A Trump win could prompt the Fed to hit pause on its rate-cutting cycle, JPMorgan strategy chief says

Former President Donald Trump with Fed Chair Jerome Powell in 2017.

If Donald Trump wins the US election this week, the Federal Reserve could pause its easing cycle as early as December, JPMorgan Asset Management’s David Kelly said.

Kelly pointed to Trump’s plans for an expansionary fiscal policy that would fuel inflation higher and keep rates from coming down.

“If you have a Republican sweep with the Trump victory, you will get much more expansionary fiscal policy, potentially a trade war, bigger deficits, and so higher interest rates,” Kelly said in an interview.

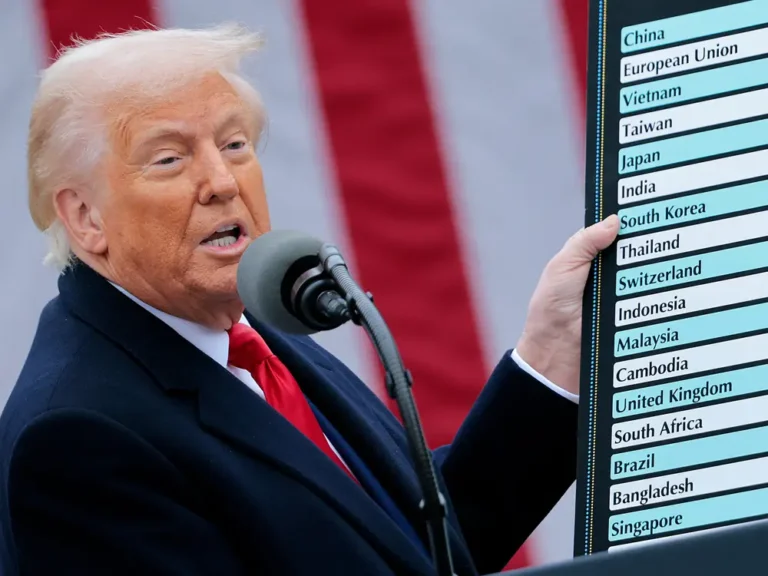

Trump’s proposals for universal tariffs, including a steep 60% duty on Chinese imports, and his proposed crackdown on immigration, are widely considered to be inflationary. The plans would involve large amounts of federal spending that would deepen the federal budget deficit.

Kelly said the impact of those policies would prompt the Fed to pause interest rate cuts.

“I think they will take a look at the possible direction of fiscal policy. If it looks like fiscal policy is going to add to the deficit, and add to fiscal stimulus, and add to inflation, they may feel that, well, if fiscal policy is going to be expansionary, we’re going to have to lean against that and slow off the easing,” Kelly told B-17.

On the other hand, Kelly says if Vice President Kamala Harris wins, the economy will likely continue its trajectory toward a soft landing.

“If you have a divided government with, say, a Harris victory, then I think you have a continuation of this slow, extended soft landing economy, but kind of dull,” he said.

In that case, the Fed would likely stick to its projected path of policy easing, Kelly said.

“I think they’ll stick to their dot plot until the economy tells them not to,” he said, referring to the potential for inflation to rise again.

The Fed’s dot plot, a chart showing members’ projections for the path of interest rates in the coming years, was released in September and pointed to another 50 basis points of rate cuts before the end of the year, with further easing in 2025.

While the Fed operates independently, Kelly noted that it still reacts to politics since developments may inform where the economy is heading.

“Once they got some sense of what fiscal policy is going to do, I think that will have some impact on their decision-making. They’re not going to try to tell the federal government what to do, but they will respond to what the federal government is doing or what the federal government is likely to do,” Kelly said.

As a result, he said the Fed is almost certainly going to cut rates by 25 basis points at the conclusion of its next meeting on November 7, even if the election is called before then.