistics have also been poor more recently. Year-to-date, the number of jobs added has been revised down by a total of 314,000 jobs, and revisions have been negative 75% of months, he said.

Rosenberg has warned of a recession over the last couple of years as the Fed aggressively hiked rates to slow the economy and cool inflation, and is sticking to his call. In a note on Friday, he shared two recession indicators that he believes paint a worrying picture for the macro outlook going forward despite other recession signals like the Sahm Rule and the Treasury yield curve being called into question at the moment.

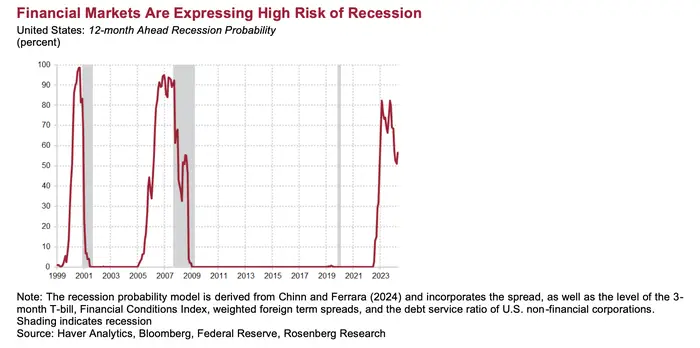

One is a model that aims to enhance the yield curve as a recession indicator by taking into account US businesses’ ability to repay debts and the Fed’s National Financial Conditions Index. While the indicator is dropping, it has risen to levels only seen in prior recessions. In those instances, the economy was only in recession after the index started declining. The measure currently shows a 57% chance of a downturn.

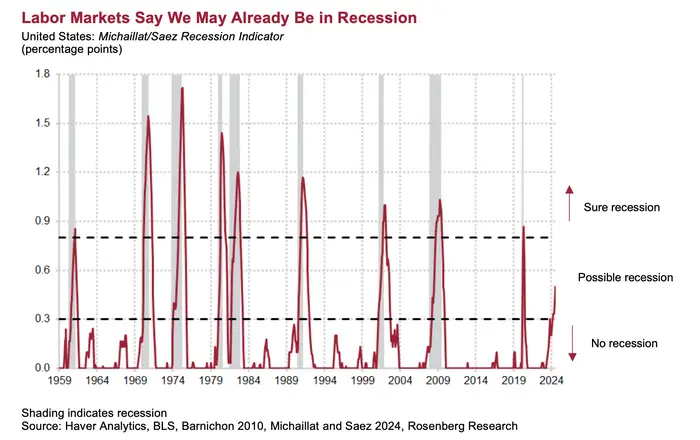

He also included a new indicator from economists Pascal Michaillat and Emmanuel Saez that seeks to build on the Sahm Rule unemployment indicator by accounting for job openings, which signal businesses’ appetite for hiring. The indicator is in “possible recession” territory and trending upward.

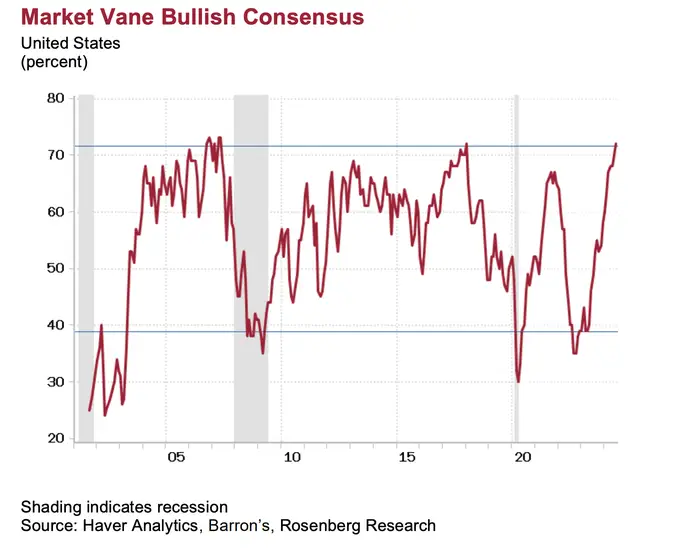

Despite the concerning data, stocks are just off all-time highs, valuations are historically elevated, and investors look forward to rate cuts.

“The smoothed CAPE, at 35x, is double the long-run average,” Rosenberg said, referencing the Shiller cyclically-adjusted price-to-earnings ratio. “Be that as it may, there are the fundamentals, and then there are ‘animal spirits,’ and sentiment over equities remains off the charts — the Market Vane bullish sentiment, at 72%, is back to where it was in January 2018 (which in classic contrary fashion, presaged a very tough year for the risk-on trade) and before that, the spring of 2007 (ahem) when Chuck Prince was telling the masses to keep on dancing (the music stopped not too long after).”

Rosenberg’s views in context

Not every economist viewed the recent payroll revisions as negatively as Rosenberg.

Ian Shepherdson, the chief economist at Pantheon Macroeconomics, said in a client note this week that the data is backward-looking and that average monthly job gains are still strong despite the revisions.

“It tells us nothing about payrolls since March, and has no implications for the unemployment rate, which is measured by the separate household survey,” Shepherdson said. “The monthly profile of the benchmark revisions will be released next February, but the total roughly indicates that payrolls grew at a still-respectable average pace of about 175K in the twelve months to March, compared to 232K previously.”

A soft-landing outcome, where the Fed avoids sending the economy into recession, is also still the consensus view on Wall Street. With inflation down under 3% and rate cuts almost surely on the way, such a scenario is still seemingly possible.

But there’s no question that recession risks are being taken more seriously following the payroll revisions and July’s underwhelming jobs report — including by Fed Chair Jerome Powell.

“The cooling in labor market conditions is unmistakable,” Powell said in a speech in Jackson Hole, Wyoming, on Friday, adding, “We do not seek or welcome further cooling in labor market conditions.”

Labor market data in the months ahead will show whether or not the Fed’s soft-landing goal is in view. If further weakening emerges, as Rosenberg expects, investors could be in for a bumpy rest of the year.