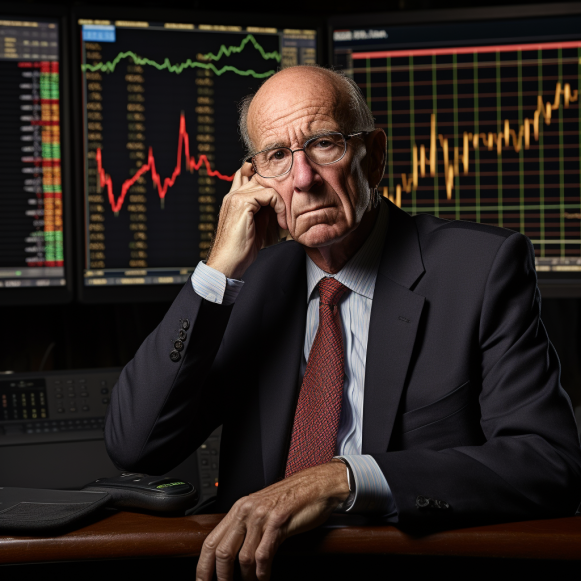

A legendary economist who called the 2008 recession says another downturn is knocking on the door — and warns stocks will end up falling 40% by the end of this market cycle

- Gary Shilling says the S&P 500 will fall by around 40% peak-to-trough this market cycle.

- He said a recession in the US may already be underway.

- Shilling pointed to recession indicators like the yield curve and The Conference Board’s LEI.

Legendary economist Gary Shilling believes the US economy is on the verge of a recession, if it isn’t already in one.

“It’s probably starting now, maybe it’s already started,” Shilling, a former economist at the Federal Reserve and Merrill Lynch, told Insider this week.

His main reason for expecting a downturn is the Fed’s determination to return inflation to its long-term target of 2%. The Consumer Price Index is currently at 3.7% year on year, while core CPI, which excludes volatile food and energy prices, is at 4.3%.

Interest rates work to slow the economy by increasing the cost of auto loans, mortgages, credit card debt, and business loans. This slows demand, theoretically slowing inflation, but frequently at the expense of profits and jobs.

Fed officials have stated repeatedly their intention to return inflation to their target, and markets believe they will not cut rates until well into next year.

“The Fed wants to make sure they’ve killed inflation,” Shilling explained.

Shilling, who predicted the 2008 recession, noted that recessions sometimes do not begin until the Fed has already begun to cut interest rates. Rate increases have a lag, taking time to fully impact the economy. According to economist David Rosenberg, 80% of Fed rate hikes result in a recession.

According to Shilling, trusted recession indicators are also indicating that a downturn is on the way. The Treasury yield curve is one of them. Since the 1960s, every time the curve inverted, a recession followed.

An inversion occurs when short-duration yields rise above longer-duration yields as a result of both rising fed funds rates and investors piling into safe-haven assets such as the 10-year note as they become concerned about the health of the economy.

The spread between 3-month and 10-year yields is shown below. When the spread falls below zero, the spread inverts.

Shilling also mentioned The Conference Board’s Leading Economic Index, which aggregates ten indexes on topics such as manufacturing activity, lending activity, bond-market performance, stock-market performance, consumer outlooks, and unemployment claims.

The indicator, like the yield curve, has a perfect track record of predicting downturns. It has been emitting a recession warning signal since last year.

Shilling expects stock prices to plummet as a result of the recession. He believes the S&P 500 will fall 40% from peak to trough this cycle. A 40% drop from the peak of 4,796 in January 2022 would put the index at around 2,850. That would represent a 36% drop from current levels.

Stocks typically fall precipitously during recessions. The S&P 500 fell 35% in 2020, compared to around 50% in 2008 and 45% after the 2000 crash.

Are stocks really on their way down?

If a recession occurs, significant downside is undoubtedly possible. One reason is the current state of valuations.

The chart below from asset management firm Robeco shows market cap-to-GDP, the Shiller cyclically-adjusted price-to-earnings ratio, and the Q-ratio valuation measures. While none have reached all-time highs, they are still at levels associated with previous bubbles.

Because of the high valuations, well-known forecasters such as Jeremy Grantham, David Rosenberg, John Hussman, and Albert Edwards have warned that we are in a bubble.

However, bubbles usually require a catalyst to burst, and a recession is probably the most pressing risk confronting markets right now. According to a Reuters survey of economists published in mid-August, there is a 55% chance that the US economy will contract over the next 12 months.

Edwards, Societe Generale’s chief global strategist who predicted the demise of the dot-com bubble, warned in a recent client note that rate hikes are beginning to seep into the economy, particularly for smaller firms with limited cash reserves.

Here is the effective interest rate that S&P 500 companies are currently paying on their debt.

“The vast majority of companies are in big trouble beneath the mega-caps,” Edwards said.

However, consumers remain strong (despite rising debt delinquencies), unemployment remains near historic lows, and GDP growth remains positive. This has resulted in a more optimistic outlook this summer, with the Reuters survey cited above putting the recession probability at 60% until June of this year.

However, how well the economy will fare in the face of unrelentingly high interest rates in the coming months remains unknown. Rising unemployment and further signs of a weakened consumer could suffocate market valuations.