A ‘silver tsunami’ of retirement-age baby boomers is creating a big opportunity for real-estate investors, research firm says

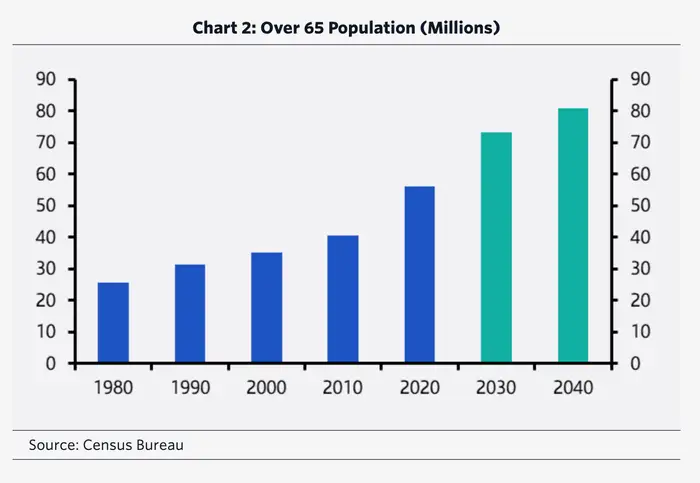

The 65 and older population in the US is on track to swell to 80 million by 2040, according to estimates from the Census Bureau.

A big investment opportunity is brewing in one corner of the real estate market, thanks to a wave of baby boomers that are about to age into retirement, according to Capital Economics.

The research firm pointed to the so-called “silver tsunami,” the moniker that’s been given to describe the imminent surge of Americans over the age of 65 entering prime retirement age. It says this will drive strong demand for senior housing facilities, including assisted living, independent living, skilled nursing, and memory care.

For real-estate investors faced with a prolonged slump in the commercial real estate space, senior housing offers an enticing alternative, wrote Imogen Pattison, an assistant economist at Capital Economics.

“With an aging population, senior housing has a clear long run structural demand driver pointing to further growth in the sector. Our analysis shows rent prospects appear strong on the back of undersupply and solid wage growth,” Pattison wrote. “That makes senior housing a compelling option for investors looking to break away from traditional property investment.”

The 65-plus population is on track to grow 30% over the next 16 years, encompassing 80 million Americans by 2040, according to estimates from the US Census Bureau.

America’s 65+ population is on track to reach 80 million by the end of the next decade.

Meanwhile, around 11% of those over the age of 65 are currently living in a form of senior housing, according to the American Senior Housing Association. Assuming that percentage holds steady, that implies demand for senior housing will grow 50% over the next 16 years, per Capital Economics’ analysis, up from 6 million in 2023 to 9 million in 2040.

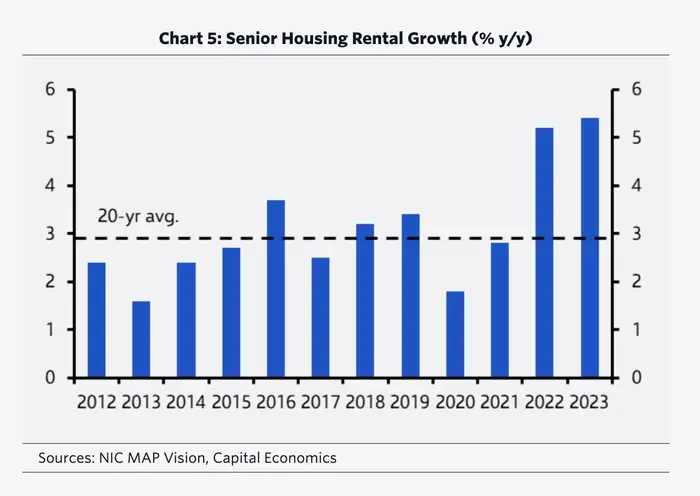

Rents, meanwhile, are seeing a strong uptrend, thanks to the supply of senior housing growing tighter after the pandemic. The sector posted more than 5% year-per-year rent growth in 2023, nearly double its 20-year average, the firm added.

The senior housing market saw more than 5% year-per-year rent growth in 2023.

That puts the senior housing sector on track to see average annual returns of 13% for the next four years, the firm estimated. Yearly returns are also set to peak in 2026 at around 16%, it added, more than triple the 4.5% yearly growth expected in 2024.

“We expect continued tight supply to bolster rents over the next year or so,” Pattison added. “Taken together, strong capital value growth and income returns mean the sector looks relatively attractive compared to the other real estate sectors.”

The commercial real estate space has been challenged in recent years, with the demand for offices being weighed down by work-from-home trends while borrowing costs rise in the sector. That means the most troubled office buildings could see a wave of fire sales and conversions, potentially sparking steep losses for property owners, real estate experts told B-17.