A lone dissenting vote on the Fed’s rate cut marks the first split by a central bank governor in 2 decades

Federal Reserve Board Governor Michelle Bowman

The Federal Reserve’s jumbo rate cut garnered support from all but one of its 12 voting members.

Federal Reserve Governor Michelle Bowman dissented, advocating for a smaller, 25 basis point cut as the committee opted for a large, 50 basis point cut.

Bowman’s dissent marks the first time a central bank governor has strayed from consensus on an interest rate decision since 2005.

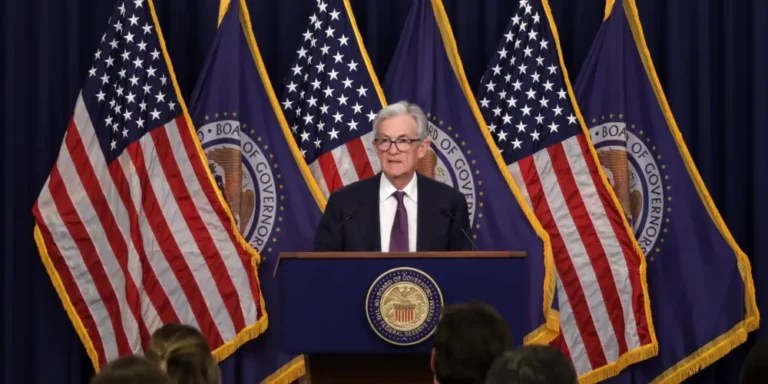

In the press conference following the decision, Chair Jerome Powell said the committee agreed on most points, after a lot of “back and forth” over whether to cut rates at its Jackson Hole meeting in July.

“We had an excellent discussion today. I think there was also broad support for the decision that the committee voted on,” Powell said.

Powell also said the committee reached a consensus that multiple cuts will be necessary going forward.

“All 19 of the participants wrote down multiple cuts this year. All 19. That’s a big change from June,” he said.

Powell acknowledged, though, that in addition to Bowman’s dissent on the size of the initial cut, some voting members disagreed on how many cuts the Fed will need.

A majority, 17 of the 19 members, advocated for three or more cuts, and 10 called for four or more, Powell said.

“There is a dissent, but there’s a lot of common ground as well,” he said.

During the Fed’s committee meetings, 19 members participate, and 12 vote. Of those voters, eight are permanent voters — including Fed governors, the Fed Chair, and the New York Fed president—while the other 11 consist of Fed presidents who rotate through one-year terms.

Dissents from Fed governors have become rare in the last two decades. Fed presidents are more frequent dissenters, and have dissented over 90 times since 1995.

The most recent dissent across the whole voting board happened in 2022, when Kansas City Fed President Esther George advocated for a smaller rate hike than her Fed peers.

The committee typically aims for a unanimous decision. The Fed’s unanimous decision to not cut rates during its July meeting marked 17 unanimous interest rate decisions in a row.

“I do think that we’re a consensus-driven organization,” Chair Jerome Powell said after the central bank’s July meeting.

Bowman joined the Fed in 2018 and been among the more hawkish voices advocating for tighter monetary policy to get inflation under control.

“We should keep in mind the historical lessons and risks associated with prematurely declaring victory in the fight against inflation, including the risk that inflation may settle at a level above our 2% target,” Bowman said in a speech last November.